Multi-Sourcing & Regionalization: The Shield of Supply Chains

English - Ngày đăng : 08:54, 14/10/2025

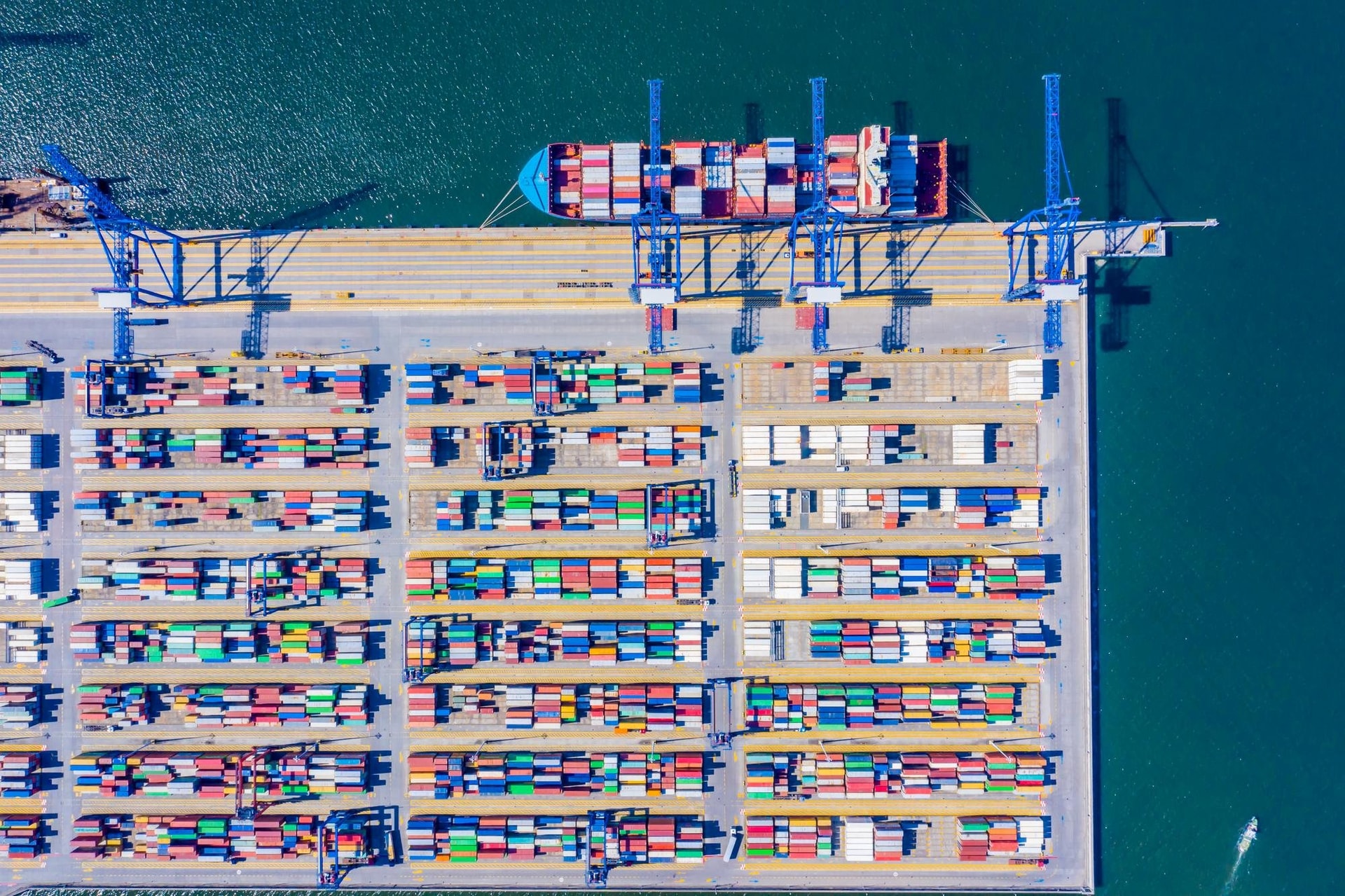

Regional Hubs & Dual-Sourcing

Instead of depending on a single country or supplier, many corporations are establishing “regional hubs.” These nodes are close enough to markets to shorten lead times, yet flexible enough to pivot to other suppliers when needed.

The “dual-sourcing” model—maintaining two strategic suppliers for a critical raw material or component—helps businesses avoid a “single point of failure.” Particularly in sensitive industries such as electronics, pharmaceuticals, or automotive, ensuring continuous supply is more important than simply minimizing costs.

Make-or-Buy at the Supply Chain Level

The decision of “make or buy,” once familiar at the factory level, has now been elevated to the scale of global networks. Companies must weigh not only production capacity but also supply chain security, intellectual property protection, and the ability to respond swiftly to disruptions.

In many cases, businesses choose to keep in-house production of “core” activities—those containing technological know-how—while outsourcing auxiliary parts to partners in different regions. In this way, the supply chain maintains strategic control while remaining flexible enough to adapt.

The Regionalization Decision Map

Step 1: Overlay risks such as tariffs, sanctions, and security concerns onto the existing supply-demand map.

Step 2: Calculate the “Total Landed Cost + Risk” for each scenario, factoring in lead time and volatility.

Step 3: Choose a combination of “local + cross-border” suppliers with clauses for rapid switching.

Step 4: Build service-level agreements (SLAs) covering data transparency and capacity scaling up or down.

The result is a flexible network that minimizes dependence on any single point of failure.

Contract Structures & Risk Sharing

For multi-sourcing to be effective, supplier contracts must be redesigned. Rather than focusing solely on purchase price, modern contracts must integrate risk-sharing clauses, two-way accountability, and incentives for transparency.

Companies can adopt index-linked pricing mechanisms, accompanied by surge-capacity clauses with capped costs. “Exit clauses” based on geopolitical risks are also indispensable to ensure enterprises can act proactively in unexpected situations.

A smart contract should include two-way performance indicators: from on-time, in-full (OTIF) delivery rates to quality, cost transparency, and the ability to switch. Raw material pricing should follow market indexes to prevent unexpected shocks; surge capacity must be capped; and exit clauses should apply in political crises. Firms should build supplier scorecards by domain critical components vs. auxiliary parts to allocate volumes wisely. At the highest level, vendor collaboration platforms allow co-development of products, shortening time-to-market.

Measuring “Total Cost” Instead of Purchase Price

In reality, the cheapest purchase price is not always optimal if it brings higher transport costs, additional tariffs, or disruption risks. Forward-looking companies now calculate the “Total Landed Cost” plus a risk factor.

Only with this holistic view covering transport, warehousing, tariffs, insurance, and political risks can managers see the true picture. This approach enables more informed decisions: keeping some production closer to markets for safety, while retaining some farther away to capture cost advantages.

Supplier diversification and regionalization are not about “buying more” but about redesigning the entire network to manage systemic risks. In an era of geopolitical complexity, companies that combine regional hubs, intelligent make-or-buy decisions, risk-sharing contracts, and comprehensive cost models will endure. Once supply chains are no longer confined to the borders of a single nation but operate on multi-regional, multi-partner platforms, resilience and competitiveness become long-term advantages.