.jpg)

.jpg)

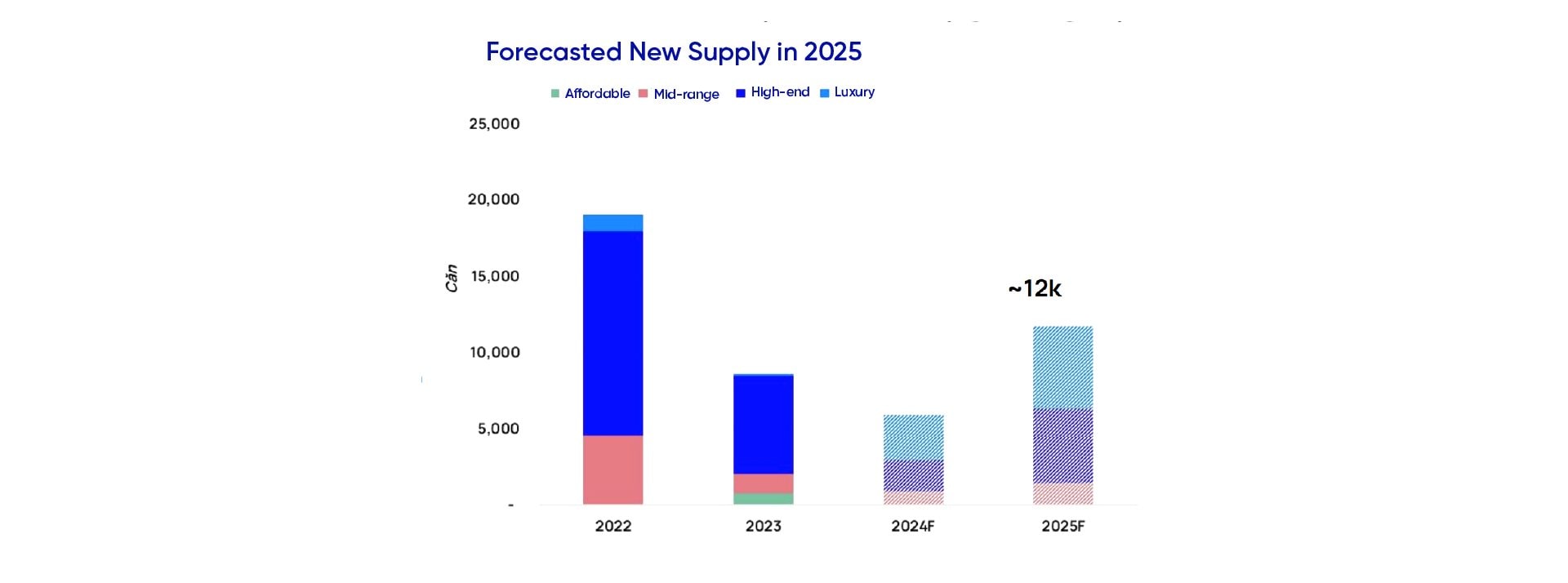

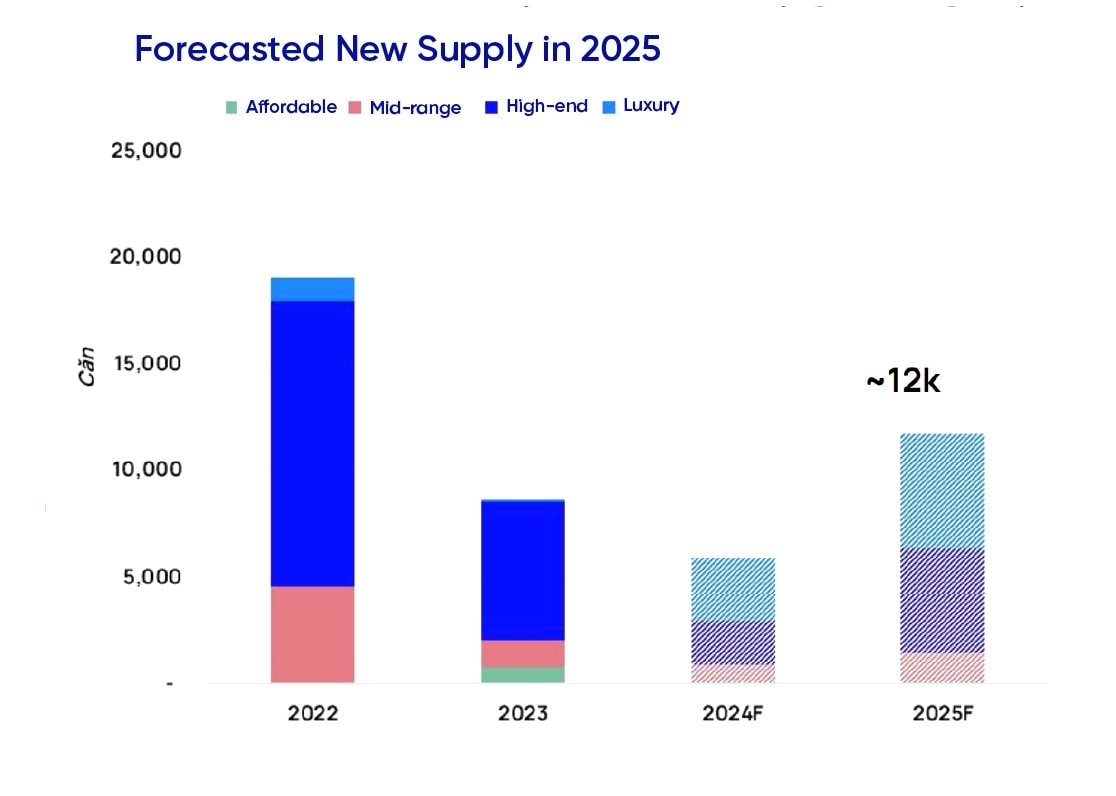

Supply Improves but Remains Uneven

The return of previously “frozen” real estate projects due to legal obstacles is generating a significant supply source for HCMC's market in 2025. Projects like Metro Star, Gem Riverside, and De La Sol are being restarted—not only adding new inventory but also helping ease buyers' caution. This demonstrates the practical effectiveness of the more relaxed legal framework introduced in August 2024. Major developers rejoining the market also sends positive signals, especially as new projects remain limited.

.jpg)

.jpg)

Upcoming projects for 2025 include Eaton Park Phase 2, East Valley, Lotte Eco Smart City, and The Global City—large-scale developments concentrated in Thu Duc City. OneHousing forecasts that apartment supply in 2025 could reach up to 12,000 units, mainly in the eastern area, particularly the former District 2. Although supply is recovering, distribution remains uneven, with mid-range and affordable segments still in short supply.

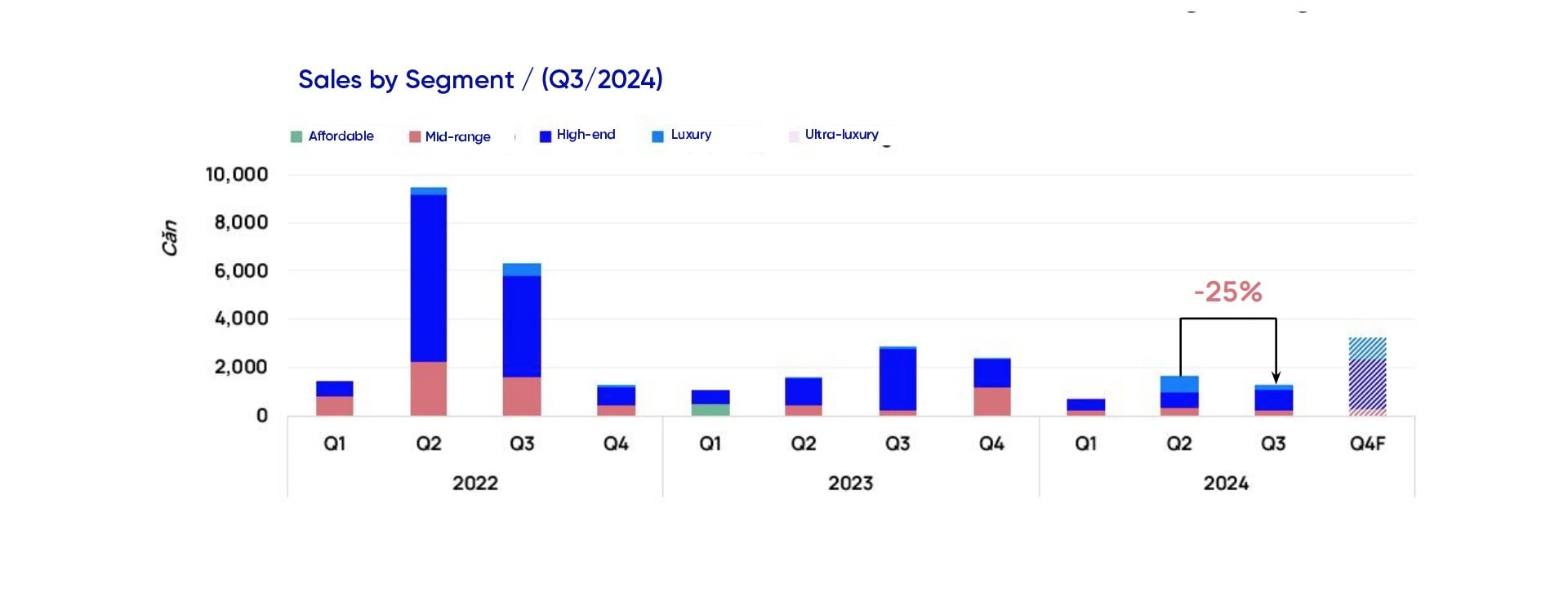

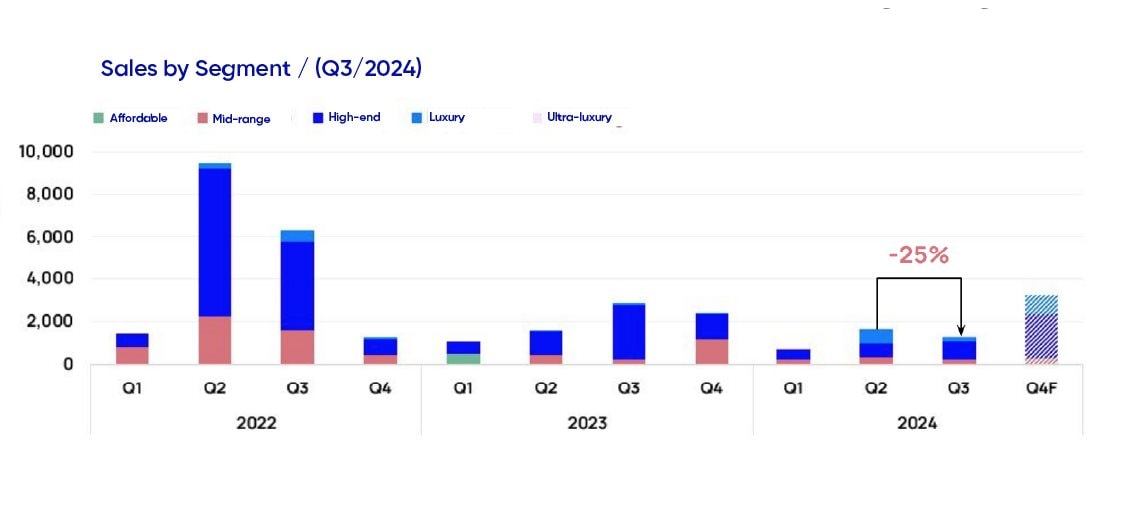

Stable Price Growth, Luxury Segment Dominates

The average primary sale price in HCMC in Q3/2024 rose 5% from the previous quarter, reaching VND 80.2 million/m². Prices continue to climb due to limited supply, especially as mid-range apartments are increasingly squeezed out. Most new projects fall into the high-end and luxury categories, with prices ranging from VND 100 million to over VND 250 million/m²—such as The Global City (~140 million/m²), King Crown Infinity (~125 million/m²), and OpusK in Thu Thiem (>250 million/m²).

.png)

In 2025, prices are expected to rise further, especially in areas with major infrastructure investment like Thu Duc City. However, this pricing trend poses challenges for real homebuyers. A OneHousing survey shows that apartments under VND 2.5 billion—representing the highest demand—account for only around 17% of the supply, indicating a continued mismatch between supply and demand.

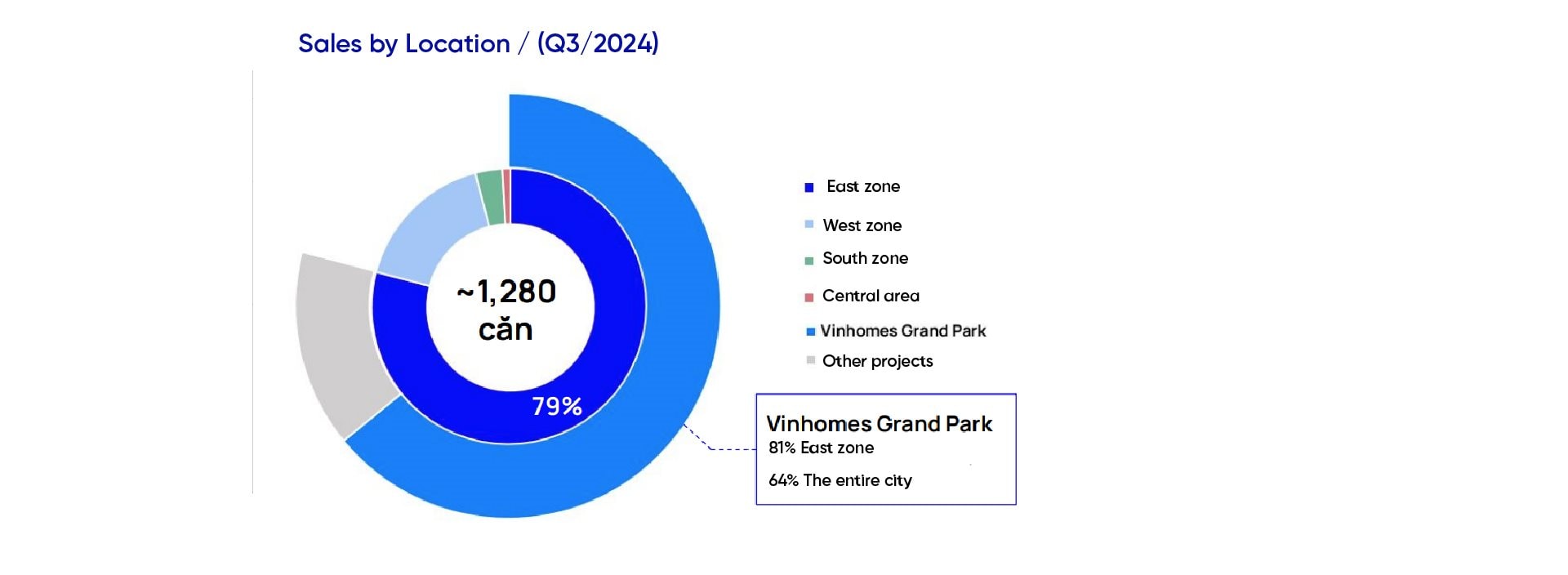

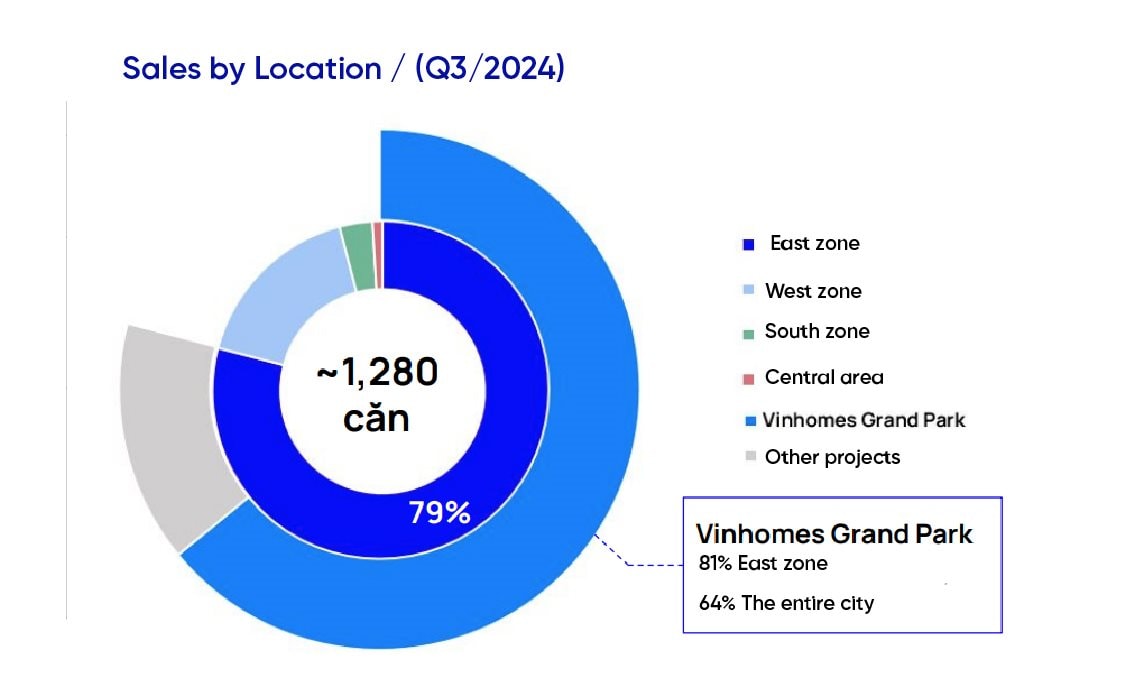

East Zone Leads Thanks to Infrastructure Investment

.jpg)

.jpg)

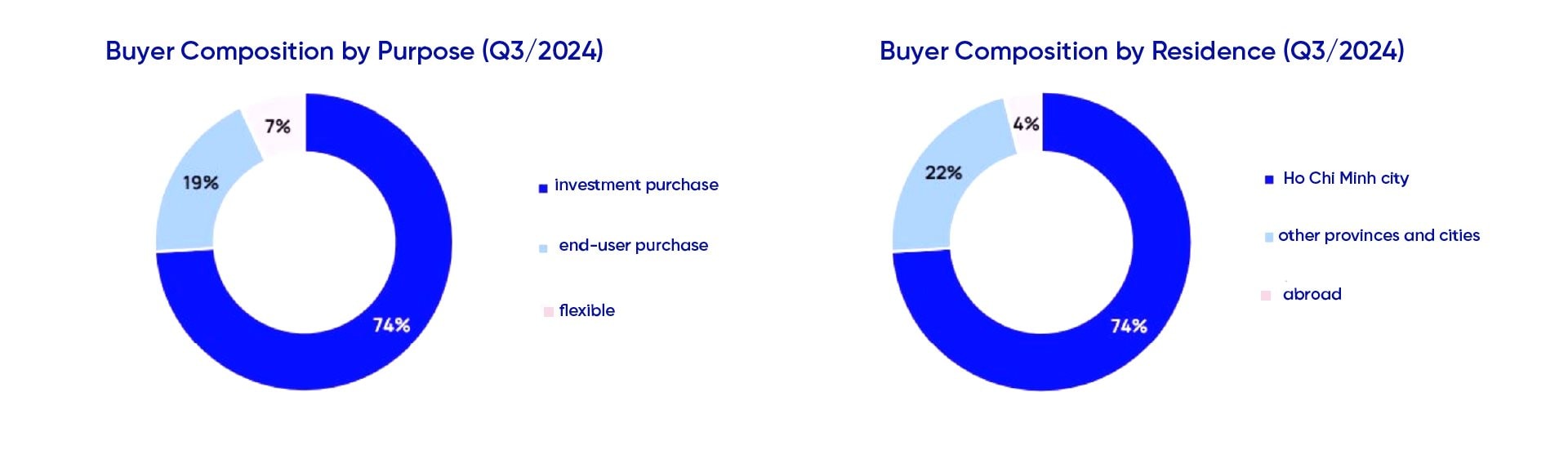

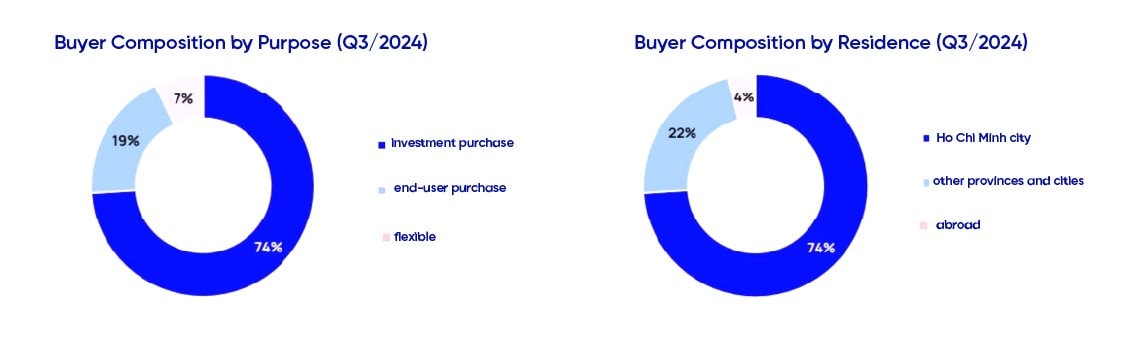

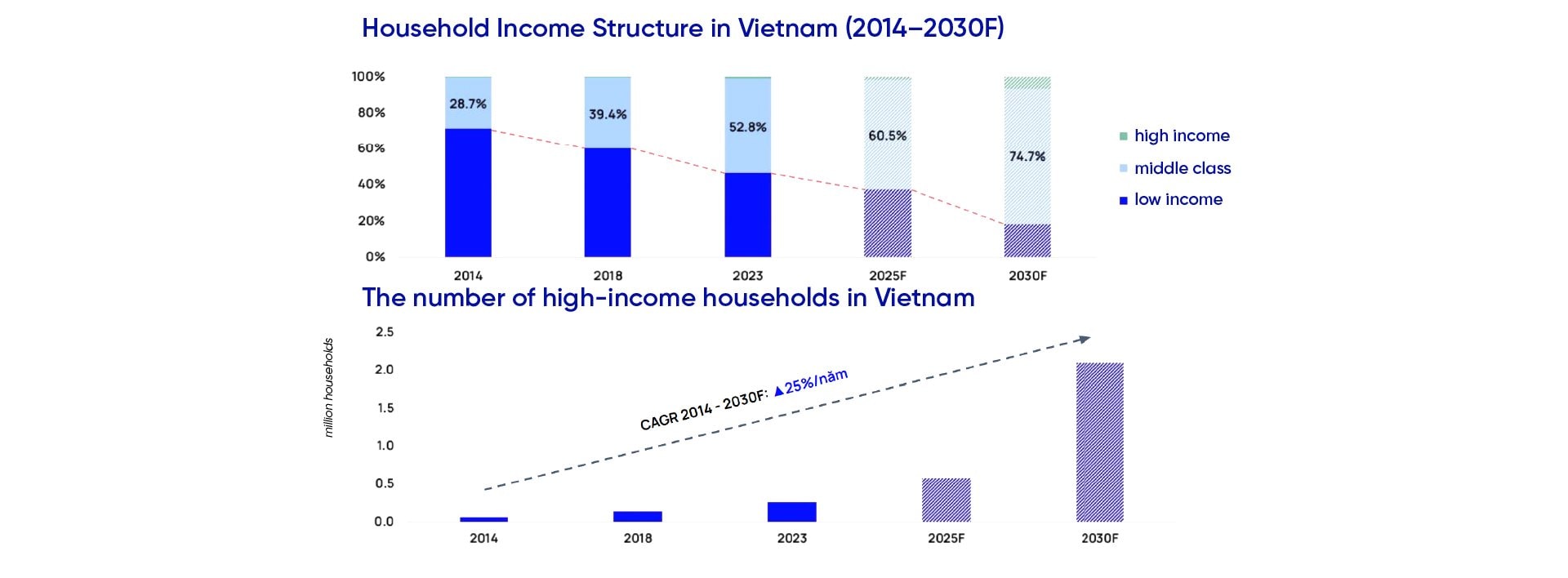

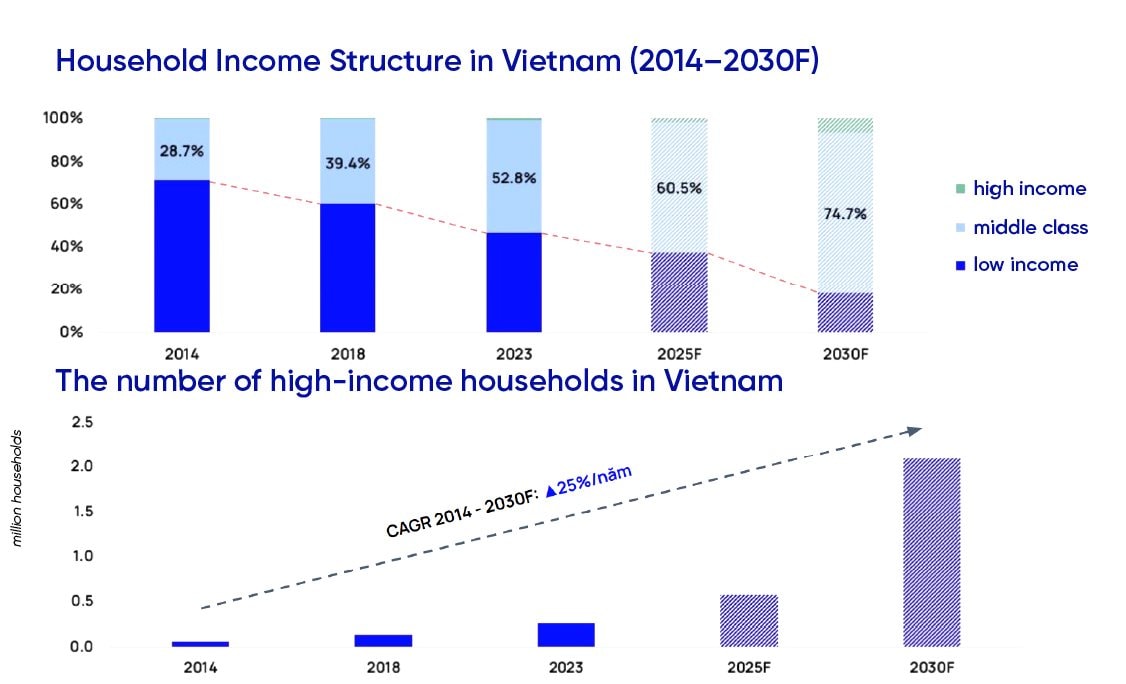

According to the report, 81% of all apartment transactions in HCMC in Q3/2024 were concentrated in the east, with over 60% coming from the mega project Vinhomes Grand Park (44,000 units). Investor buyers made up 74%, mostly from within the city, highlighting the area's strong appeal. Notably, upcoming 2025 projects such as Lotte Eco Smart City and East Valley are also targeting the growing middle c lass in Vietnam.

Office and Retail Markets Remain Stable

Beyond housing, the office and retail sectors in HCMC also show signs of stability. According to Savills, Grade A office occupancy outside the CBD remains high in early 2025, driven by FDI enterprises and a shift toward more affordable rental areas.

In retail real estate, market-wide occupancy stands at 94%, with strong demand from the F&B, entertainment, and furniture sectors. Vietnam's middle class—projected to account for 70% of the population by 2030—is helping shape new consumption patterns, pushing developers to expand commercial and service projects in urban gateway areas.

A Pivotal Year for Sustainable Recovery

Homebuyers in 2025 tend to be more pragmatic yet have higher expectations for quality of life. Most are still investors—over 70%—but their focus is shifting from short-term profits to sustainability and capital safety. Meanwhile, end-users are becoming more selective, favoring green environments, full amenities, and convenient infrastructure. This evolving behavior is pushing developers to adapt their strategies, which will be crucial to market liquidity in the coming year.

.jpg)

.jpg)

As Vietnam’s middle class continues to grow and the desire for quality living intensifies, the HCMC real estate market needs flexible and effective solutions from both the government and private sector to capitalize on the opportunities that 2025 presents.