Tech Reset 2025: The Supply Chain Investment Landscape

English - Ngày đăng : 08:00, 08/11/2025

.jpg)

Hot Spots

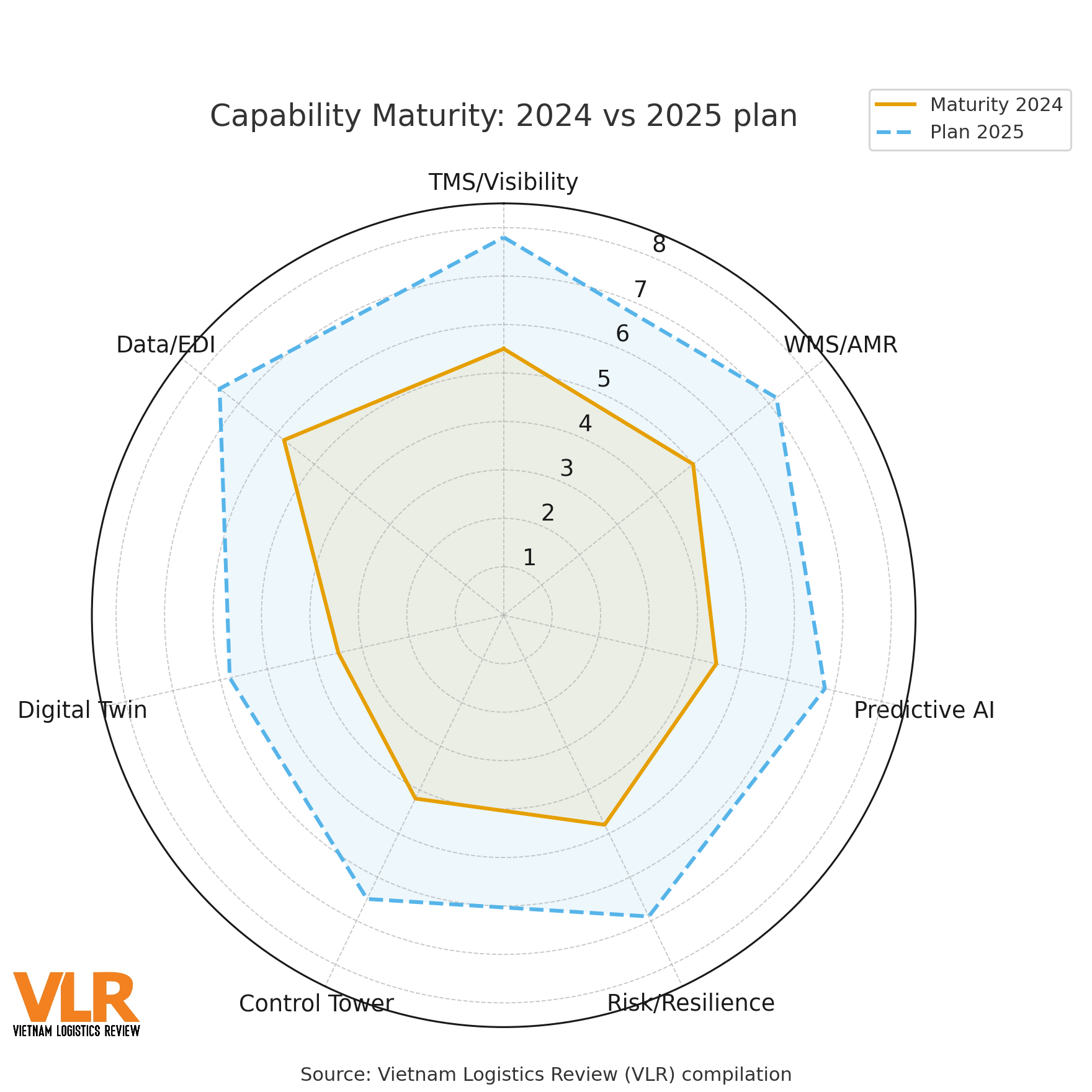

Projects that combine TMS with real-time visibility continue to lead spending as companies seek to lock in optimal transportation schedules based on accurate ETAs and actual loads. In the warehouse, WMS paired with AMRs addresses the twin challenges of productivity and consistent quality - especially with long SKU assortments and fast changeovers.

Predictive AI is shifting from pilots to production, enabling risk-based inventory planning and orchestration recommendations driven by simulated demand. At the same time, risk and resilience capabilities are emerging as a strategic safety net: early triggers based on dwell time, spot rates, or port congestion automatically propose lane shifts, extra time buffers, or activation of postponement. Together, these hot spots form a unified orchestration layer where operational data is converted into same-day decisions.

Data Skills & the Digital Control Tower

Technology only endures when it is anchored in organizational capability. Many companies have set up a digital control tower as the convergence point for data from TMS, WMS, IoT, and orders, where operations, commercial, and finance teams share a single KPI dashboard to manage exceptions. Core capability now means data literacy across roles: reading dashboards, tracing root causes, running “what-if” scenarios, and asking vendors the right questions.

Successful organizations typically train in three layers: foundational safety and process discipline; basic digital skills for frontline teams; and an “advance guard” specializing in analytics, simulation, and continuous improvement to translate recommendations into new operating rules.

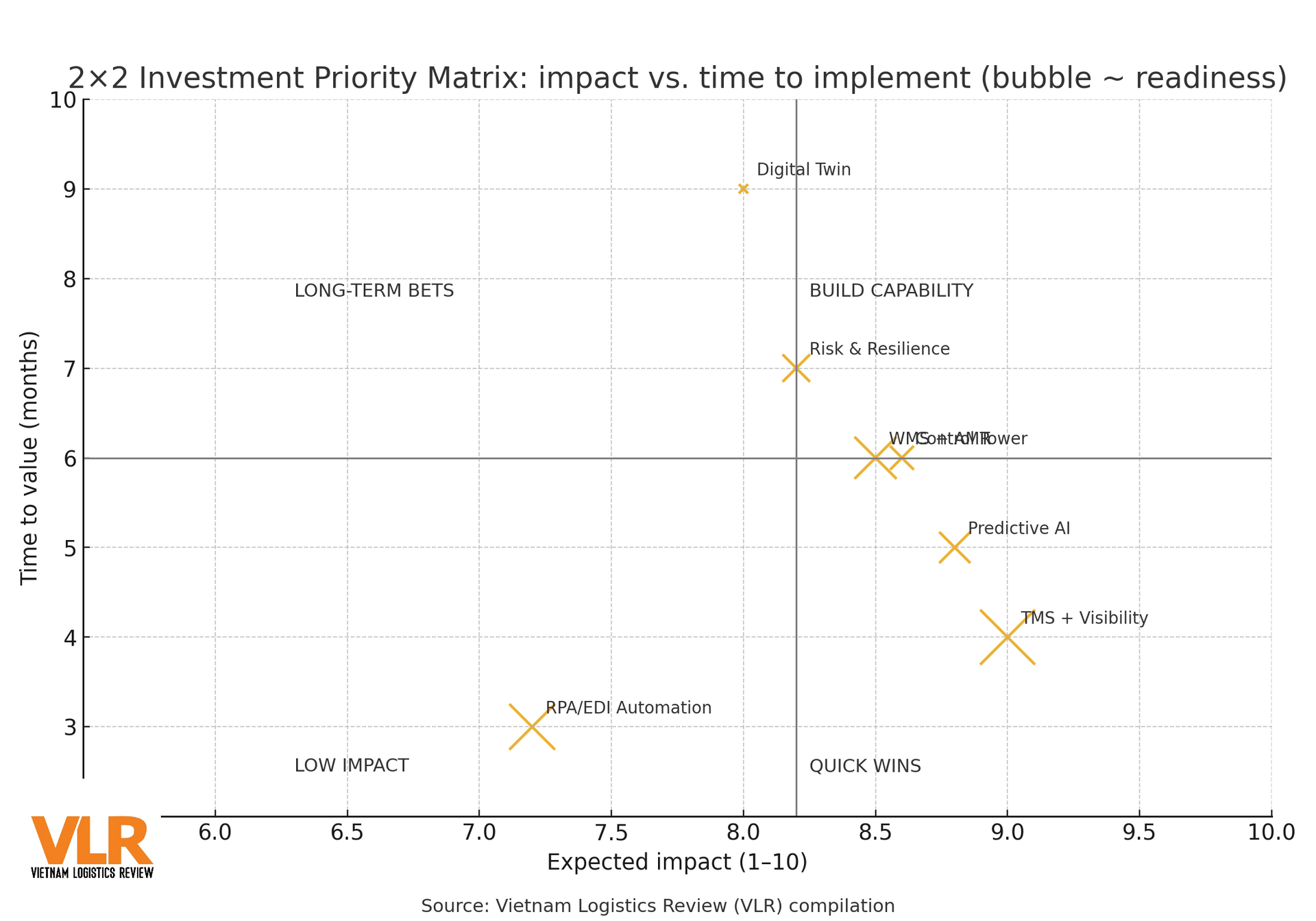

A 2×2 investment-priority matrix helps: rank initiatives by impact and time to implement, favoring “quick wins” such as TMS + visibility or targeted AMR deployments that deliver value in three to six months. Platform plays like control towers, risk systems, or digital twins should scale along a maturity roadmap, tied to cost–service–carbon metrics each quarter to avoid “big purchase, half-hearted adoption.”

Technology Contracts

Contracting is shifting toward phased value rather than long, monolithic rollouts. The first 90-day phase focuses on a single process to prove measurable outcomes - higher ETA accuracy, lower cost-to-serve, or reduced CO₂ per order - before broadening scope. Companies also negotiate flexible licensing and open API integrations to avoid vendor lock-in and formalize data provisions: ownership, export formats, refresh cadence, and security requirements. This approach balances speed, risk, and cost while preserving strategic control.

Before signing, buyers should demand proof of impact via operational KPIs, a clear integration roadmap with existing systems, explicit commitments to open APIs and data standards, security and audit mechanisms, on-site support capability, role-based training plans, value-linked pricing, Scope 3 handling, exit options, and case studies from comparable industries. Convincing answers to these ten areas form the bedrock for sound decisions.

Investments in technology deliver durable results only when paired with a program to upgrade people and processes. In 2025, firms don’t need to “innovate at any cost”; they need a sharp priority list: a few 90-day quick wins to build momentum, several architectural foundations (control tower, risk, and data) to enable scale, and a data-skills program that turns dashboards into decisions. When technology, process, and people move in concert, the supply chain truly enters its tech-reset phase - faster, more transparent, and more resilient.