Air Cargo 2025: Cooling after the E-commerce “Bull Run”

English - Ngày đăng : 08:51, 31/10/2025

Demand & Capacity Outlook: A New Picture

Airlines and analysts have been dialing back growth expectations after the 2023-2024 bull run as demand is restrained by inflation, tariff changes, and more cautious consumer sentiment. According to IATA, the growth momentum of airfreight decelerated in Q1 2025; on the supply side, capacity continues to loosen as passenger networks recover, bringing belly capacity back more strongly on long-haul routes. The upshot: 2025 no longer looks as “capacity-tight” as last year.

From a market perspective, Xeneta projects global air cargo growth of around 4–6% in 2025, roughly matching or only slightly outpacing capacity growth (estimated at 3–5%). That scenario implies less strain and greater bargaining power for shippers, especially on lanes where passenger traffic has rebounded early.

Another variable to watch is US “de minimis” and tariff policies for low-value parcels previously a major driver of the e-commerce air boom. As some preferences tighten, the China - US e-commerce air flow has fallen sharply, forcing airlines and retailers to retime and reroute and even shift part of the volume back to ocean thereby easing pressure on Trans-Pacific air capacity.

When weighing a sea–air configuration, evaluate three axes: price–time–risk.

(1) Price threshold: if ocean rates spike due to geopolitical events, temporarily expand the “air” share in the mix;

(2) Time threshold: for seasonal fashion, new consumer electronics launches, and cold-chain pharmaceuticals, sea–air can “cut the second half” of transit while still saving versus all-air;

(3) Risk threshold: when vessel schedules are unreliable, use air for the final leg to protect delivery dates.

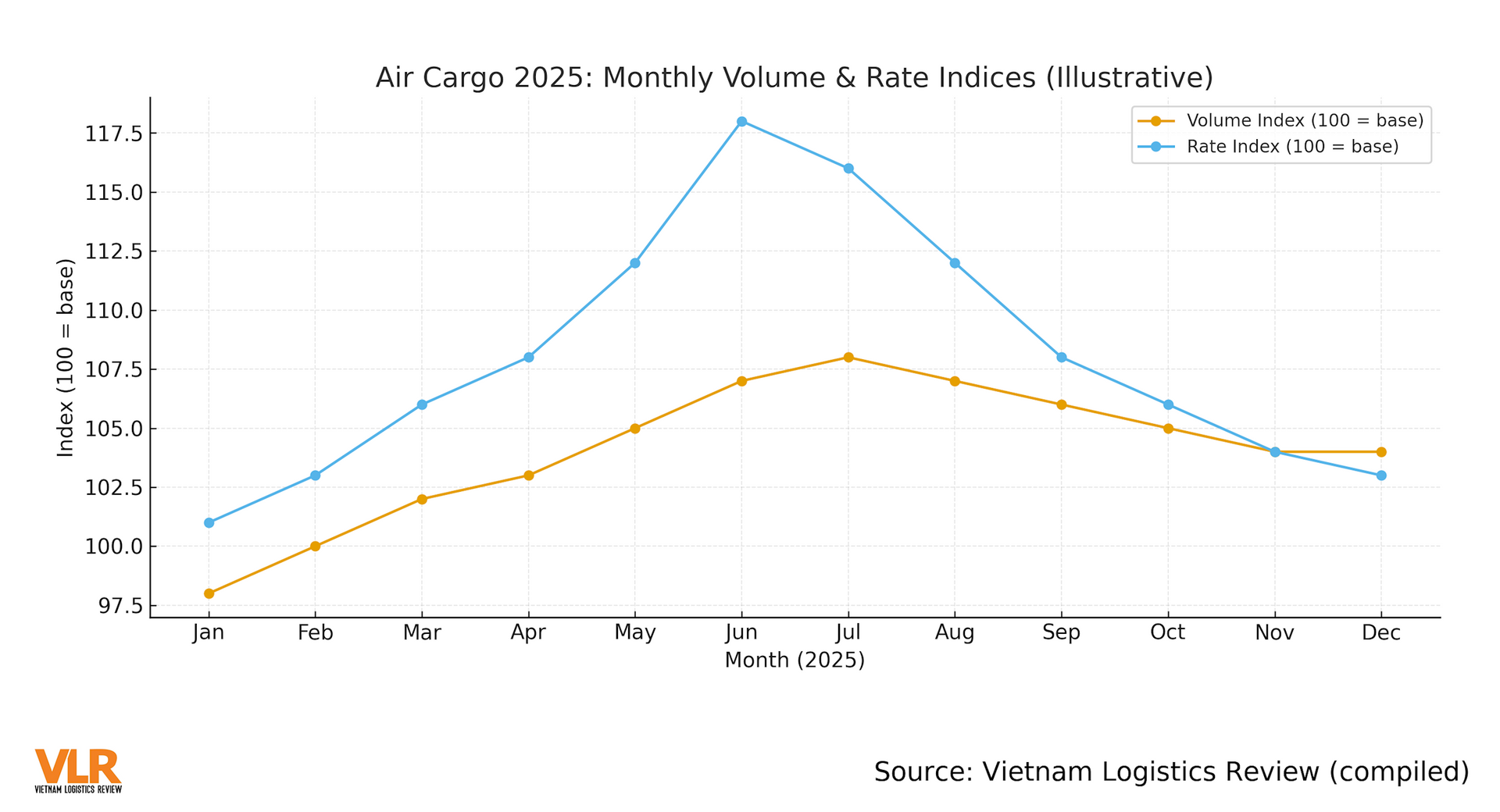

Rates & Yield Management

When capacity expands faster than demand, average rates and yields (revenue per unit of lift) come under pressure especially on Asia - US trades that closely track retail cycles. Still, the market is never short of short-term spikes: tension in the Red Sea/Suez can push some demand back to air on certain lanes when ocean networks are forced to detour or schedules are disrupted. This creates weekly/regional hot spots that require shippers to watch rate-locking windows closely.

Another factor is aircraft supply lag: delivery delays of new Boeing/Airbus aircraft combined with an aging freighter fleet mean capacity is not uniformly abundant, particularly in peak seasons. This supply uncertainty makes yields less likely to collapse and could even prompt rebound spurts if local demand flares.

In booking strategy, work explicitly with service classes e.g., Economy/Deferred, Standard, Priority—and with clear cut-off times. For shipments with hard deadlines, buy up to a higher service class on risky segments (storm season, congested cargo hubs, corridors with tighter security) and pre-lock allotments for 2–4 weeks.

Five Common Mistakes in Airfreight Booking

- Incorrect HS code/security declaration, triggering extra screening and missed flights;

- Wrong temperature range for sensitive goods (pharma, cosmetics), causing damage or surcharges;

- No US domestic buffer (last mile delayed by weather/strikes);

- Missing Incoterms-aligned insurance, leaving the seller exposed;

- Unclear transit hub selection (e.g., ICN/HKG/DOH), raising the risk of missed connections.

Using this checklist reduces operational errors and unplanned costs.

A Flexible Sea–Air Playbook for Vietnamese Exporters

Choose reliable hubs: Doha (DOH), Incheon (ICN), and Hong Kong (HKG) currently offer dense frequencies and strong connectivity to both Southeast Asia and North America/Europe. Anchoring routes via stable hubs helps control bottlenecks, especially when ocean trades face geopolitical risks or canal constraints. For high-tech and fast-fashion segments, consider ocean to an Asian hub, then air to the US/EU during “spiky” market phases.

Q4 peak scenarios: Even if 2025 is expected to “cool,” Q4 still brings seasonal peaks (holidays, product launches). Build three scenarios:

(1) Base case - calm market: prioritize ocean, add air for hero SKUs;

(2) Mild tightness - raise the air share at key marketing moments;

(3) Severe tightness - lock 4-6 weeks of allotments and favor lower-congestion hubs.

For each, pre-define switching thresholds when price or transit exceeds preset limits.

Design chain-wide KPIs:

(i) End-to-end lead time (days) from factory gate to DC/retailer;

(ii) On-season shelf-date rate (% of SKUs hitting the “golden window”);

(iii) Post-freight gross margin;

(iv) Slot reliability (% of booked flights kept);

(v) Temperature-damage claim rate.

Breaking KPIs down this way allows leadership to measure – adjust - optimize weekly, instead of waiting to recap after a full season.

Post-bull run, air cargo in 2025 is cooler - but not cold: demand is growing moderately while capacity alternately loosens and tightens with aircraft schedules and policy. Vietnamese businesses should build product-specific sea–air playbooks, updated quarterly based on yields, seasonal demand windows, and ocean-lane risk so decisions are data-driven: price thresholds, time thresholds, and risk thresholds. When air is used as a strategic lever (right time, right SKU, right hub), supply chains stay nimble amid volatility while protecting margins in the new normal of global logistics.