EU ETS for Maritime Shipping: What Should Businesses Do Now?

English - Ngày đăng : 08:00, 10/11/2025

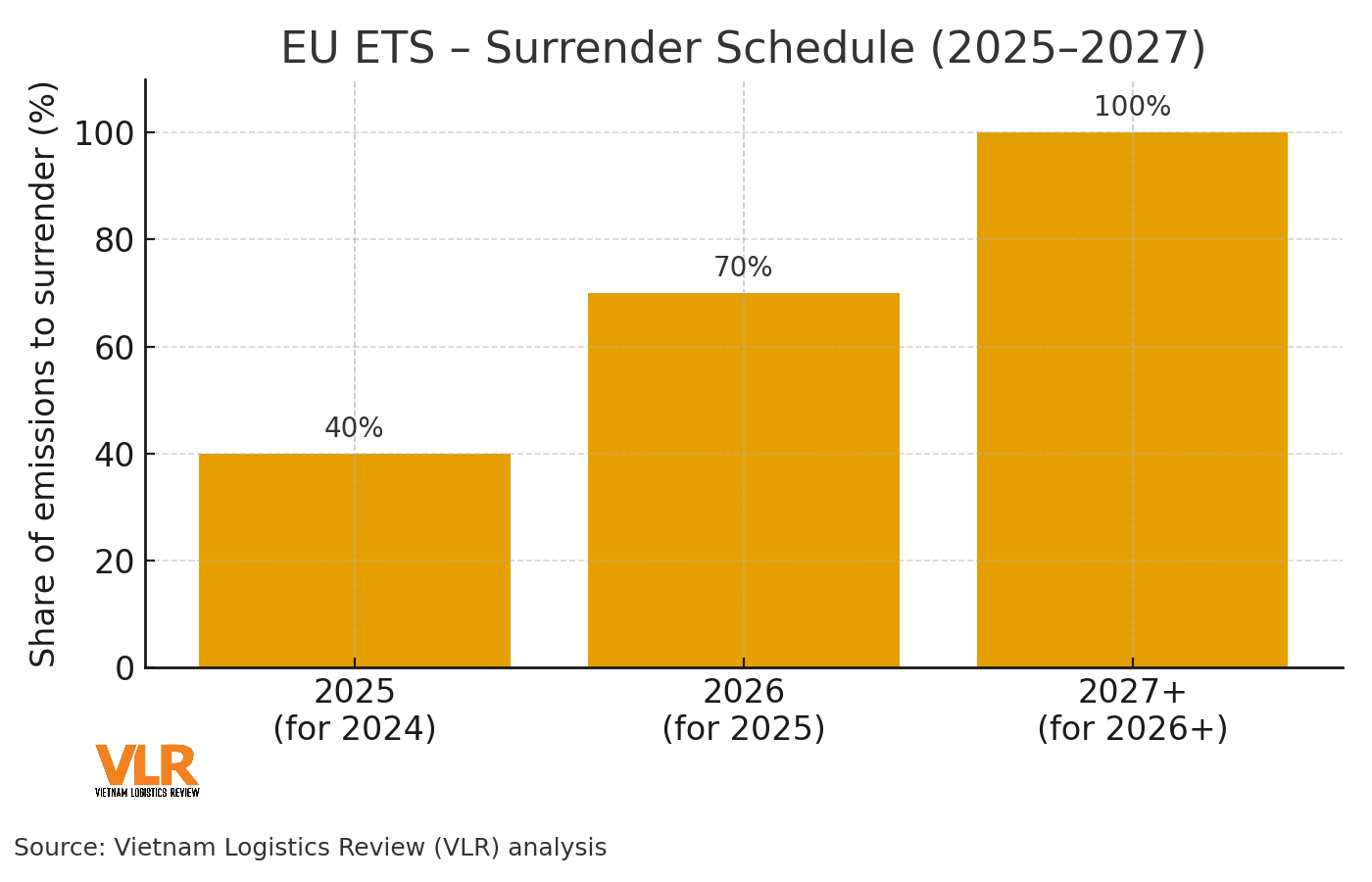

Emissions to Be Purchased from 2025 to 2027

The EU formally extended the EU ETS to maritime transport in 2024, creating a rising obligation to purchase and surrender carbon allowances (EUAs). Specifically: by September 2025, companies must surrender EUAs equal to 40% of 2024 emissions; by September 2026, 70% of 2025 emissions; and from 2027 onward, 100%. This obligation applies to ships ≥5,000 GT on voyages involving EU/EEA ports, based on MRV-verified reports.

Under the implementation guidance, the compliance cycle consists of monitoring–reporting–verification (MRV) for the calendar year. In practice, the first industry-wide “ETS payment day” for maritime concentrated on 30/09/2025, driven by EUA volumes derived from 2024 emissions data already submitted on the MRV platform.

At its core, ETS creates a real, invoice-level carbon cost. In addition to traditional fuel and operating costs, operators and shippers must add an EUA cost stream for every lane and vessel. The ETS currently covers around 40–45% of total EU emissions and the cap-tightening path to 2030 is accelerating—making EUA price swings a key risk factor over the next 12–24 months.

Cash Flow and Hedging Carbon Price Risk

The first task is the carbon budget. Many companies have set up a quarterly EUA Budget for 2025–2027 based on: (i) operating output (lanes, sailings, loads), (ii) forecast emissions intensity by vessel, (iii) the share of EU/EEA-related routes, and (iv) EUA price bands (low–medium–high). At minimum, build a carbon cash-flow calendar that specifies when to pre-purchase and how much—while preserving operating liquidity.

The second task is hedging. Companies can use EUA derivatives (futures on EEX/ICE, options, swaps) to lock in part of the price and bring budget certainty. Methodologically, many studies recommend risk models such as VaR/EVT to estimate tail losses when EUA prices move sharply, and combining carbon-bunker hedges to manage the “dual” risk of fuel and carbon. For SMEs, execution via risk agents/brokers can help minimize transaction costs.

The third task is contracting and risk sharing. In transport/3PL contracts, separate a Carbon Cost Clause: (i) clearly define the EU ETS (EUA) component distinct from other surcharges; (ii) set a transparent pass‑through mechanism by lane–vessel–period; (iii) specify EUA price bands that trigger renegotiation if breached; and (iv) include a quarterly true‑up schedule to adjust for EUA shortfalls/overages. Attach an evidence pack (voyage–bunker–emissions data trail) to enable reconciliation.

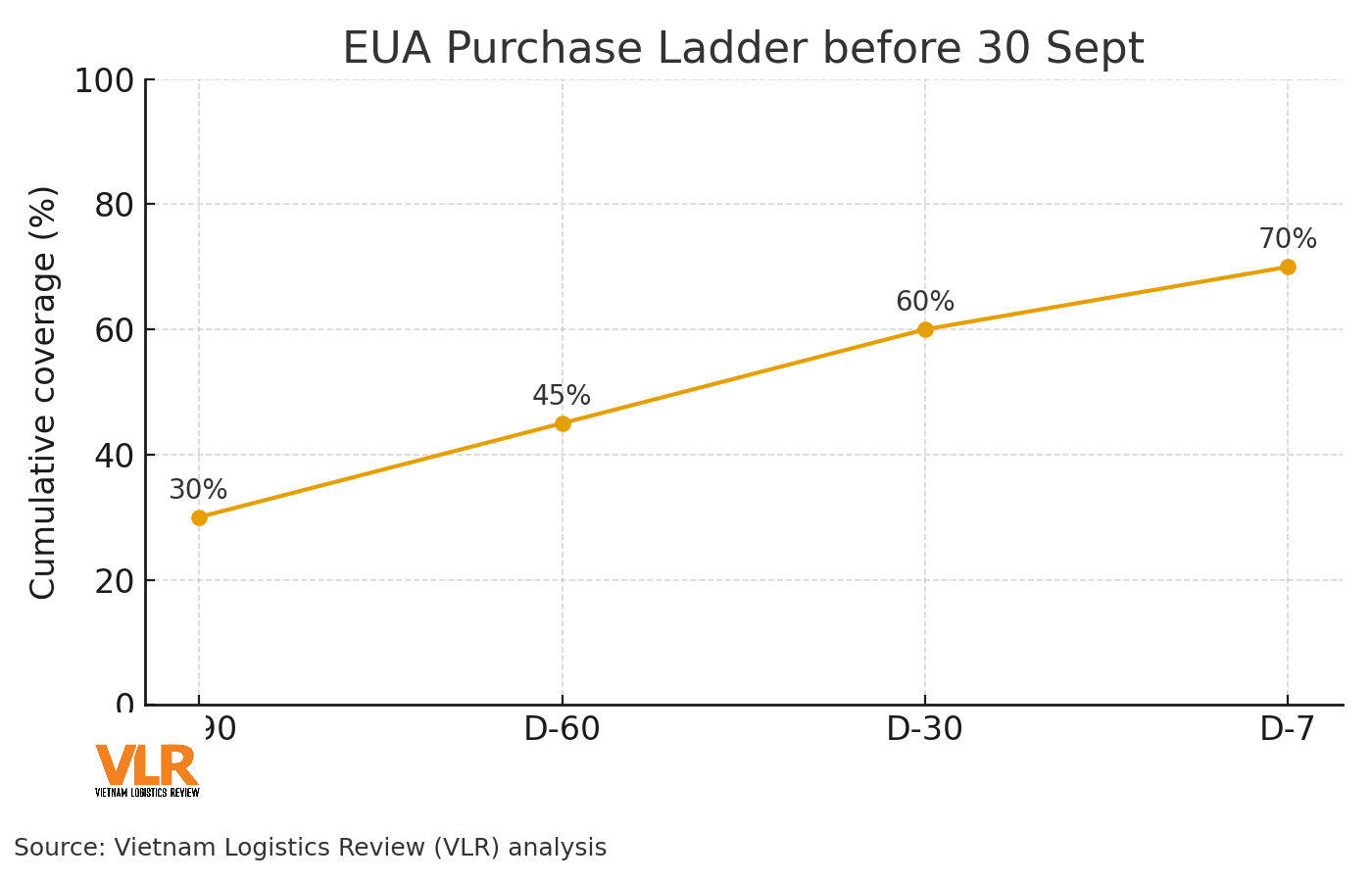

Build a purchase ladder with 3-4 steps across prices and time (D‑90/D‑60/D‑30/D‑7), prioritizing 60–70% of needs locked before the deadline, with the balance left flexible depending on market conditions. For SMEs, pooling demand via buying alliances or broker mandates can cut transaction costs and the retail mark‑up.

MRV Data and Reconciliation with Carriers

Maritime EU ETS stands on MRV: measured–reported–verified data is the basis for final EUA obligations. Companies should standardize a Monitoring Plan for each vessel (or require it from carriers/agents), agree on the measurement method (fuel‑based vs. direct), and lock verification workflows with an accredited verifier. From 2025, MRV scope is being extended in stages to smaller vessels, increasing the data‑management burden for supply chains with diverse fleets.

For reconciliation, set up a lane‑level ETS ledger: link each shipment to vessel–voyage–port, and match fuel data, auxiliary‑engine time at berth, AIS tracks and emission factors. ETS surcharges invoiced by carriers should include a documented evidence chain; otherwise, service buyers have grounds to request adjustments. Small errors in emissions intensity can inflate into significant costs when multiplied by EUA volumes.

Finally, the surrender process. Ensure your Union Registry account holds sufficient EUAs for the previous year’s verified emissions before the deadline. Leaving surrender to the last minute increases operational risk (market congestion, delayed EUA transfers), especially in early years when the whole industry converges on the same date.

Set up a Carbon Control Tower: (i) an ETA dashboard for EUA obligations coming due, (ii) alerts for funding/EUA shortfalls, (iii) synchronization of contracts, the MRV plan, and the EUA purchasing plan, and (iv) “Plan B” scenarios for sharp EUA market volatility. A control-tower mindset treats ETS as real cash flows and real risk - not merely another surcharge.

EU ETS for maritime is no longer a “policy shadow” but a clear cash‑flow and legal obligation already in force since 30/09/2025. Early movers will stay in control: with a defined carbon budget, structured price‑risk hedging and MRV‑grade data to reconcile invoices. In this new game, the advantage goes to those who measure right - buy right - surrender right, turning carbon from a shock into a manageable variable.