Upgrade the Warehouse to Create Profit: Pick the Right Problem, Measure the Right ROI

English - Ngày đăng : 15:01, 17/09/2025

Why 2025 is an “inflection point” (capital costs, CPG/auto demand)

The 2025 picture is more favorable for warehouse-automation investments thanks to three concurrent forces. First, interest rates have cooled versus 2023–2024, easing capital costs—especially for operating-lease or service-based models. Second, demand is recovering in fast-moving consumer goods and automotive, creating pressure to lift productivity, stabilize quality, and reduce labor volatility across shifts. Third, recent supply-chain disruptions have pushed companies to prioritize hour-by-hour predictability and orchestration—capabilities that mobile robots and automated storage/retrieval systems can deliver when correctly integrated. Automation is no longer a “tech toy”; it is a structural lever for cost and service. The question is not whether to automate, but where in the network, at what cadence, and with which pre-mortemed risks.

Choosing the problem: picking, replenishment, put-away

A disciplined program starts by matching the right problem to the right warehouse zone and constraints. Piece picking is a common candidate because it dominates labor share and is error-sensitive; AMRs that tow carts or bring goods to person stations can shorten walking distance, cut waiting time, and improve stability. Replenishment makes sense where daily flow fluctuates and SKUs turn fast; guided robots with smart shelving can push stock into “hot” positions before peak hours. Put-away lends itself to AS/RS, shuttles, or VLMs when you need height and high storage density; the orchestration layer assigns optimal locations by size, frequency, sell-by time, and handling conditions. The core is to quantify benefits for each task level and avoid spreading thin; pick one or two scenarios with short decision cycles, sufficiently clean data, and acceptable operational risk for the pilot.

AMR blueprint: layout, safety, WMS/WES integration

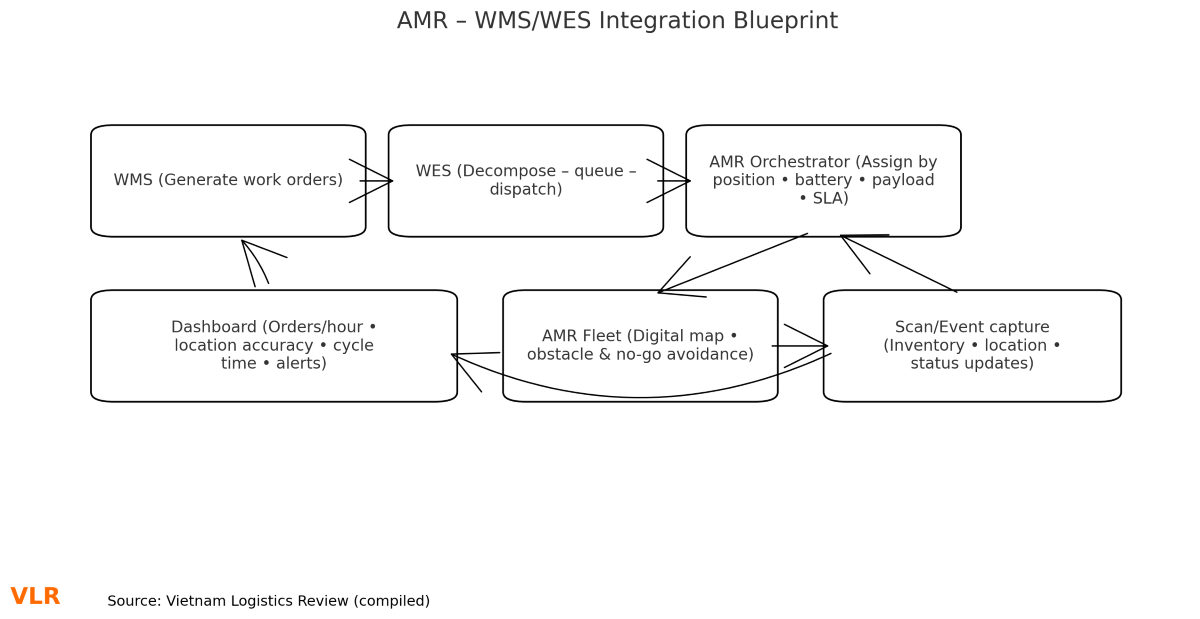

A solid AMR design is about more than robot counts: it’s aisles, intersections, priority lanes, charging spots, and safety zones. The layout should minimize choke points and separate people and robots using virtual lines and sensors, while keeping emergency egress clear. The safety layer requires zone-based speed matrices, slow-downs on obstacle detection, emergency stops, and incident logs for audit. The operational “heart” is integration with WMS/WES: WMS creates work, WES decomposes it into tasks, queues them, and dispatches to the AMR fleet via the orchestrator; near-real-time feedback on status, location, and inventory must loop back to the core system to keep counts and order states in sync. A trustworthy blueprint includes stress tests at peak flow, bottleneck simulations, priority rules for rush orders, and a battery-swap and preventive-maintenance plan so peaks don’t stall.

Orders flow into WMS, which generates work orders; WES splits and queues the work; the AMR dispatcher assigns robots based on position, battery, payload, and SLA; AMRs navigate via a digital map, avoiding people, obstacles, and no-go zones; scans update inventory events; states return to WES and synchronize with WMS in near real time; the dashboard shows KPIs such as orders/hour, location accuracy, and cycle time, with incident logs and flow-change simulations to optimize peak periods.

TCO and financing models (buy, lease, RaaS)

For warehouse automation, total cost of ownership must be decomposed down to task, shift, and asset life. Buying outright suits companies with stable long-term volume, in-house maintenance, and good depreciation use—at the cost of longer-lived technology/design risks. Finance leases spread cash outflows but require careful terms for upgrades and conversion when scaling. RaaS turns CAPEX into OPEX, flexes with seasonality, and lowers the entry barrier; the downside is potentially higher long-run spend if committed volumes and performance clauses aren’t negotiated well. Whichever model you choose, count the “hidden” items: floor works, industrial Wi-Fi, safety systems, go-live downtime, training, and middleware. Convert benefits to concrete financial metrics: lower cost per order line, lower safety stock, fewer cancellations due to lateness, higher peak-hour throughput, and reduced quality variability.

Organization: evolving skills and roles

Automation doesn’t replace people with robots; it replaces repetitive tasks so people can take higher-value roles—if skills are prepared early. Shift leaders move from experience-based coordination to reading dashboards, acting on alerts, and “root-cause investigations” when performance drifts. Warehouse staff learn safe operation, light troubleshooting, hot-swapping batteries, sensor calibration—paired with data discipline at scan/confirm steps. IT and operations co-design change procedures, patch testing, and “hot cut-off” mechanisms when software misbehaves. Incentives must shift to system-level KPIs rather than individual counts; in parallel, safety and health policies must fit an AMR workplace, including the right to stop when unsure and a blameless incident-reporting duty.

Scale-up: from one site to multi-site

Many projects end up in “pilot purgatory” because there was no scale plan from day one. Multi-site thinking demands standardization: layout templates, a reference equipment list, software-integration standards, a common KPI set, and repeatable training packs. Each site still needs “just-enough” tailoring to footprint, SKU mix, and order rhythm—but without breaking the standard; differences should be parameterized, not rewritten. A command center watches the network, benchmarks sites, provides remote support capacity, and rotates spare robots to regional peaks. Event data must converge into a data store for continuous learning: dispatch policies, optimal routes, charging schedules, congestion-forecast models—forming the base to increase automation over time from semi-automatic to supervised autonomy.

A path for AS/RS in a hybrid network

AS/RS shines where vertical space is available, land is expensive, SKUs are reasonably standardized, and retrieval must be stable. In a hybrid network, use AS/RS as the storage “spine” and AMRs as the “muscle” to move—balancing capital with flexibility. Connecting the two layers needs a prioritizing WES: as items exit AS/RS on conveyors to goods-to-person points, AMRs take the last mile to rush packing; in reverse, AMRs bring returns to inbound, and the system decides deep storage versus buffer by turn velocity. Don’t chase absolute storage density if it slows fast movers; instead, zone hot areas with short egress and let AS/RS serve slow-moving or high-value items requiring control.

Data quality and WES as a “second brain”

An automation project is only as strong as its data. Location codes, SKUs, units of measure, dimensions, weight, packing rules, cut-off windows, and customer-priority rules must be clean and consistent; every change needs logging and approval. WES acts as the second brain between WMS and equipment, translating high-level orders into controlled motion; if WES is weak, you get “great hardware, poor conductor.” Architect for simulation and A/B testing of dispatch policies, and run in parallel before flipping to full automation. Real-time equipment-health monitoring and early warnings enable planned preventive maintenance instead of break-fix.

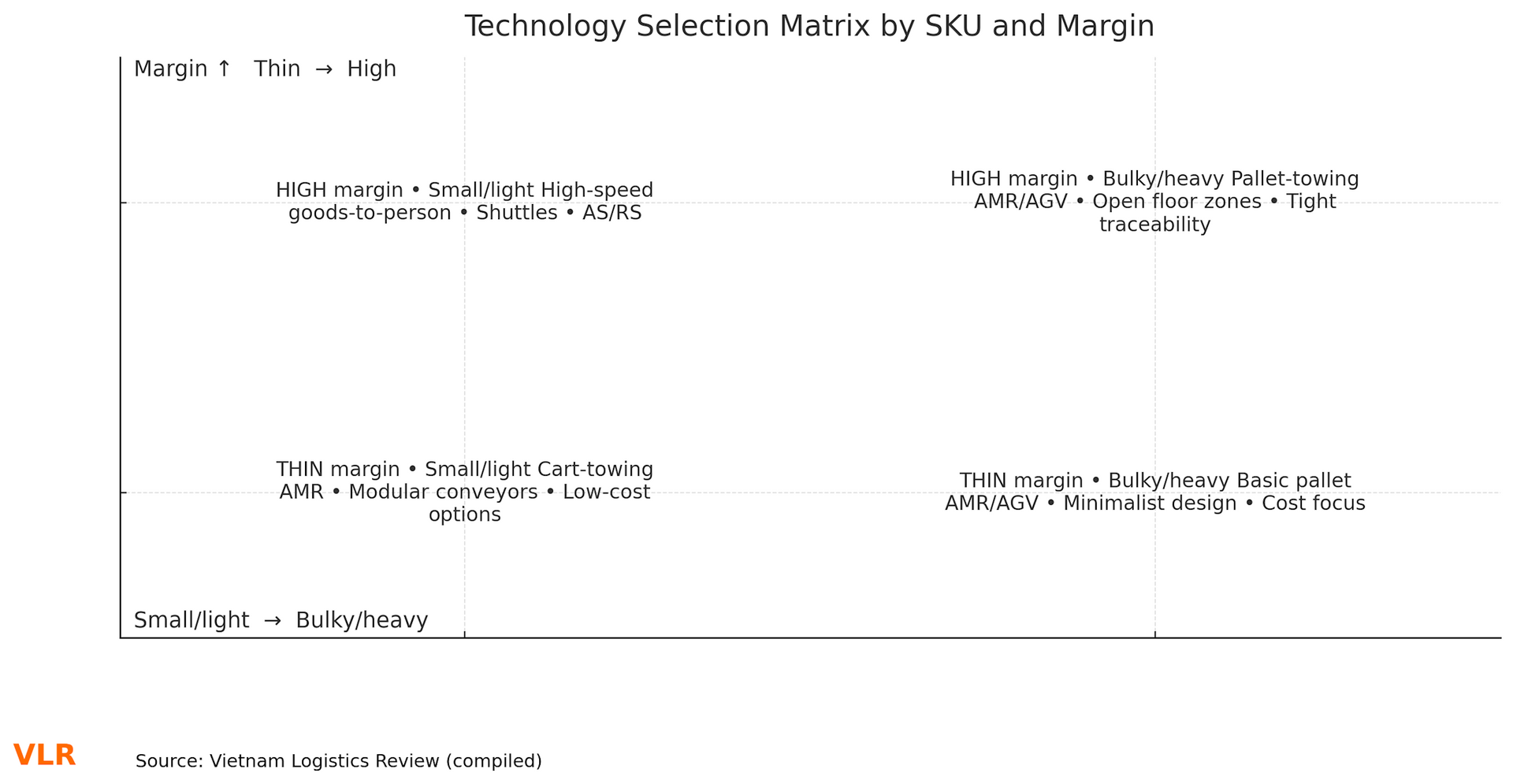

Small/light fast-movers favor goods-to-person or cart-towing AMRs; bulky/heavy items favor pallet-towing AMRs or AGVs with open floor zones; high-value SKUs that need tight traceability fit AS/RS or VLMs with detailed logs; thin-margin SKUs favor low-cost options such as towed AMRs and modular conveyors; high-margin SKUs justify high-speed goods-to-person, shuttles, or AS/RS; the decision threshold is based on cost per order line, cycle time, and incremental revenue preserved by shortening lead time.

Operational TCO and safety: common blind spots

Many companies under-estimate the “soft” costs that decide success. Budget for industrial wireless networks; dust/moisture protection; periodic sensor calibration; incident-logging software; retraining the safety team; and emergency-drill rehearsals. In layout, don’t forget primary/secondary routes and maneuvering room if a lane is blocked. In IT, standardize protocols, timeouts, and self-recovery to prevent process hangs. A blameless “near-miss” reporting culture surfaces risks early and enables timely safety-algorithm tuning.

Warehouse automation in 2025 will reward firms that are both disciplined and agile. Prioritize fast-payback use cases with short decision cycles and ready data; avoid spreading thin and getting stuck in pilot purgatory. Design a compact, safe blueprint with tight WMS/WES integration; pick a financing model that fits margin structure and demand cycles; prepare the organization with new skills and transparent measurement. Once sites are standardized and data flows steadily, AMRs and AS/RS will not only cut cost per order line but also turn the warehouse into a real-time operating platform—where decisions are made quickly, reliably, and at a scale that grows with the business.