AI demand forecasting has moved from pilots to wide deployment. Why do some firms see outsized gains while others get lovely forecasts but persistent stock-outs or overstocks? Because the core is not the model alone; it’s operational discipline - clean inputs, short adjustment loops, and embedding forecasts into inventory, purchasing, and transport decisions.

AI is extremely sensitive to sales-data noise: stacked promotions, SKU code changes, and delayed reporting destabilize models. Start with data hygiene/enrichment: normalize marketing calendars; attach weather/seasonality attributes; flag supply-chain anomalies; connect position-level inventory. Once inputs are clean, models (from gradient boosting to time-series transformers) learn real signals. Don’t chase fashionable algorithms on messy histories a “good-enough” model on good data beats a “great” model on bad data.

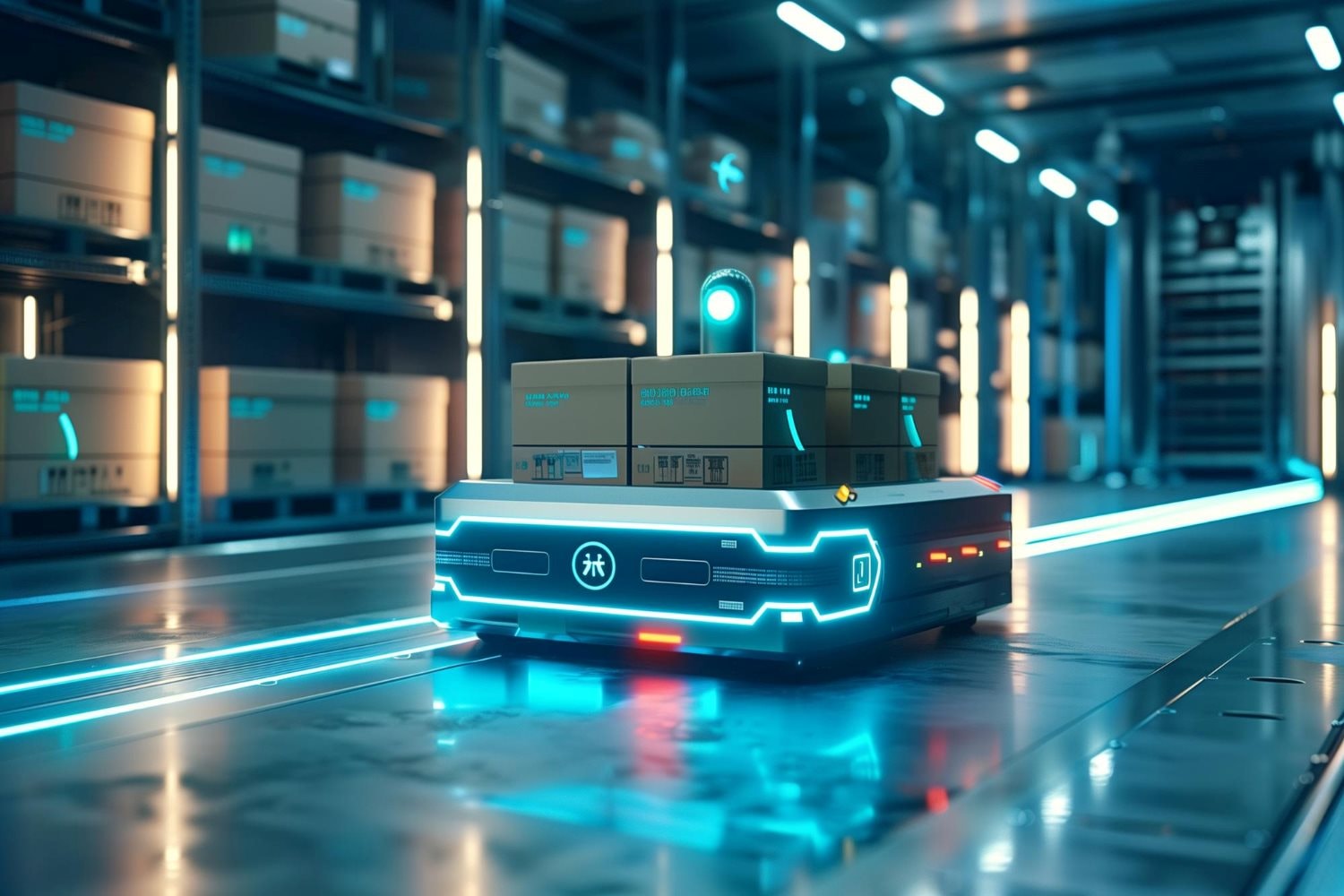

Value lives not on the dashboard but in issued orders, production, and transfers. For fast SKUs, compress the loop to weekly or even daily: model emits a forecast; the system proposes actions (DC/MFC/store transfers, replenishment POs, route changes); humans approve within thresholds. Clear RACI avoids accountability gaps when forecasts miss: who approves, who carries cost, who feeds learnings back into parameters. When operating decisions are mechanically tied to forecasts, P&L impact appears.

Smooth forecasts but frozen inventory; KPIs track only error metrics - not shortage/overstock costs; no marketing-event labels; SKU changes without mapping tables; no fast-track approvals for transfers; and no financial post-mortems. If you see two or three, stop scaling and fix root causes.

Good forecasts must flow into target inventory by location, with buffers sized to uncertainty and replenishment time. For long ocean/rail lanes, seasonal/event buffers are mandatory. On air/road legs, link forecasts to weekly slot/ULD/container capacity and add flexibility clauses to lock capacity early while keeping an “adjustment door.” Connect forecasts to packaging, labor, and shift plans - perfect inventory without handling capacity still fails.

Absolute error by SKU group is necessary but insufficient. Track revenue-bearing stock-outs; excess-inventory carrying cost; transfer cost; expedite transport cost; and campaign-level contribution impacts. When forecasts are “measured in money,” finance, operations, and commercial speak the same language.

AI doesn’t replace discipline; it amplifies it. A solid model, clean data, short loops, flexible transport contracts, and money-based KPIs create real P&L impact. Pouring budget into algorithms while skimping on data hygiene, decision rights, and execution capacity yields pretty charts - and empty shelves or clogged yards.