Autonomous Trucking: From Trials to Conditional Commercial Operations

English - Ngày đăng : 08:00, 30/10/2025

Even so, the field isn’t fully “unlocked”: overlapping federal rules, evolving safety standards, and maturing response procedures continue to shape the pace of deployment. Vietnamese shippers need to understand this shift because it directly affects US domestic line-haul transit times, thereby influencing delivery planning and end-to-end logistics costs.

Deployment Progress & Technical Milestones

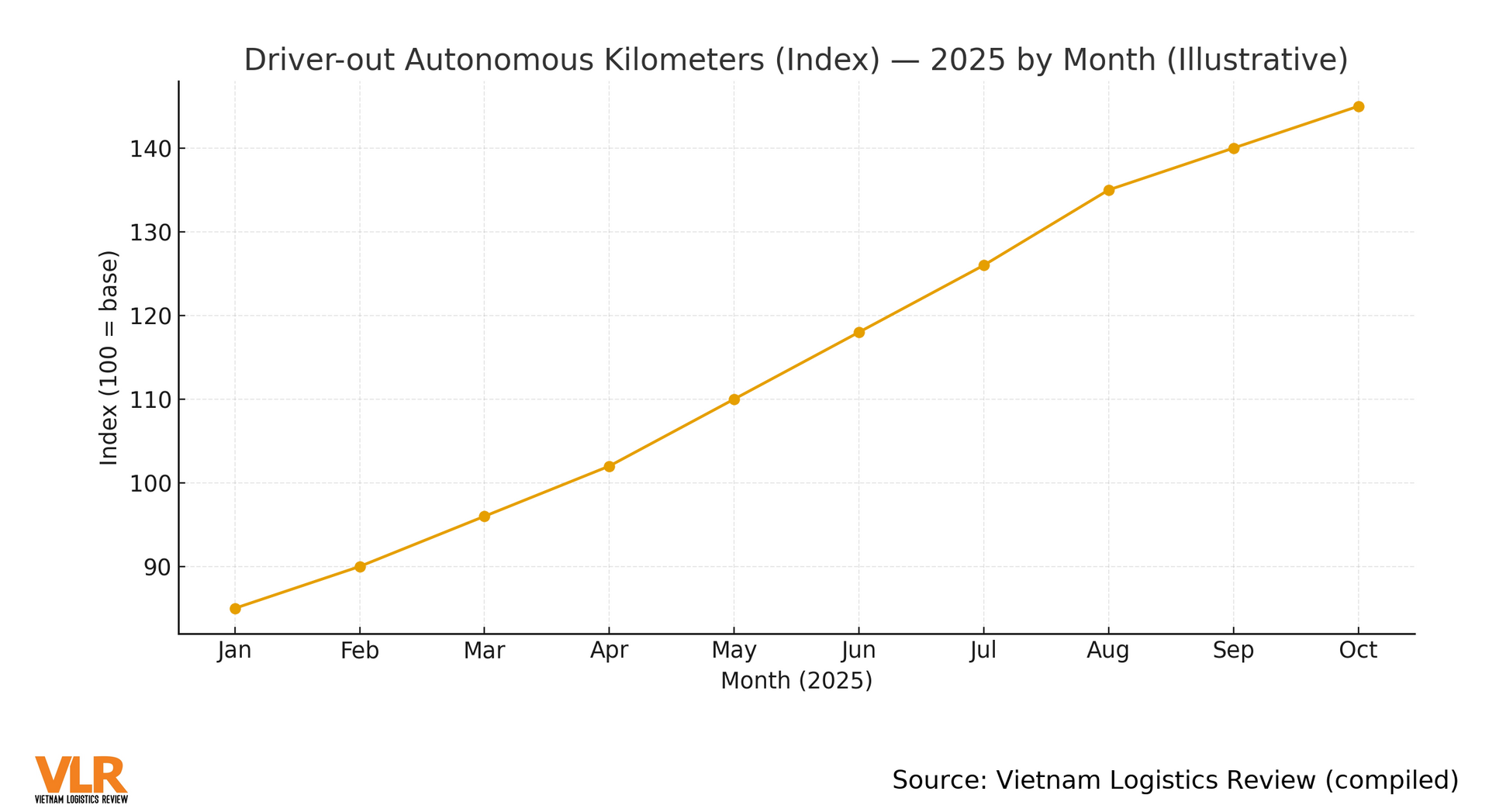

Driver-out operations are accelerating. Aurora has announced commercial service on the Dallas–Houston corridor with driver-out trucks operating on a regular schedule and steadily expanding service scope - one of the first heavy-duty autonomous trucking services in the US. Other players Kodiak, Plus/PlusAI, and Waabi - are also ramping up trials and limited operations in Texas and other Southwestern states, focusing on stable interstate corridors (I-35, I-10, I-40).

Technical thresholds and the operating “OS.” In 2025, autonomous fleets are not only demonstrating longer driver-out distances; they are also maturing their operational “operating systems”: automated launch/arrival yards, remote fleet supervision from control centers, over-the-air software updates, and dedicated actuation controllers (e.g., Kodiak’s ACE) that translate electronic commands into consistent mechanical motion. The goal is to improve on-time reliability and predictability the two metrics shippers care about most.

An ecosystem of upfitting, operations, and remote assist. It’s no longer just about the autonomy software vendors. Heavy-duty OEM partners, component suppliers, yards/terminals, transportation management systems (TMS), and remote assist providers are all moving in sync. Kodiak’s collaboration with Vay brings in remote-assist capabilities when needed; Aurora’s integrations with TMS platforms streamline order intake, tracking, and handoff - so traditional drivers/dispatchers can “read” autonomous trip data within a familiar interface.

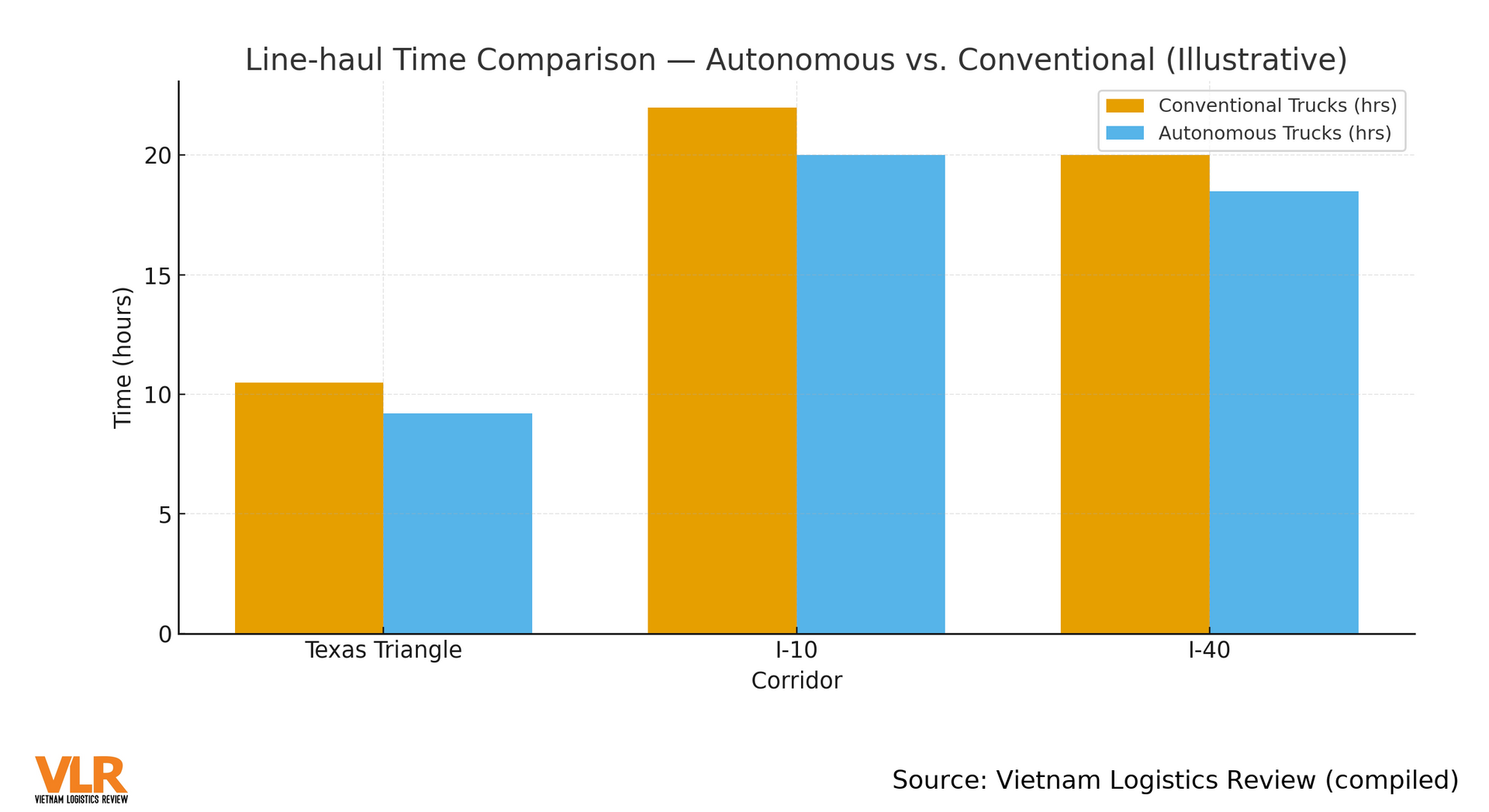

From the standpoint of infrastructure and weather, three corridor clusters are being prioritized for their operational stability: (1) the Texas Triangle (Dallas – Houston - San Antonio), where launch/arrival yards are being built out; (2) I-10 (California/Arizona – Texas - Florida), a key lane for inter-regional flows; and (3) I-40 (California/Arizona - New Mexico - Texas the Southeast), useful for fast-moving consumer goods. When combined with ocean-truck or “ocean - rail - truck” routings, shippers can better predict door-to-door times thanks to steadier cruising speeds and denser departure windows.

“Conditional Opening” on Safety & Regulation

Federal cadence: cautious but opening. In recent months, federal safety and transport agencies have continued consultations and granted narrowly tailored exemptions for certain vehicle configurations and warning systems - incrementally moving toward allowing driver-out operations under specified conditions. Some proposals, however, have been rejected or put on hold due to insufficient safety evidence, particularly around roadside warning devices and emergency-stop procedures. This reflects a “guard-railed openness” at the federal level.

State politics: a tricky puzzle piece. California the largest trucking market in the US - has circulated a draft framework for testing heavy-duty autonomous trucks, yet remains a focal point of debate among safety, jobs, and innovation. In the past, the state legislature attempted to mandate a human safety operator in the cab; the governor vetoed the bill, but the political spotlight remains intense. In contrast, Texas/Arizona have been more permissive, making Texas a de facto “commercial lab” for driver-out runs.

Toward common standards. On Capitol Hill, several legislative ideas seek to create a smoother runway for commercial autonomy, calling for more authority and budget for regulators to build safety standards, data-sharing regimes, and liability frameworks. Industry stakeholders likewise push for a single federal standard to avoid a patchwork of state rules an essential condition for scaling services.

Implications for Vietnamese Shippers

Potential savings in cost and line-haul time. On the right corridors, autonomous trucking can stabilize cruising speeds and reduce variability tied to driver shift changes, improving on-time performance and lowering incidental costs. Combined with DC networks in Texas/Arizona and Trans-Pacific services to the US West, shippers can design smoother “ocean-to-yard, autonomy-to-DC” flows especially for fast-moving consumer goods, electronics, and campaign-based shipments.

Liability and insurance risk. Driver-out service raises the question: who bears legal responsibility in a collision the asset owner, the tech provider, or the contracted motor carrier? Insurance rates, claims procedures, and the definition of a “safety incident” differ from conventional trucking. Shippers should scrutinize indemnity and hold-harmless clauses and require counterparties to disclose safety records (accident-free miles, remote-assist intervention frequency, emergency-stop procedures).

Service contracts: add “technology contingencies.” When hiring US 3PLs/carriers that deploy autonomous trucks, insert technology-contingency provisions: criteria for pausing the technology (e.g., temporary suspension after Class A/B incidents), lanes and commodities eligible for autonomy, post-incident reporting standards (timelines, trip data, video), and a fallback to human-operated trucks if regulators mandate changes during a given period.

A “Contract Clause Framework” for Autonomous Trucking

- Safety: operating criteria, weather limits, emergency-stop procedures;

- Data: access to de-identified trip logs and incident reports within 24-48 hours;

- Liability: clear allocation of risk among carrier, technology provider, and shipper;

- Compensation: caps and coverage broadly comparable to human-operated service;

- Fallback: objective triggers to switch back to conventional fleets when the technology pauses or rules change abruptly.

- Complementing the Network - Not Replacing It

Autonomous trucking is not a magic wand that replaces every human-operated fleet at least not in the next few years. The value of the technology is additive: match the corridor, conditions, and safety protocol correctly and it will stabilize lead times, dampen cost volatility, and improve forecastability. Conversely, chasing the “tech halo” while neglecting the legal framework, safety data, and contract language pushes shippers into a risk zone. The prudent path for Vietnamese businesses: standardize SLA by lane, run controlled pilots, and anchor KPIs around on-time performance, safety, and cost so they can capture the benefits of autonomy in US-bound supply chains without overexposure.