3PL 2025: Redefining Services in an Age of Uncertainty

English - Ngày đăng : 08:00, 06/11/2025

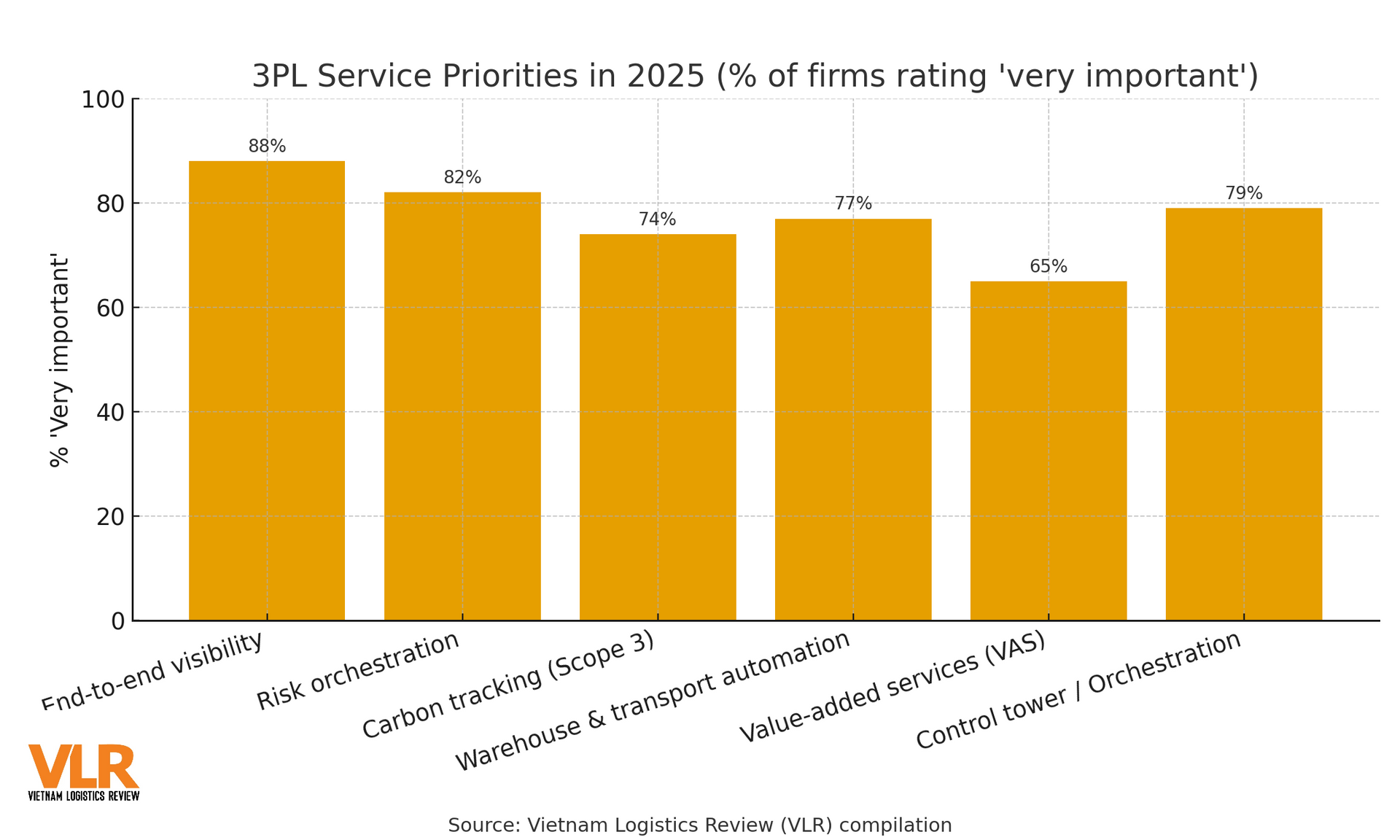

A new service portfolio: visibility, carbon control, risk management

3PLs are moving beyond “execute transport/warehousing” toward “intelligent orchestration,” in which end-to-end visibility, proactive risk management, and Scope 3 emissions tracking form a new core trio. Visibility isn’t just shipment location; it’s real-time data streams—dwell time, ETA, load factor, and rate variance. On top of that data layer, risk modules attach triggers to automatically recommend rerouting, mode shifts, or SKU-specific safety buffers when time sensitivity is high. On emissions, shippers increasingly want per-order/ per-move reporting with clear methodology; therefore, 3PLs are embedding Scope 3 standards into their value stack, turning carbon into a KPI that sits alongside cost and service. 2025 surveys by Inbound Logistics note that technology and data capabilities are now central to improving margins in a thin-margin market.

Co-designing solutions: 3PLs as network architects

As disruptions (conflict, tariffs, port issues) become the “new normal,” successful 3PLs don’t just sell point services—they engage from the network-design stage: DC siting, postponement configurations, intermodal planning, and building operating triggers tied to market signals. This “network architect” role requires an integrated control tower (WMS/TMS/IoT) and “what-if” simulation to quantify cost–service–carbon impacts before touching the floor. Shippers therefore favor 3PLs with domain expertise (retail, FMCG, pharma, consumer tech, etc.), the right operational footprint in target markets, and an open technology stack to co-author quarterly KPIs. Independent studies on shipper–3PL relationships reinforce this: satisfaction is highest when both sides collaborate deeply at process and data levels, not just through transactional buying.

A trustworthy 3PL decision typically begins with proven vertical expertise—evidenced by relevant case histories and compliance with sector-specific requirements like pharma, food, or e-commerce; next is the right market footprint with DC networks, intermodal capability, cross-border competence, and lane-specific lead-time commitments with clear contingency plans; finally, an open tech platform integrating WMS, TMS, and ERP that enables real-time visibility and KPI dashboards combining cost, service, and Scope 3—so both parties can co-design and monitor value quarter by quarter.

Contract models and flexible KPIs

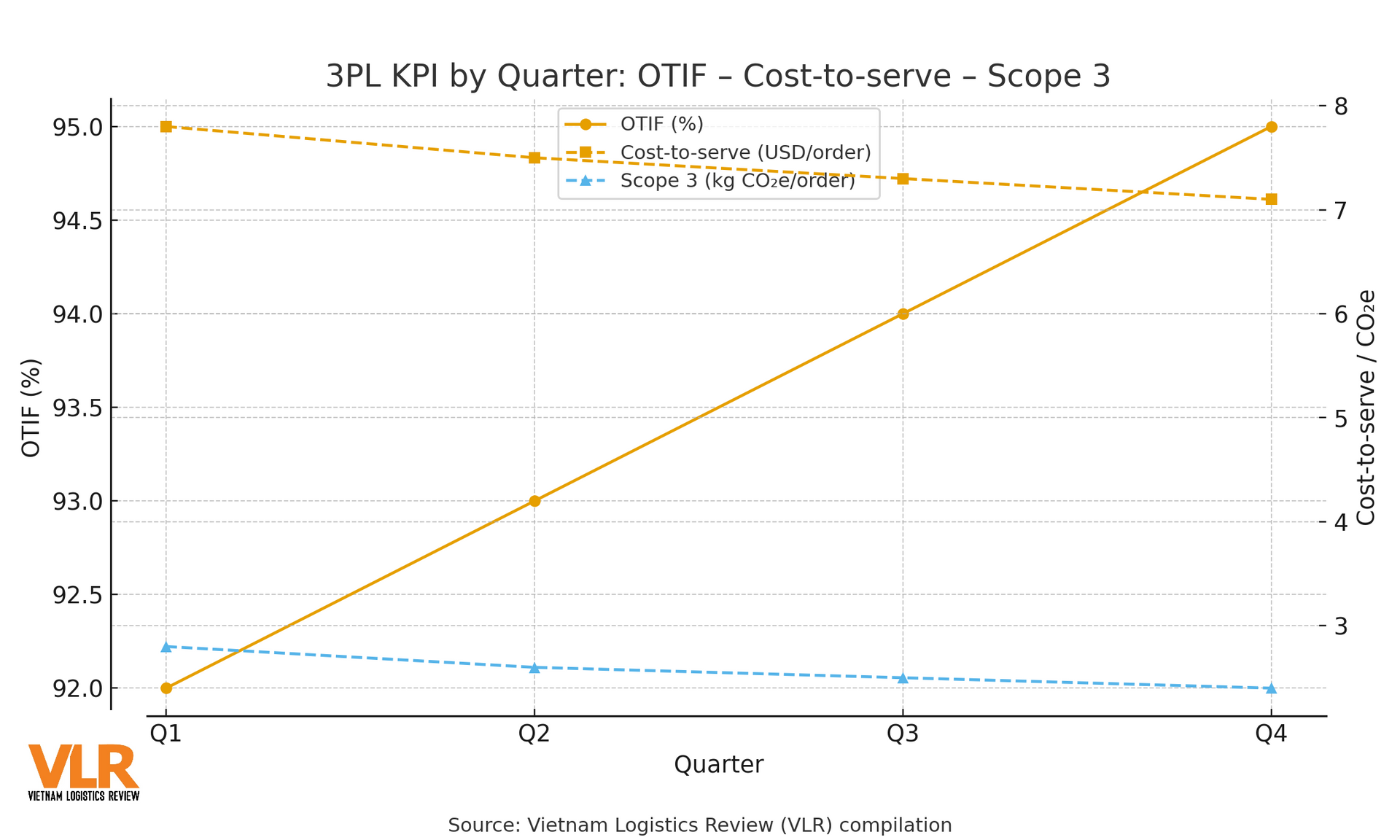

In 2025, transport/warehousing contracts are shifting from rigid frames to flexible, cycle-based models with renegotiation triggers. On volatile lanes, the spot/contract mix is tuned to demand indicators (upstream orders, dwell time, port congestion). KPI boards should avoid sprawl and focus on the backbone: OTIF, cost-to-serve by SKU/channel, ETA accuracy, Scope 3 per order, and time-to-recover after incidents. Commercially, many shippers are proposing gain-share mechanisms for optimization wins (e.g., CO₂ reductions or shorter lead times) to incentivize proactive improvement from 3PLs. With competition for customers up 13 points in two years, demonstrating quarterly KPI results is the most convincing “value weapon” at the negotiating table.

An effective KPI set must be concise yet comprehensive. Anchor on OTIF by channel and ETA accuracy to reflect service quality; pair with cost-to-serve by product group to expose true flow economics; add Scope 3 emissions per order as an emerging competitive metric demanded by customers and regulators; and track time-to-recover plus the real utilization of automation to reveal resilience and asset leverage—thereby steering the next quarter’s improvement roadmap.

Integration capability & people: closing the loop between data and process

Technology is the lever; durable advantage comes from turning data into operating decisions. Leading 3PLs run a closed loop: (1) capture standardized field data; (2) analyze and forecast demand/capacity; (3) generate automated recommendations (AI agents) for dispatch; (4) measure via the three-lane KPI set; (5) reconfigure processes and rules each quarter. On talent, 3PLs need “digital-hybrid” teams: field staff who understand dashboards; planners who can work with forecasting models; account managers who can narrate KPIs to customers and convert them into value proposals. Firms with a higher share of digital-hybrid workers consistently lift OTIF and lower cost-to-serve across cycles—mirroring broader industry findings that effectiveness stems from the mix of automation, analytics, and upskilled labor.

.jpg)

Winning 3PLs co-create, run on digital platforms, and operate with transparent KPIs. They step beyond “operators” to become partners that architect and orchestrate supply chains—where every decision is data-based and measured by a three-lane scorecard. In a fiercer market, the 3PL formula for advantage is: core services + open tech stack + vertical co-design capability + trigger-based flexible contracts. That is also the consistent message echoed in Inbound Logistics’ 2025 publications and surveys.