Asia–Pacific Leads the Pack: A New Air Cargo Boom After the Pandemic

English - Ngày đăng : 08:00, 22/11/2025

In that picture, the Asia–Pacific region is the key growth engine, with carriers there posting a 14.5% rise in demand and an 11.3% increase in capacity – the strongest performance worldwide. This surge has given a powerful boost to the regional economy, but it has also exposed a series of bottlenecks in fleet, infrastructure, and development strategy.

IATA data: Asia–Pacific is pulling the global market forward

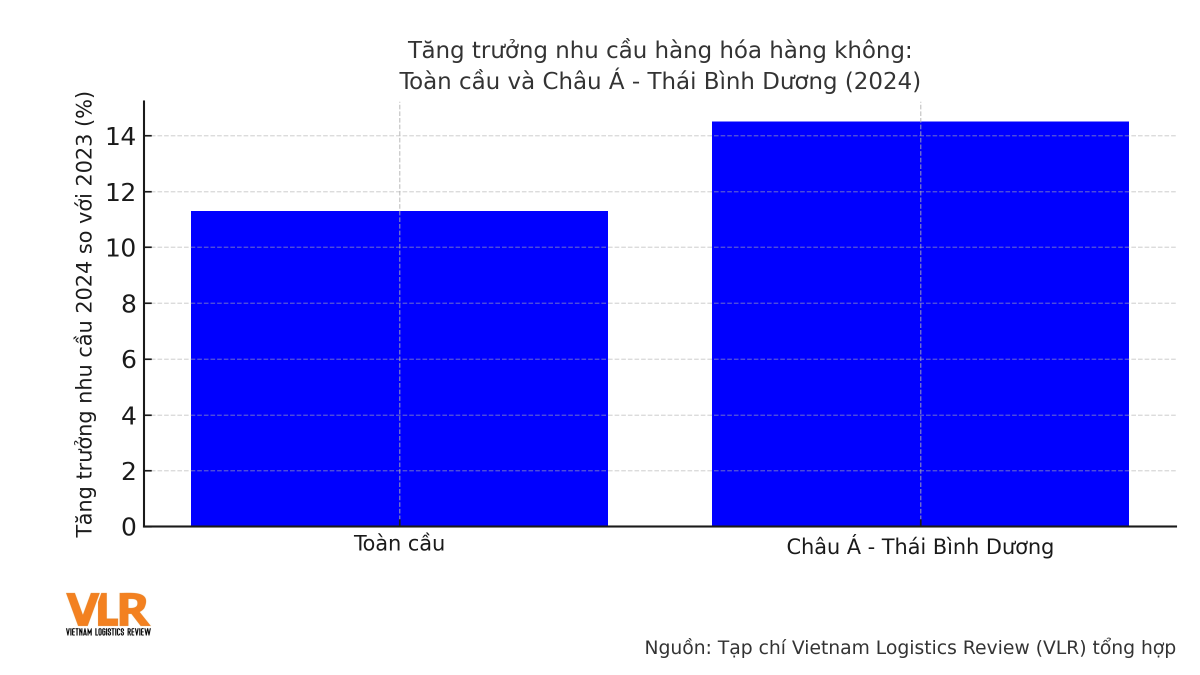

According to IATA’s market analysis reports, from the second half of 2023 through the end of 2024, air cargo demand consistently grew at double-digit rates year-on-year, driven by cross-border e-commerce, high-value consumer goods and a partial shift of volumes from sea to air. Within that trend, Asia–Pacific stands out as the fastest-growing region: 14.5% for all of 2024, far above the 6–11% range seen in other regions.

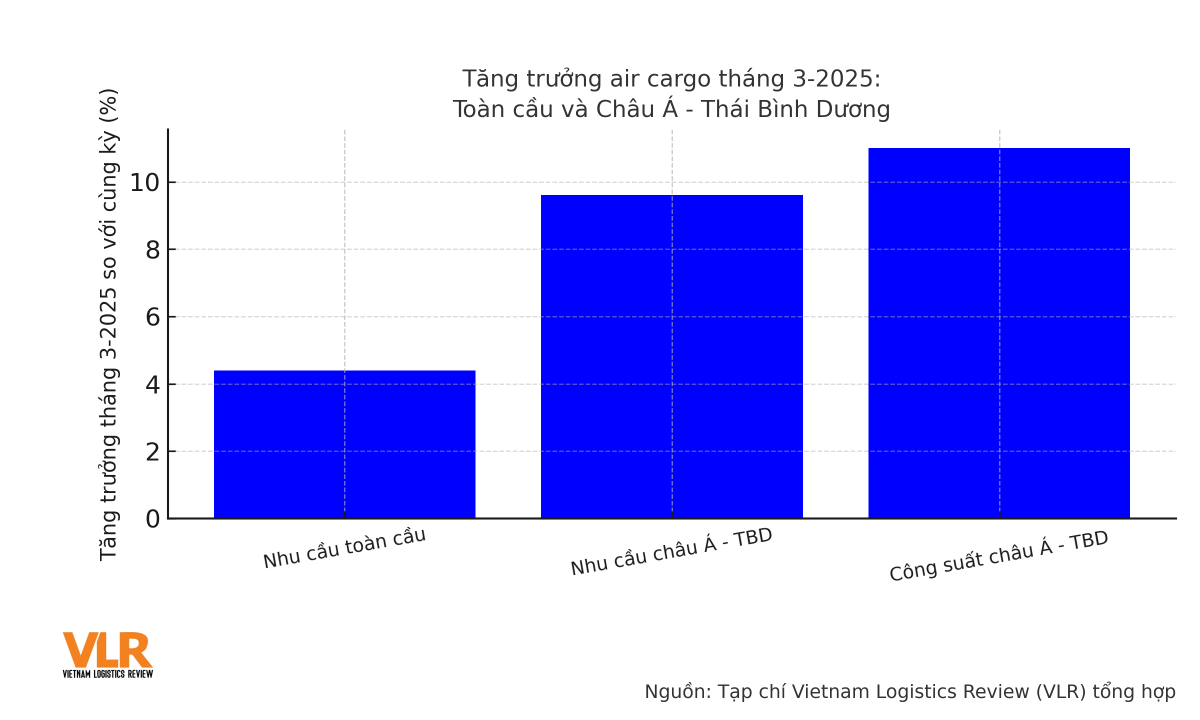

The momentum has not stopped at 2024. In March 2025, IATA reported that global international air cargo demand rose 4.4% versus the same month a year earlier – the highest figure ever recorded for March – while Asia–Pacific carriers led the world with 9.6% growth, well ahead of other regions, and regional capacity also climbed by more than 11%.

Importantly, growth is spread across multiple lanes rather than just a few “hot routes.” Intra-Asia, Asia–Europe, Asia–Africa and Asia–North America all saw strong CTK increases, reflecting a broader shift in global supply chains: production of electronics, garments, auto parts, pharmaceuticals and more is relocating from China to Vietnam, Thailand, India, Indonesia and Bangladesh, in turn driving demand for fast transport to meet peak selling seasons in the US and Europe.

Fleet, slots, infrastructure: new bottlenecks emerge

Behind the upbeat numbers lie serious constraints. On the fleet side, operators are warning of potential capacity shortages in the medium to long term. Because of supply chain difficulties, Airbus and Boeing have delayed deliveries of next-generation freighters; at the same time, around 150 of the world’s more than 600 large wide-body freighters are approaching or have passed the 25-year mark and will soon need to be replaced. This forces many airlines to “sweat” their existing fleets, postpone new route launches or hold back on frequency increases.

On the ground, many airports in the region prioritize slots for passenger flights now that travel demand has rebounded, making it harder for freighters to secure attractive slots, especially at night – the “golden hours” for cargo. Cargo terminals, cold-storage facilities and e-commerce handling areas at a number of Southeast Asian airports have not expanded quickly enough to match volume growth, creating local congestion during peak seasons.

Financially, the “golden year” of 2024 has encouraged some overly optimistic expectations. Analyses from FreightWaves and IATA forecasts suggest that the pace of growth in 2025 could be roughly half that of 2024 as the market normalizes, belly capacity returns and part of the e-commerce flow shifts back to cheaper sea options. If airlines and logistics providers fail to adjust in time, expanding fleets and infrastructure too aggressively could quickly lead to overcapacity and eroding margins.

Opportunities for Southeast Asia amid a global supply chain reset

Despite those short-term challenges, the long-term trend is tilting in favor of Asia–Pacific, especially Southeast Asia. Under their “China+1” strategies, US, European, Japanese and Korean corporations are diversifying production into Vietnam, Thailand, Indonesia, Malaysia and the Philippines. For high-value categories such as electronics, components, pharmaceuticals and fast fashion, when factories move, the air logistics network tends to move with them.

At the same time, e-commerce flows from China to the US and EU have been heavily squeezed by tighter “de minimis” tax rules and stricter controls on low-value parcels, reducing volumes and cooling rates on those lanes. Some freighter capacity is being re-deployed to new markets, including Southeast Asia, India and Latin America – regions where middle-class consumption is rising quickly and online marketplaces are expanding aggressively.

This is a genuine “window of opportunity” for ASEAN countries to move up the air-cargo value chain. Singapore is strengthening its hub status with a strategy to position Changi as an integrated center for passengers, cargo and high value-added logistics. Thailand aims to turn its Eastern Economic Corridor into an “aerotropolis” closely linked with Suvarnabhumi Airport. Vietnam, Indonesia and Malaysia are pushing investments in cargo terminals, cold-chain facilities and distribution centers for express and global 3PL players, while also reforming customs procedures and rolling out e-AWB and e-freight to shorten clearance times.

If these efforts are combined with coherent strategies that integrate seaports, airports, industrial parks and logistics zones, Southeast Asia can evolve into the “core region” of global air-cargo supply chains, not just a destination for low-cost labor and contract manufacturing.

In a world where trade is fragmenting and geopolitical risks are multiplying, Asia–Pacific is emerging as a shock absorber that helps keep supply chains moving. The region’s sustained leadership in air cargo growth, along with rising FDI in manufacturing and logistics, shows that its role is shifting from that of a simple “factory of the world” to that of a region shaping the fast-transport networks underpinning global commerce. For Southeast Asia – and Vietnam in particular – this is a chance to break through, provided infrastructure upgrades and institutional reforms keep pace.

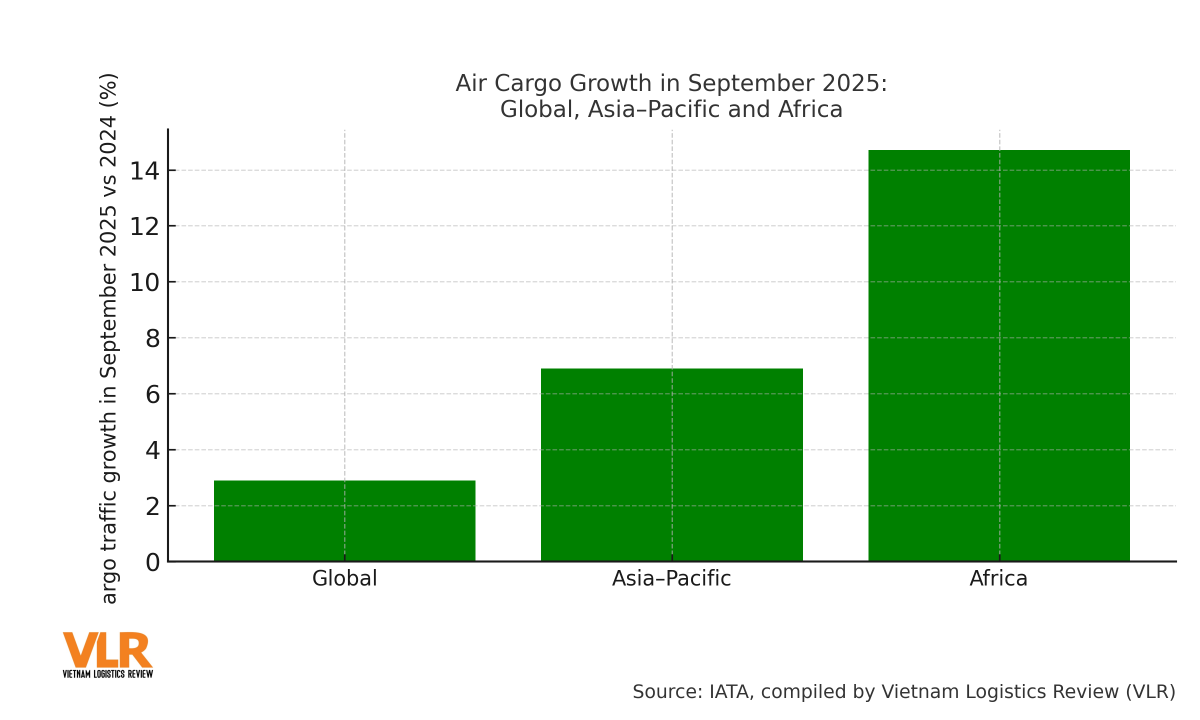

Stepping into 2025, the air cargo “boom” is clearly cooling, but far from over. IATA’s June 2025 update shows that global cargo volumes for the full year are now expected to grow by only about 0.6–0.7%, to around 69 million tonnes – a far cry from the 11.3% surge seen in 2024. Yet recent monthly data confirm that Asia–Pacific remains one of the main engines: in September 2025, the region’s international cargo traffic rose 6.9% year-on-year, more than double the global rate of 2.9%, and second only to Africa (14.7%). This underlines that airfreight demand tied to Asian supply chains is still running hot, even as global growth slows.

The current air-cargo boom in Asia–Pacific is not a short-lived phenomenon but a milestone in a deeper restructuring process. From record CTK numbers to concerns over fleet shortages and infrastructure bottlenecks, every signal points to the region becoming the most critical anchor of global air-cargo supply chains. The question is no longer whether growth will continue, but how countries and businesses in the region – including Vietnam – will capitalize on it to move from being followers to becoming rule-makers in the new era of global logistics.