After the post-pandemic demand shock, U.S. truckload rates slid toward a prolonged bottom, with short bursts of recovery. But has true equilibrium returned? Looking across the spot–contract spread, fleet capacity, and consumer demand, the market looks more like a system resetting itself: weaker carriers are exiting, mini-bids are replacing annual deals, and supply–demand indicators still diverge by lane.

Prices, Capacity, and Demand: The Current Picture

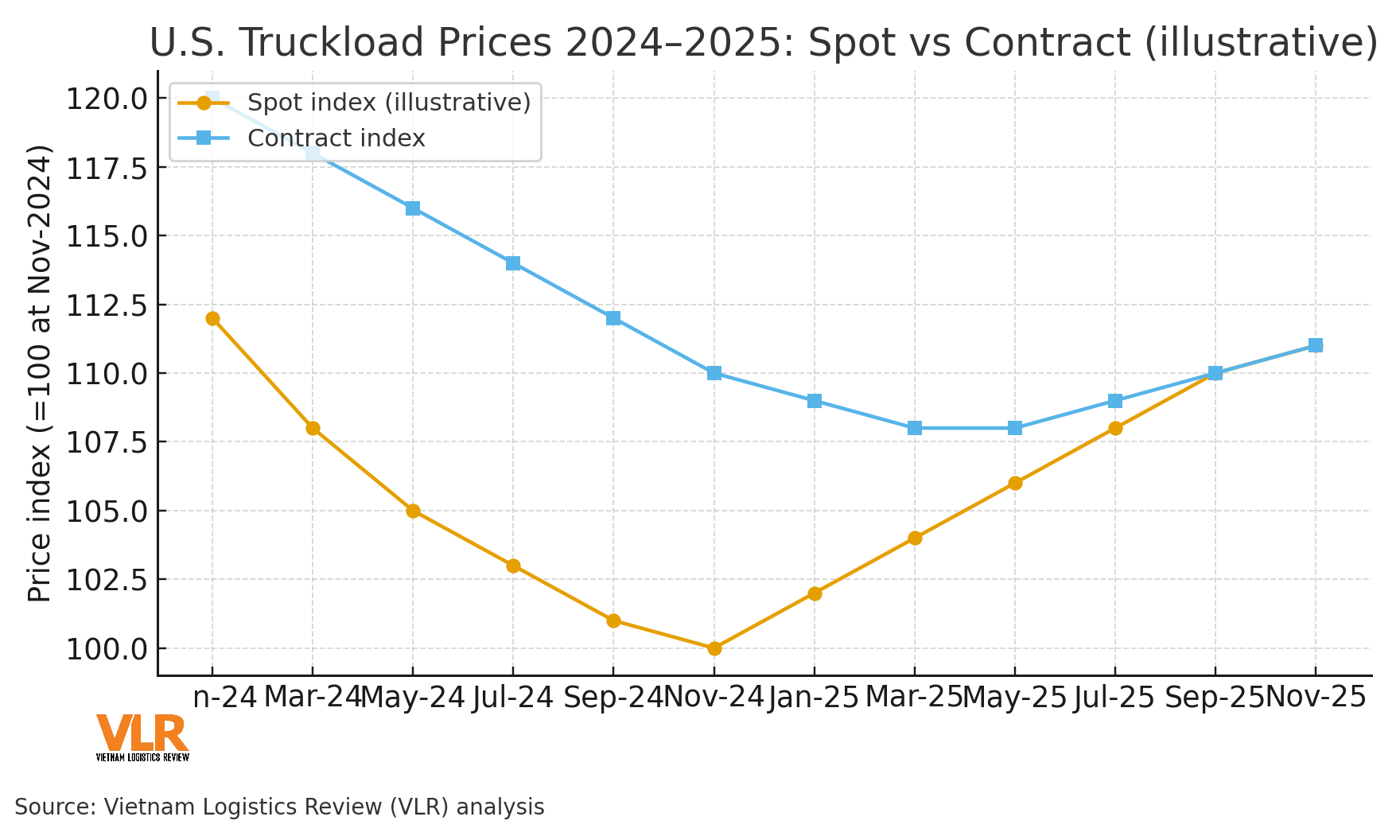

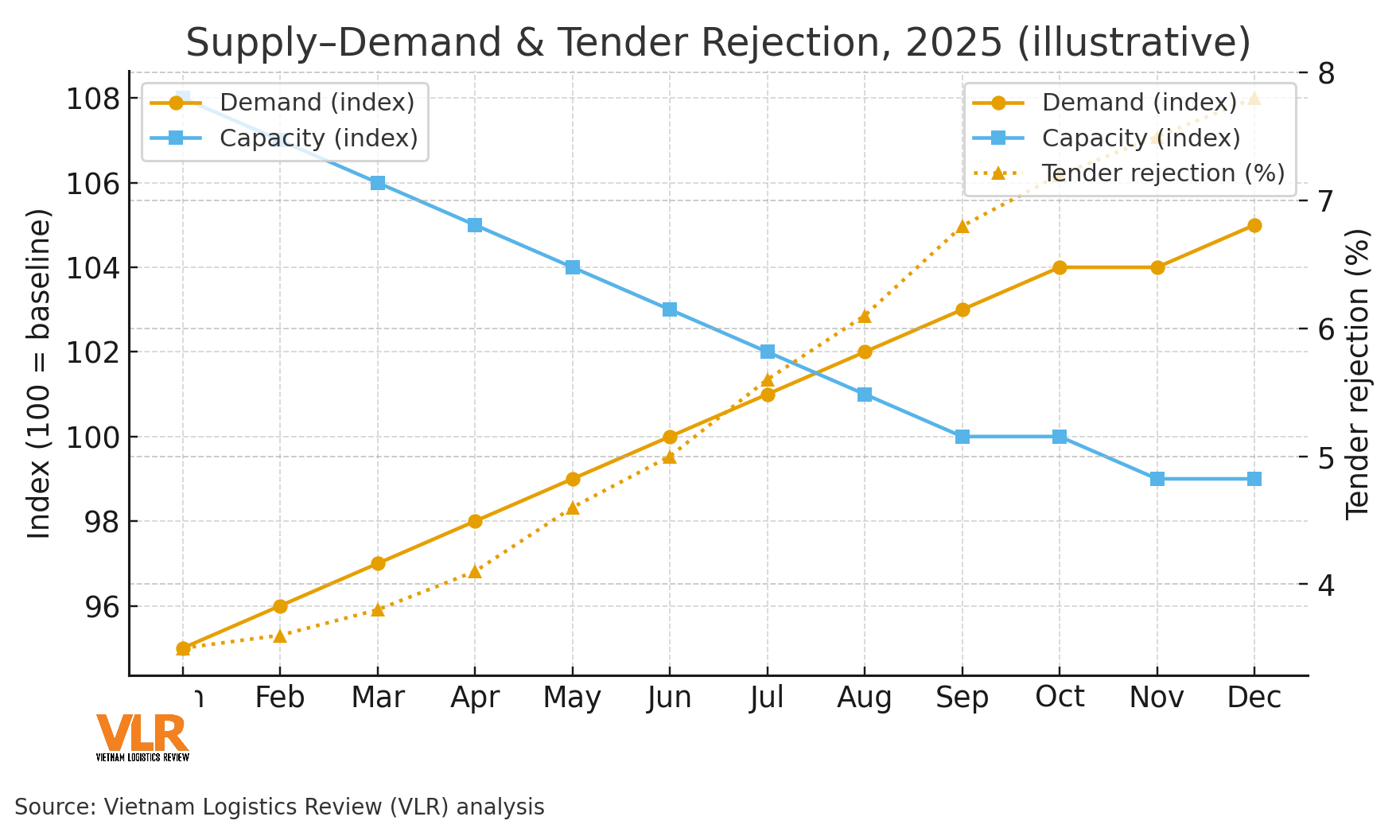

Spot indices have shown episodic upticks on seasonality and lane rebalancing, yet remain close to late-2024 lows. Contract pricing adjusts more slowly, but convergence is underway as carriers accept thinner margins to defend share. On the supply side, smaller fleets are shrinking under the weight of financing costs, insurance, and equipment debt, while larger carriers are squeezing empty miles and concentrating tractors on positive-margin lanes. Freight demand is capped by retail inventories and imports that haven’t fully re-accelerated; as a result, tender rejections are inching up but still sit below long-run averages.

Cycle Reset: When Does a “Bottom” Become Balance?

Track three leading signals. First, the lane-level spread between spot and contract. When that gap narrows toward zero for several consecutive months, structural upward pressure on contract rates tends to follow. Second, the depth and stability of import flows to West and East Coast gateways: if vessel schedules normalize, retail inventories draw down, and new orders rise, drayage needs and domestic FTL demand will firm. Third, fuel and the cost of capital: higher diesel but lower interest rates pull P&L in opposite directions, shaping carriers’ decisions to retain or release capacity. Put together, the “bottom” is likely a zone that lingers rather than a single, V-shaped inflection.

Six–Twelve-Month Playbook for Shippers and 3PLs

Instead of single, annual awards, move to quarterly mini-bids segmented by lane, with partial indexation to reduce cycle-mismatch risk. Re-benchmark lanes against intermodal; where rail service reliability has improved, a blended IMDL + drayage option can be both cheaper and steadier. On volatile lanes, keep volume “options” with two to three providers so coverage can shift quickly when the market tightens. In operations, standardize contracts around end-to-end KPIs (on-time, returns, claims) and a transparent surcharge schedule to avoid month-end surprises.

Many shippers are switching from annual negotiations to quarterly mini-bids. This approach locks costs on volatile lanes while preserving the ability to shift providers quickly as market signals worsen. Build a lane-level dashboard comparing spot and contract, and define a spread threshold that automatically triggers re-bids or volume reallocation. The result is tighter control of transportation P&L without sacrificing service resilience.

Don’t overlook the financial layer. Financing, insurance, and equipment debt are pushing smaller fleets to exit. Shippers should assess carrier insolvency risk, embed “step-in” rights, and keep contingency providers warm. If capacity exits faster than demand recovers, rates can snap back unexpectedly - another reason to keep flexible, multi-path contracts and avoid over-concentration on a single provider.

The 2025 U.S. truckload market is not a simple “bounce off the bottom”; it is a drawn-out rebalancing. Teams that run on data discipline and contractual agility will keep costs within a controllable band while preserving service quality. The core work is to re-segment the lane portfolio by efficiency, consolidate volume with high-value carriers, and maintain a measured degree of indexation as a hedge against cycle turns. Do that well, and transportation becomes a managed variable - predictable enough to plan, flexible enough to protect margins when the market shifts.