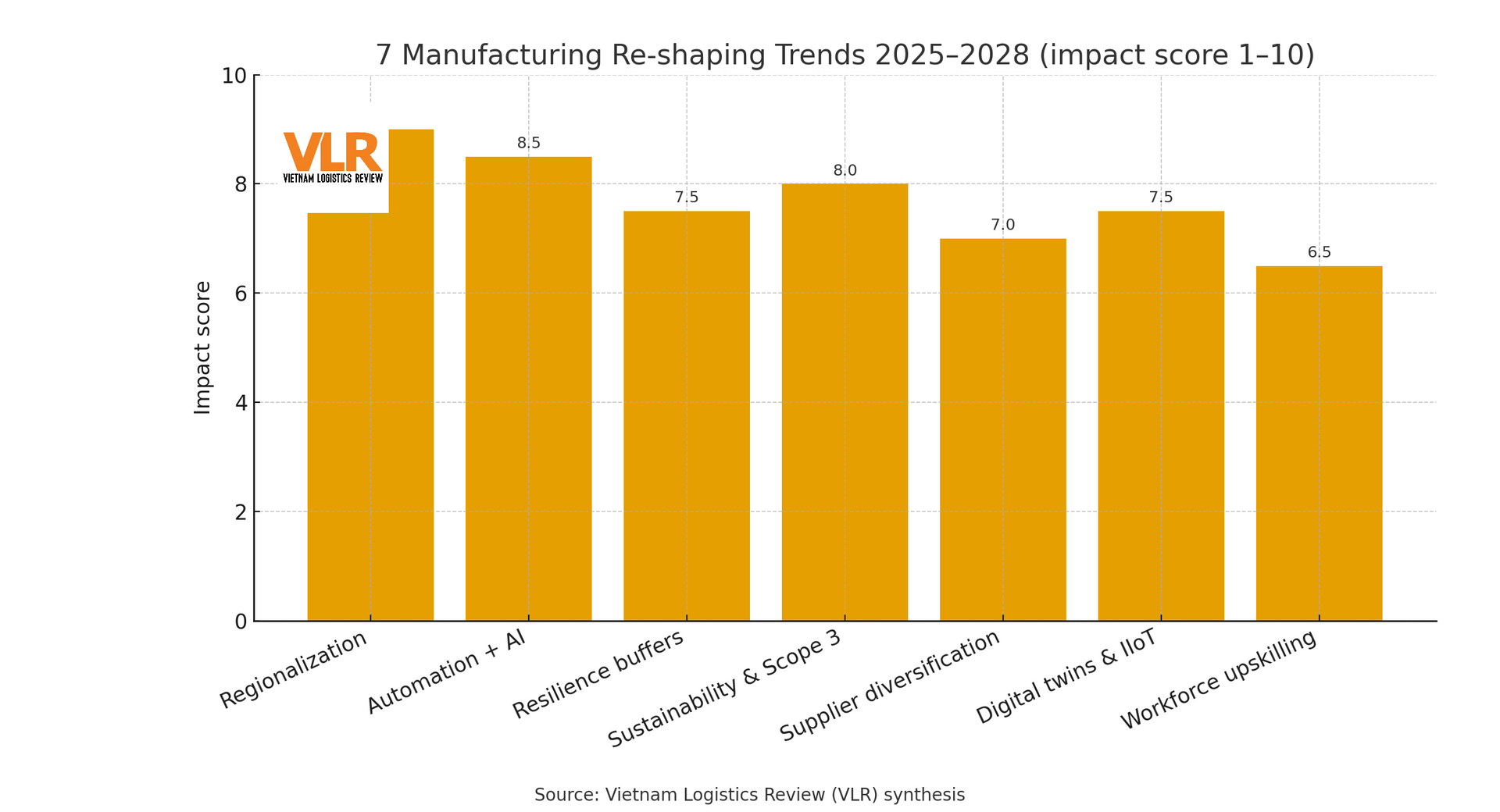

“Supply Chain Reset”: 7 Trends Reshaping Manufacturing

English - Ngày đăng : 08:00, 05/11/2025

Smart Regional Network Design & Multi-Sourcing

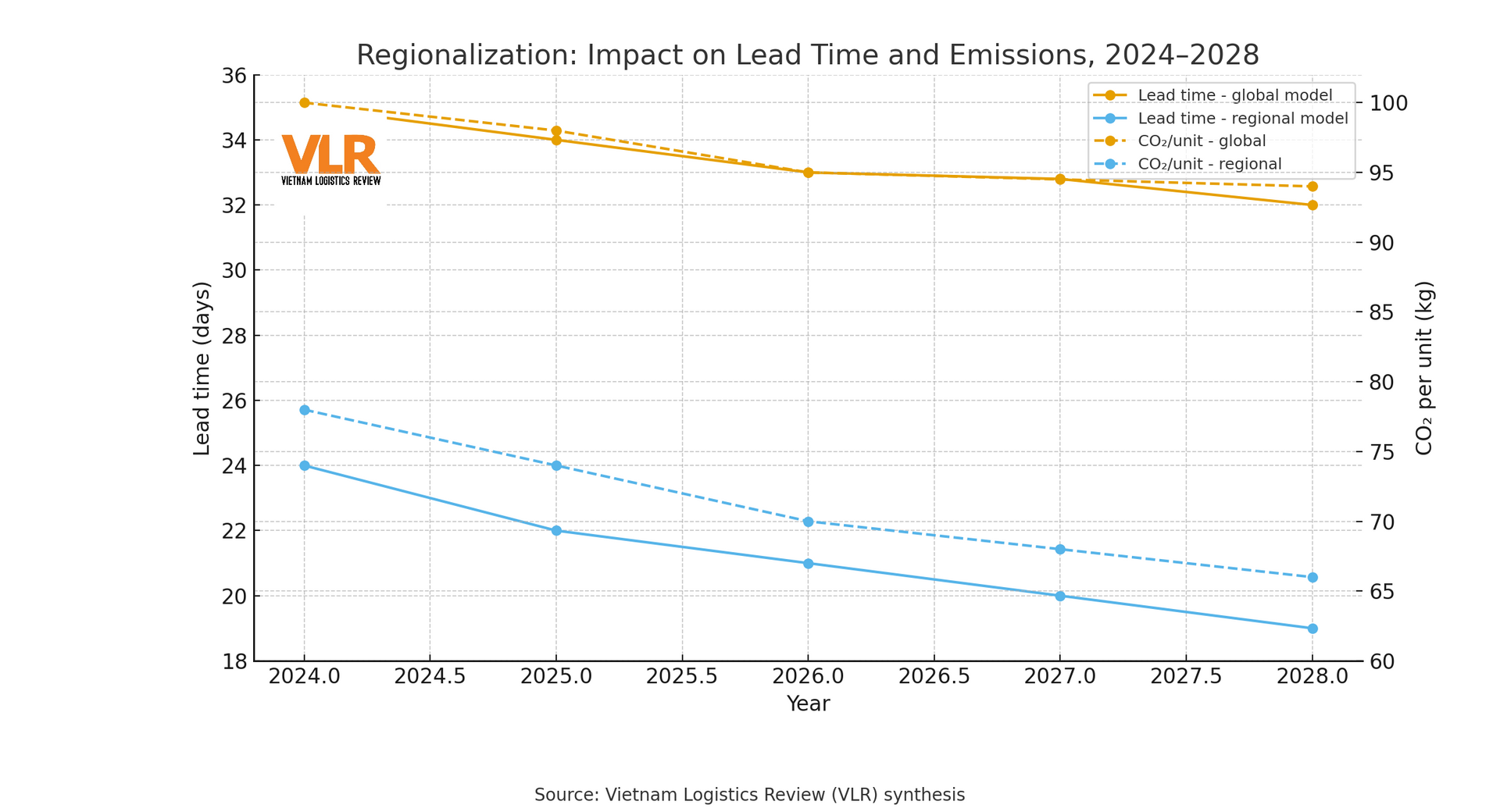

Regionalization means redesigning material flows around major consumption clusters to shorten lead time, reduce geopolitical risk, and balance inventory. Companies begin with a “map of SKU–market–DC–plant–supplier,” run total cost of ownership with carbon pricing and risk weighting. Three common moves: relocate finishing steps closer to market, deploy regional DCs with postponement capability, and sign 3PL/4PL contracts with lane-level data quality requirements.

Dual/multi-sourcing is not just a “safety belt”; it also increases competitive pressure: use conditional split awards; secondary suppliers maintain a minimum order level and must meet data/quality standards to ramp share when demand pivots. In logistics, multi-carrier contracts with “lane-switch gates” tied to quantitative triggers (spot/freight index, dwell, sailing schedules) enable rapid adaptation without runaway cost.

Intelligent Automation & a Digitally-Hybrid Workforce

The robot/equipment wave is durable only when paired with AI tied to business KPIs. In 2025 the emphasis shifts to module-by-pain-point automation: slotting + AMR to shorten cycles; vision-picking to cut errors; dynamic labor planning to balance shifts; AI forecasting to improve ETA and lock transport schedules. Real-time data from TMS/WMS/IoT feeds a control-tower dashboard where AI agents handle exceptions. ROI is measured by labor productivity, ETA accuracy, OTIF, and cost-to-serve by channel.

The deciding factor is still human. A digitally-hybrid workforce understands processes, reads dashboards, and supports robots; supervisors operate AI agents and evaluate KPIs. A three-tier upskilling path: safety–process–5S; basic digital skills (WMS/TMS, dashboards, data literacy); a core group for analytics, simulation, and continuous improvement. Retention policy is tied to skill bands, not just short-term pay/bonuses.

Getting started: take a “snapshot” of today’s network (SKU–market–DC–plant–supplier), score risk for each node, and estimate “cost–carbon–service” by lane. Pick 2–3 pain points with clear ROI for quick wins (slotting+AMR, route optimization, regional postponement) while building a minimum data table for Scope 3. Define quantitative triggers for lane switches/carrier changes. Re-run the twin each quarter to recalibrate.

Quantified Shock Buffers & Trigger-Based Risk Management

Instead of “padding” inventory across the board, design time–risk buffers: stagger departures/receipts to avoid concentrating risk in a single sailing; tier suppliers into A/B/C; build “escape hatches” through flexible transport contracts. In plants, buffers appear as flex capacity (extendable shifts, multi-skilled teams) and SMED to switch SKUs quickly when demand shifts.

Operate buffers by triggers: when risk indicators (dwell time, spot index, port congestion) cross thresholds, the system automatically proposes re-routing, carrier changes, raising safety stock for time-sensitive SKUs, or activating postponement at regional DCs. Track results through time-to-recover and service at risk weekly.

Measurable Sustainability & Digital-Twin-Driven Decisions

Scope 3 (transport/suppliers) enters contracts: emission reporting by shipment/leg/unit, integrated into the cost–carbon–service KPIs for network design and transport planning. You’ll need standard emissions intensity by mode/vehicle type, distance data, load factor, and recording of SAF/SMF use or electrification. Lane-level data agreements with 3PLs are a prerequisite to “see” Scope 3 truthfully.

Digital twins + IIoT form the orchestration brain: a strategic twin (quarterly network design) and a tactical twin (daily transport/warehouse scheduling). With real-time data, managers can A/B test “what-ifs” (DC relocation, lane mix, shift changes, packaging tweaks) and commit within the day—shortening decision cycles and reducing reliance on gut feel.

A Quarterly “Reset” KPI Set

Keep the list tight but hit the spine. Suggested seven:

(1) OTIF by channel;

(2) Median lead time and variability band;

(3) Cost-to-serve by SKU family;

(4) CO₂ per unit by lane;

(5) Time-to-recover when disruptions occur;

(6) Effective automation utilization (hours/device/day);

(7) Share of workforce meeting digital-skills standards.

Quarterly cadence allows earlier pivots instead of “year-end fixes.”

Bottom line: “Supply chain reset” is not a gear race or a one-off relocation. It is a long-term architecture with four blocks:

(i) disciplined regional networks & multi-sourcing;

(ii) intelligent automation tied to KPIs plus a digitally-hybrid workforce;

(iii) quantified buffers operated by triggers;

(iv) measurable sustainability embedded in a digital twin.

Companies that center decisions on data and maintain a quarterly improvement rhythm will move from reactive to proactive value creation—resilient to shocks and fast enough to seize opportunities.