SAF is moving from pilot to price tag: from Amazon Air - Neste deals to pooled buying, book-and-claim lets shippers book real abatement even when fuel isn’t uplifted on site. The real bottleneck isn’t feedstock - it’s technology, scale, and certification discipline to turn trials into standard operating practice.

Recent SAF Deals and the Book-and-Claim Model

Over the past two years, market signals for Sustainable Aviation Fuel have strengthened. Amazon Air signed a long-term cooperation with Neste in California; airline–logistics alliances and 3PLs are aggregating demand to unlock scale. The common denominator is book-and-claim, which lets buyers account for emission reductions even if SAF is uplifted at a different airport. For air cargo, this circumvents current fueling constraints while giving shippers access to verifiable abatement.

Book-and-claim only holds value under three conditions: a transparent chain of custody (e.g., ISCC, RSB), unique serial numbers that can be looked up and retired to avoid double counting, and audited well-to-wake lifecycle data that converts to CO₂e under recognized ESG frameworks.

Mass Production Hurdles: More Technology than Feedstock

The popular narrative is “SAF lacks feedstock”. In practice, most recent assessments point to technology scale-up, efficiency and cost - as well as enabling infrastructure (green hydrogen, concentrated CO₂, renewable power) as the binding constraints. HEFA, Alcohol-to-Jet, Gasification/FT and Power-to-Liquid are technically viable, but require large capex, stable supply chains and learning-curve time before prices converge toward Jet A-1. Hence carriers and shippers are locking offtakes to finance plants akin to PPAs in renewables. For logistics buyers, the key is that SAF constitutes audited abatement for Scope 3, distinct from external carbon offsets.

Turning It into “Freight Rate + Certificates”

To embed SAF cleanly into invoices, use a two-layer design: (1) a SAF surcharge based on the quarterly price delta between SAF and Jet A-1 multiplied by the target blend for each lane/airport, with clear indexation and cap-and-collar to avoid shocks; and (2) certificates/credits attached to book-and-claim transactions, with serial numbers on invoices and ESG accounting aligned to the GHG Protocol. Buyers should retain the right to independent lifecycle and CO₂e verification.

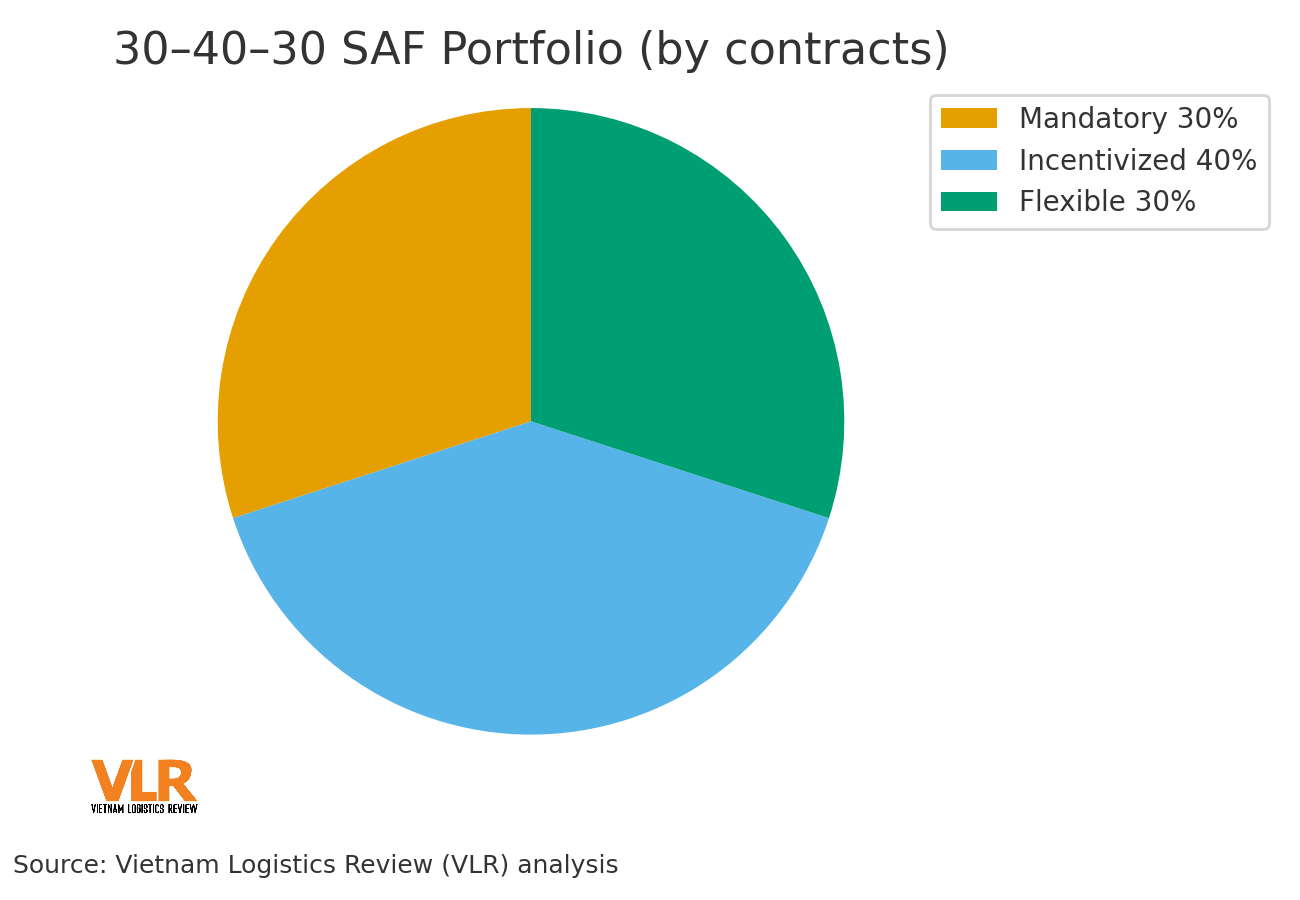

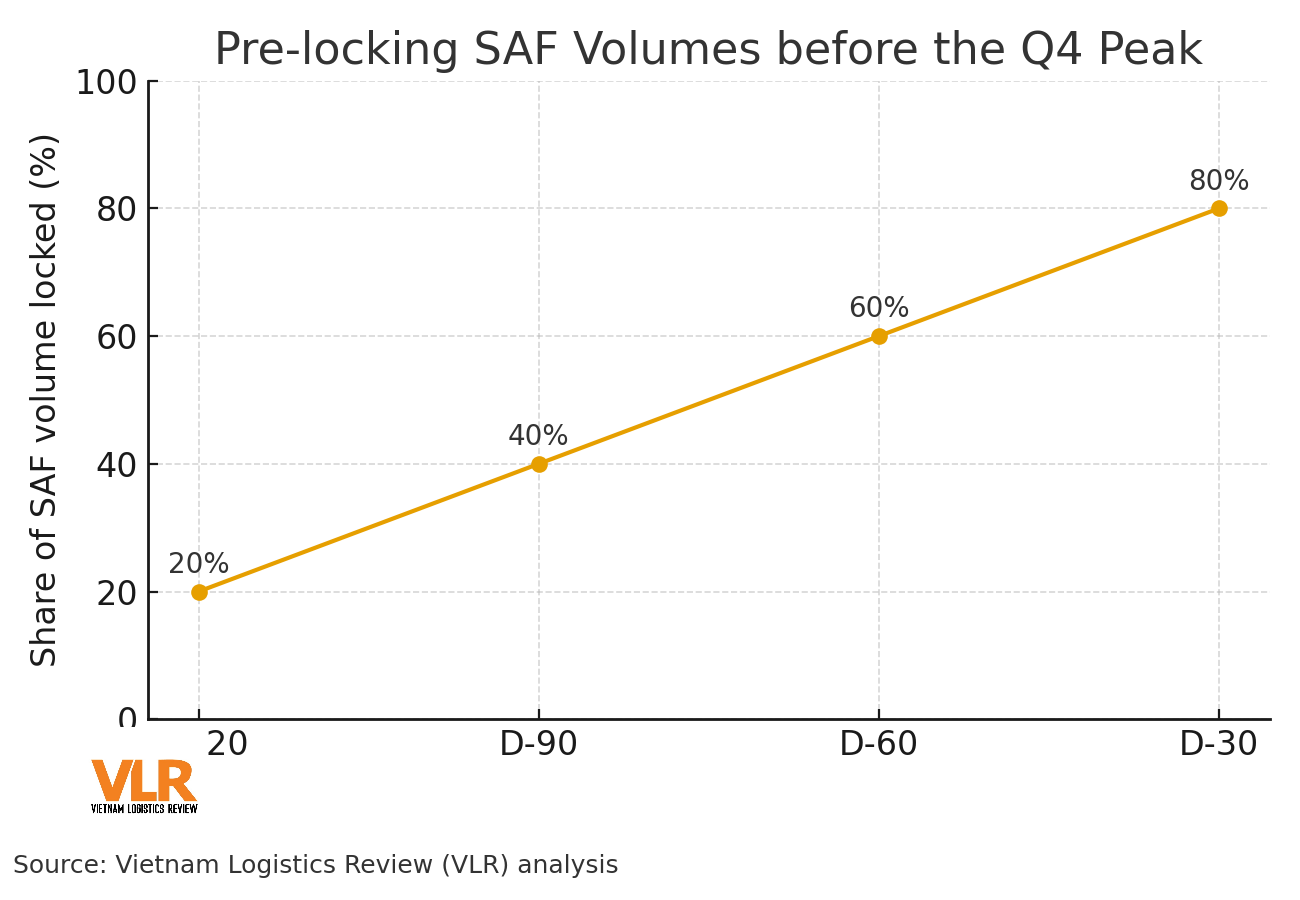

Build a 30-40-30 SAF portfolio: 30% mandatory SAF clauses on strategic lanes; 40% optional, triggered when the price spread falls below a threshold; 30% flexible. The aim is to learn the cost curve, pre-lock volumes for Q4 peaks, and diversify volatility risk instead of buying at the top.

At the operational level, adopt a clear playbook: prioritize airports with available SAF/low-cost renewable power, optimize payloads and schedules to lower CO₂e per tonne-km before blending, and standardize three-party contracts (carrier–forwarder–shipper) for transparent cost/benefit allocation.

Book-and-claim has value only with transparent certification. Prefer platforms issuing unique, searchable serials with retirement to prevent double counting. Your internal ESG system should auto-reconcile serials with flight, lane and date, and keep audited abatement from SAF distinct from any external offsets.

As production scales, SAF will become a de-facto mandatory cost in air-cargo logistics. The winners will be those who secure supply early, codify transparent surcharges and maintain rigorous certification and reconciliation. The challenge is not merely “finding feedstock” but switching on the technology–finance–contract triad that turns pilots into scale.