Trans-Pacific 2025: “Early Peak - Long Trough” and How Vietnamese Exporters Can Ride the Freight Waves

English - Ngày đăng : 08:02, 28/10/2025

Why did the “early peak” form in 2025?

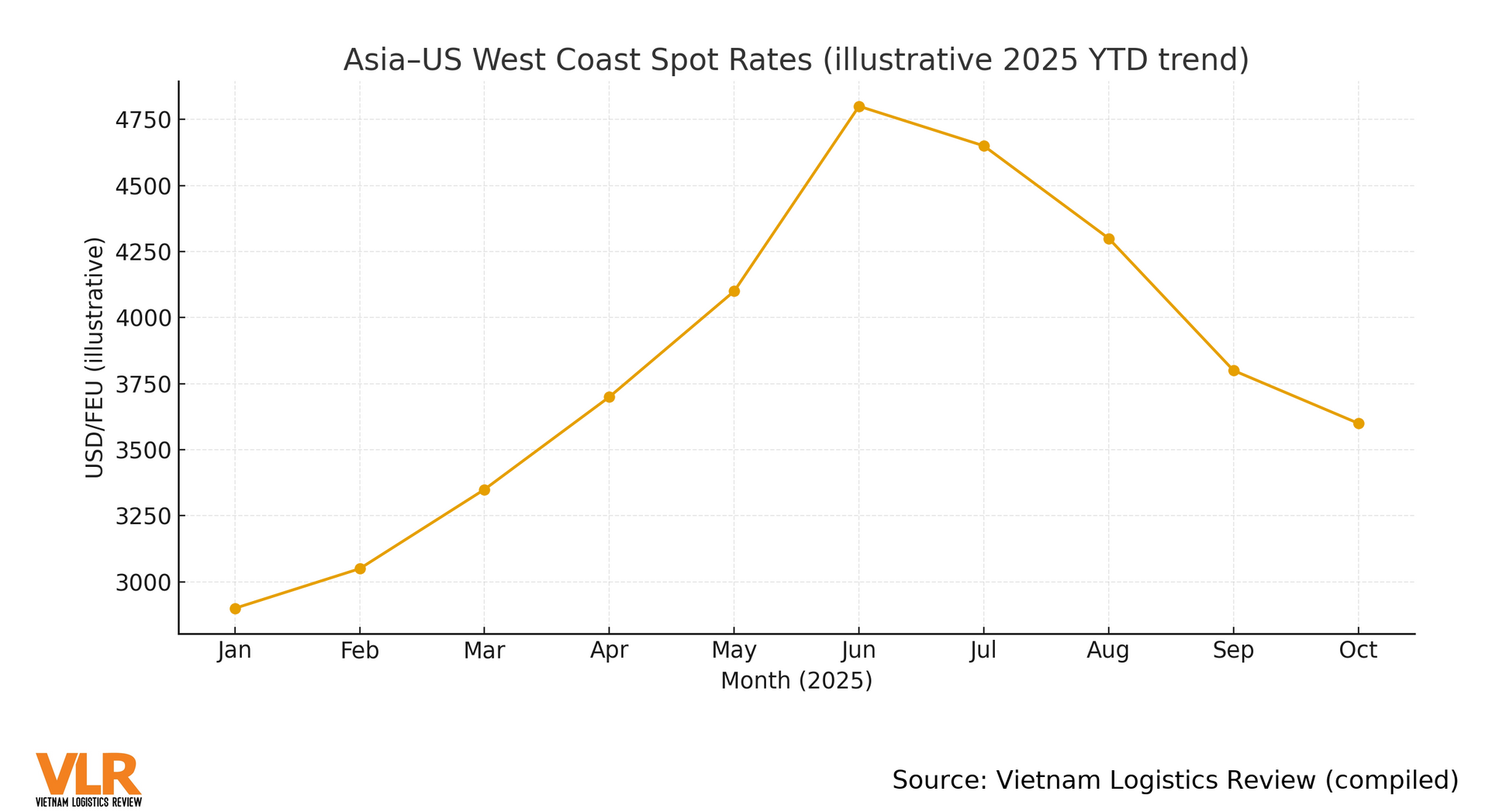

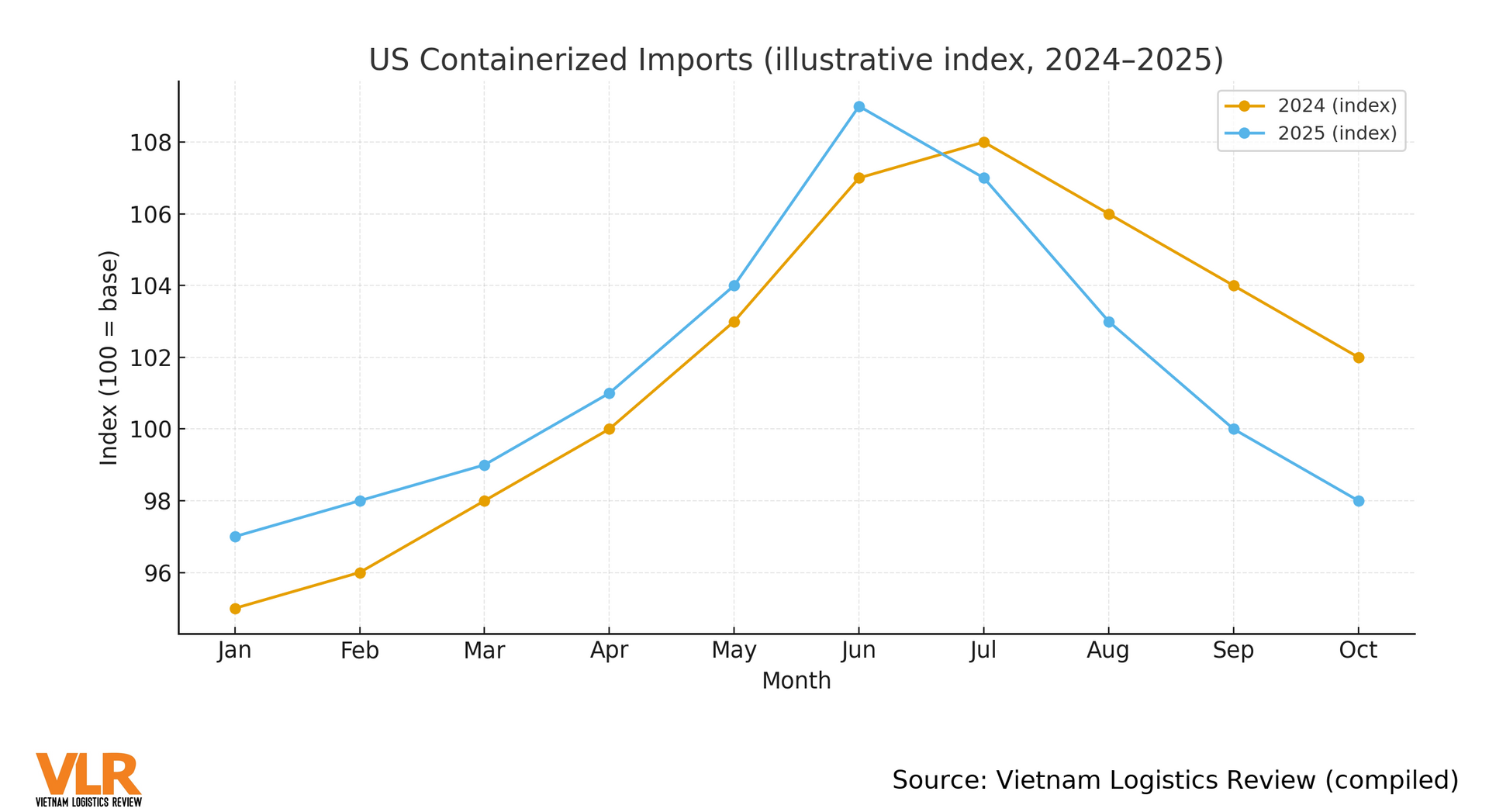

From late Q1, US importers increasingly “pulled forward” orders, worried about geopolitical volatility, security risks on key lanes, and tariff changes shifting a portion of traditional peak-season demand into earlier months. Market reports observed Asia - US West Coast (USWC) spot rates jumping in early June, then cooling from late June into July as demand thinned out.

US summer imports neared record levels but that crest came earlier than usual. New booking indicators softened soon after. An August 2025 macro update likewise concluded that “the peak season arrived significantly earlier than normal,” followed by declines in both volume and rates as consumer demand cooled and tariffs shifted.

Ahead of any surge, track three indicators: (1) new bookings from Asia to the US and the “thawing” pace of retail inventories; (2) the weekly path of spot rates especially the spread between West and East Coasts; (3) dwell times at major USWC ports. When all three rise together, a local peak is likely near; when all three fall, the risk of a prolonged trough increases. Using weekly, lane-level data rather than seasonal rules of thumb helps shippers lock capacity in time and avoid mistimed, overpriced bookings.

Cautious US demand - and what it means for transport plans

Since July, signs of softer demand have become clear: several retail categories decelerated, with orders pushed into 2026. Full-year 2025 US imports are forecast to decline 5.6% year-over-year. The immediate effect: spot rates slid quickly after an early peak; lane-to-lane and week-to-week price spreads widened, heightening the risk that exporters “miss the window.”

Beyond demand, external “wild cards” security around the Red Sea/Suez and capacity through the Panama Canal remain uncertain, swinging transit times and slot availability month to month. While these factors did not sustain a summer-long rally on Asia - US lanes, geopolitical risk can still create short-lived spikes in schedules and surcharges.

Conversely, in a few off-peak weeks, rates may rebound modestly due to micro-events (surcharge resets, equipment repositioning, or schedule changes). Staying on weekly data rather than seasonal instinct improves booking timing and price discipline.

What to do now: smart booking, flexible contracts, and risk hedging

Split bookings along the rate wave.

For programs spanning multiple weeks, divide volumes into “booking clusters” every 2–3 weeks to smooth price risk. This avoids loading all tonnage into a single short-lived peak and preserves negotiation leverage when the market cools. Where distribution allows, switch between USWC and USEC gateways to exploit weekly price dislocations.

Index-linked contracts over fixed-price annuals.

Instead of locking one figure for the year, peg contracts to recognized indices within a negotiated band, and include renegotiation triggers

when spot deviates beyond a threshold (e.g., ±15%). For fast-cycle, price-sensitive categories (consumer electronics, fashion), even greater flexibility is warranted.

Timetable buffers and alternate routings.

Build weekly playbooks for alternate routings (including, if truly necessary, Cape of Good Hope detours for USEC cargo) and maintain sea–air options for higher-value SKUs under tight delivery windows. Adjust origin-to-destination lead time ahead of known congestion pockets or last-minute schedule rolls.

Tight control of surcharges and free time.

In a “long trough,” prioritize trimming non-essential surcharges, extending free-time at both ends, and standardizing port-change and equipment return terms. These line items often erode margin as much as the base ocean rate.

(1) Clearly defined security/contingency surcharges when they apply and when they don’t;

(2) Practical free-time at origin/destination aligned with inland US operations;

(3) Port-change and re-routing clauses for schedule disruptions;

(4) A “trigger” to reopen pricing when spot moves past a set threshold;

(5) Weekly equipment-availability commitments;

(6) Seven-to-ten-day delivery windows to reduce wait charges. This checklist helps shippers protect unit economics when rates gyrate quickly and keeps both parties aligned on service, cost, and risk-sharing obligations.

From “riding the hype” to data discipline

The “early peak - long trough” of 2025 nudges Vietnamese exporters away from seasonal intuition toward weekly data discipline: track spot rates, booking momentum, retail inventories, and lane conditions. The optimal strategy is not “the cheapest rate,” but the right rate for the risk, meeting targets on time, on budget, and at an acceptable margin. When short-term shocks hit (security, weather, policy), the winners will be those with flexible contracts, pre-baked alternate routings, and robust hedging practices securing a durable competitive edge on the Asia - US trade.