September air cargo market: A temporary slowdown before growth?

English - Ngày đăng : 15:40, 29/09/2024

Impact of holidays and seasonal factors

According to Dimerco, the volume of e-commerce and electronics cargo in September did not meet expectations. While the Global Purchasing Managers’ Index (PMI) composite output index remained positive, growth primarily came from the service sector, while the manufacturing sector saw a decline. Dimerco also noted a slowdown in cargo trade across both developed and emerging markets in August, with China’s exports falling for the first time in 2024—a sign of broader manufacturing sector downturns.

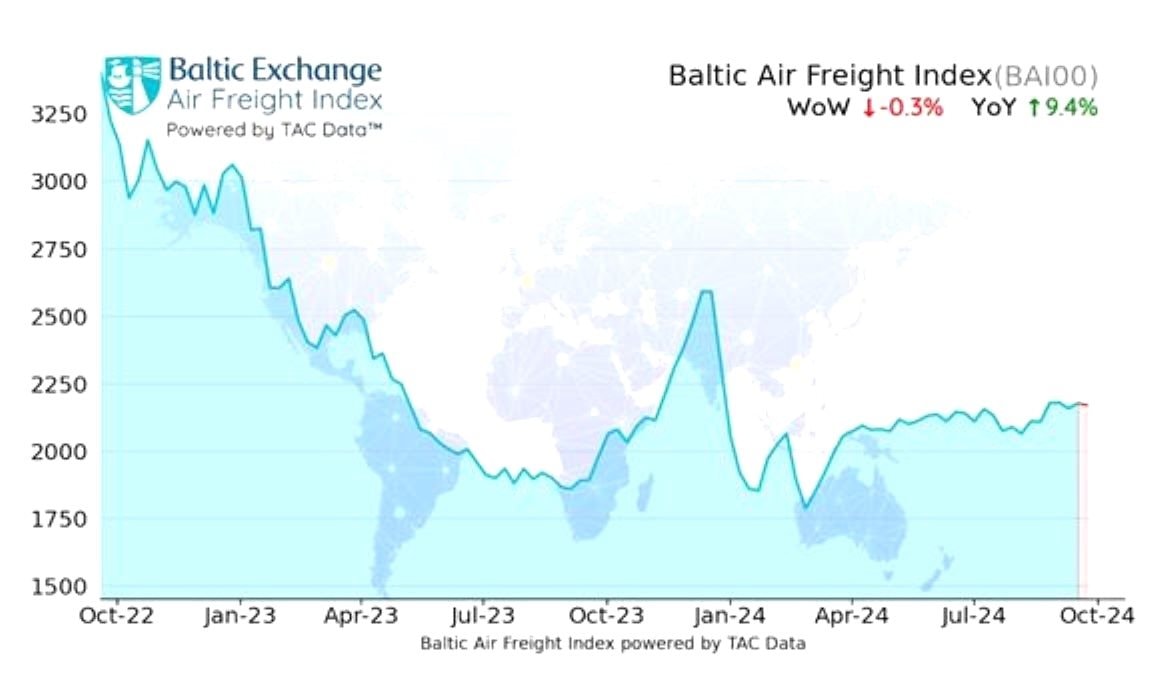

Air freight rate provider TAC also reported a quiet market leading up to China’s Golden Week, which began on October 1. Rates typically see a slight uptick during this period, but it remains too early to determine whether demand will be weaker than previously forecasted as the traditional peak season approaches.

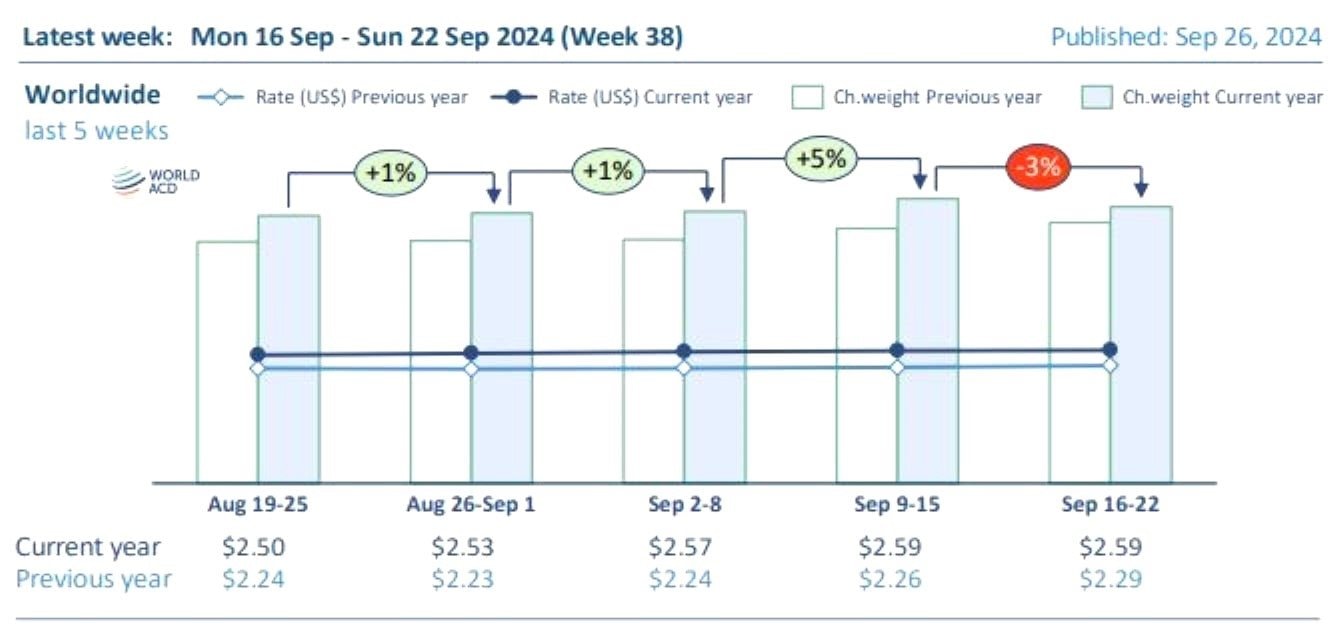

Data from WorldACD showed a similar slowdown in September, with total air cargo volumes dropping by 3% compared to the previous week in the week ending September 22 (week 38). Notably, volumes originating from the Asia-Pacific region fell by 6%, largely due to the Mid-Autumn Festival and harvest celebrations across East Asia.

Positive signals from the economy and market

Despite the September slowdown, experts suggest this is temporary, forecasting a swift recovery in demand. Dimerco predicts a strong surge in air freight demand from late September into October, with the start of traditional online shopping festivals around mid-October. Additionally, the U.S. Federal Reserve's larger-than-expected interest rate cuts are expected to boost consumer spending, supporting the market.

Another key factor that could drive growth is the potential strike at container ports on the U.S. East Coast, anticipated on October 1. If the strike occurs, it could prompt a shift of goods from sea to air freight, adding further growth pressure to the air cargo market, particularly for shipments bound for the U.S. East Coast.

Kathy Liu, Vice President of Sales and Marketing at Dimerco Express Group, emphasized that the potential strike by the International Longshoremen's Association (ILA) would increase air freight demand. This would particularly benefit shipments to the U.S. East Coast, where sea freight may shift to air to meet delivery deadlines.

Additionally, according to Dimerco, intra-Asia air cargo capacity will tighten as airlines prioritize long-haul routes during the peak season, further contributing to rate increases. WorldACD also noted that strong or even rising freight rates in some regions—especially Asia-Pacific and Middle East & South Asia (MESA)—indicate that demand is likely to recover soon, particularly with the growth of e-commerce.

While the air cargo market showed signs of cooling in September, these slowdowns were primarily due to seasonal factors and major holidays. This dip does not reflect a broader market weakness but rather a temporary pause. With positive economic signals, the potential U.S. port strikes, and the peak e-commerce season, air cargo demand is expected to rebound quickly in October.

As a result, companies in the air freight industry should prepare for the upcoming surge by optimizing capacity and adjusting business strategies in response to market shifts. With the holiday shopping season fast approaching, the market is set to experience strong growth once again, offering significant opportunities for businesses ready to ride this new wave.