With the scale being expanded, the aquaculture sector has become one of the spearhead economic sectors, playing an important role in the development of Vietnam’s economy. The brand name “Vietnam’s aqua products” has not only been affirmed in the country but also in many other countries worldwide. In 2022, Vietnam’s aqua-product export is forecast to reach USD 11bn.

Available in the market and expanding

It is noted that shrimp export reached USD 4.3bn- an increase of 30%; catfish export reached over USD 2bn- an increase of 80% year-over-year in 2001- and it will possibly reached USD 2.5bn at the end of the year; tuna export reached over USD 1bn for the first time... Export turnover of all aqua-products experienced two-digit growth from 18% -77%.

Vietnam’s aqua-products have currently been consumed in 160 markets and gained important positions in great markets. Four markets of EU, the U.S, China and Japan accounted for 74% of Vietnam’s total export turnover. In 2022, Vietnam’s aqua products to the U.S reached USD 2bn for the first time. The U.K has become the 7th market of Vietnam aqua-product export...

It is said that Vietnam’s aqua-product export has increased in all markets. This is a good sign to show Vietnam’s enterprises have been able to find opportunities in the hard time.

According to experts, the achievement was thanks to the fact that financial factors of markets and prices had impacts on aqua-product export sales. In addition, it was because enterprises had information from markets promptly and responded to them appropriately and at the right time.

At the beginning of 2022, after impacts from the pandemic, the global supply chain had other serious impacts from the Ukraine- Russia conflicts. However, enterprises have kept doing their production. And it was reasonable. Needs for aqua-products increased after the pandemic and brought about opportunities for Vietnam’s aquaculture.

In 2023, it was forecast there would be difficulties and challenges from the world’s geopolitical situation: China would not open door soon and be consistent with its “Zero COVID” policy. However, markets cannot be going down. Needs for foods in both popular and upscale markets will always develop according to the law of quality of life.

Therefore, experts in the sector forecast that Vietnam’s aqua-product export in 2023 will be over USD 10 billion. The problem is that enterprise should make good use of this time for better preparation of production activities, financial matters and production costs or even product quality improvements.

The golden key logistics

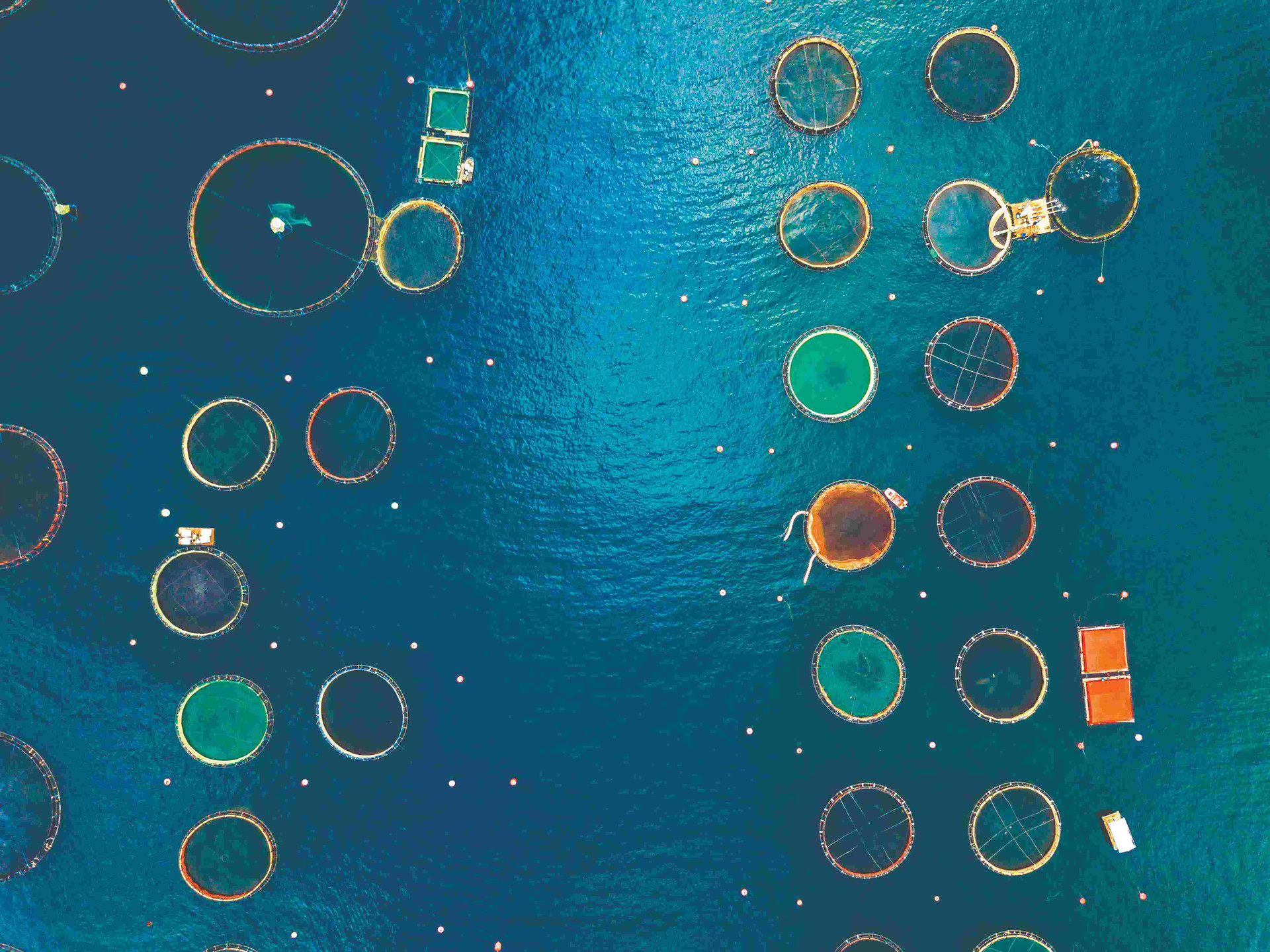

Vietnam has a very favorable position for aquaculture development from fresh-water agriculture (rivers, river basins, lagoons, lakes...) to marine fisheries. However, it is not an easy job to export aqua-products to international markets and expand market shares.

Vietnam’s aquaculture has been facing with many challenges. Although E.U and the U.S are large markets with large proportions and good export prices, consumptions in the areas have been affected by “storms of inflation” Besides, high logistics costs made aqua-products from the U.S and E.U undergo fierce competitions on prices with those from Ecuador and India.

For example, in case of shrimp export. A 40-feet container from Vietnam to the U.S bears the logistics costs of USD 20,000, meanwhile a container from Ecuador to the U.S costs only around USD 5,000. Thus, for 15 tons, their price reduced USD 15,000 and their shrimp price is 1 dollar/kg less than ours.

Vietnam’s products have been suffering from many irrationalities from macro to micro. In terms of micro, shipping cost is a matter. For example, fresh-water aqua-products from the Mekong Delta account for a large proportion in the export structure, however, shrimp and fish for export have to go backwards by road to seaports in HCMC or Ba Ria-Vung Tau. The system of cold warehouses in HCMC and the Mekong Delta does not meet requirements and is not properly located. They become reason for logistics cost increase.

In supply chain, it is impossible not to mention packaging and shipping process to avoid causing unfortunate losses. In addition, the choice of container is equally important because aqua- products are often frozen and need an appropriate storage temperature. Choosing a reputable and experienced logistics partner in transporting them is something that import-export enterprises cannot take lightly. It is a mandatory requirement.

On the “map” of world aqua-product export, Vietnam is proud to be the third largest exporting country, just behind China and Norway - two superpowers with a much larger land and water surface area than Vietnam. With the results of 2022, it is estimated that Vietnamese aqua-products will account for over 7% market share in the world market.

“By 2030, developing fisheries into an important national economic sector, large commodity production associated with industrialization and modernization, sustainable development and proactive adaptation to climate change; having a reasonable structure and organizational form of production, high productivity, with quality and efficiency; having a prestigious brand name, having abilities for competition and international integration” (Strategy on development of Vietnam’s fisheries to 2030, vision to 2045).

To achieve the target depends much on macro policies and abilities of exporters... All solutions come from the problem of the “logistics key”.