After severe drought spells, the Panama Canal remains a strategic variable for Asia–US East/Gulf trades. Transit quotas, draft adjustments, and booking mechanisms have helped operations gradually normalize, yet weather risk persists. From the proposed Río Indio reservoir to shippers’ “hedging” of sailing schedules around water cycles, the industry is searching for a balance between a fragile present and a sustainable future.

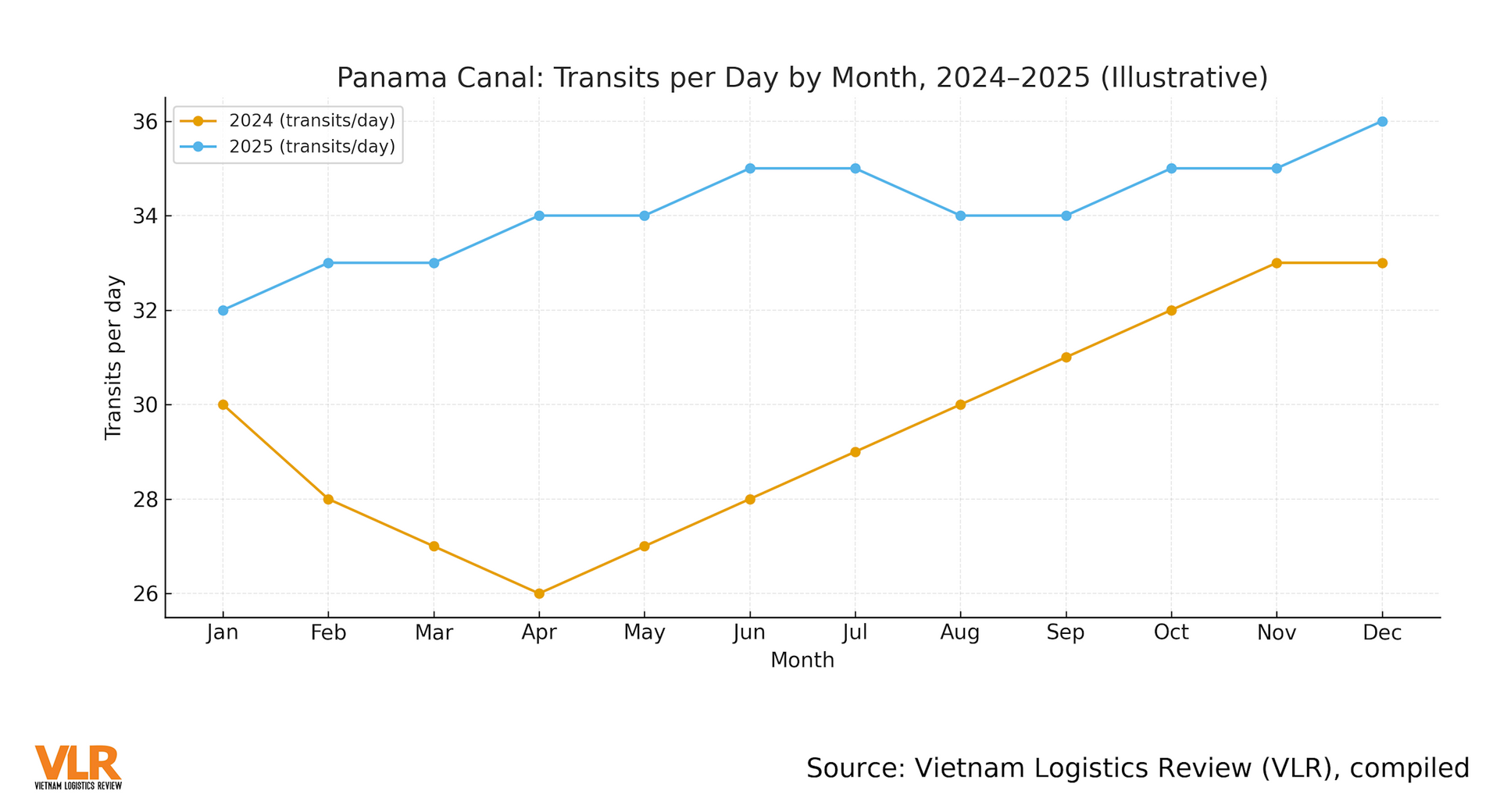

Moving through 2024–2025, the Canal has been easing out of the El Niño “shock”: rainfall recovery has allowed daily transits to rise and drafts to loosen after a prolonged tightening at the end of 2023 and early 2024. The Panama Canal Authority (ACP) progressively increased slots—from 32 to 33 and then 34 transits per day as Gatún Lake levels improved during the rainy season, according to official advisories in mid-2024; by fiscal year 2025, total transits rose sharply again, reflecting a relative degree of normalization.

Even so, monthly volatility remains meaningful. In March 2025, the average stood at just 33.7 ships/day, below the post-restriction maximum of 36 ships/day—signaling that demand, maintenance schedules, and seasonal water levels can still “apply the brakes” to throughput. Earlier clampdowns reduced transits by more than one-third, setting off knock-on effects on cost and waiting time.

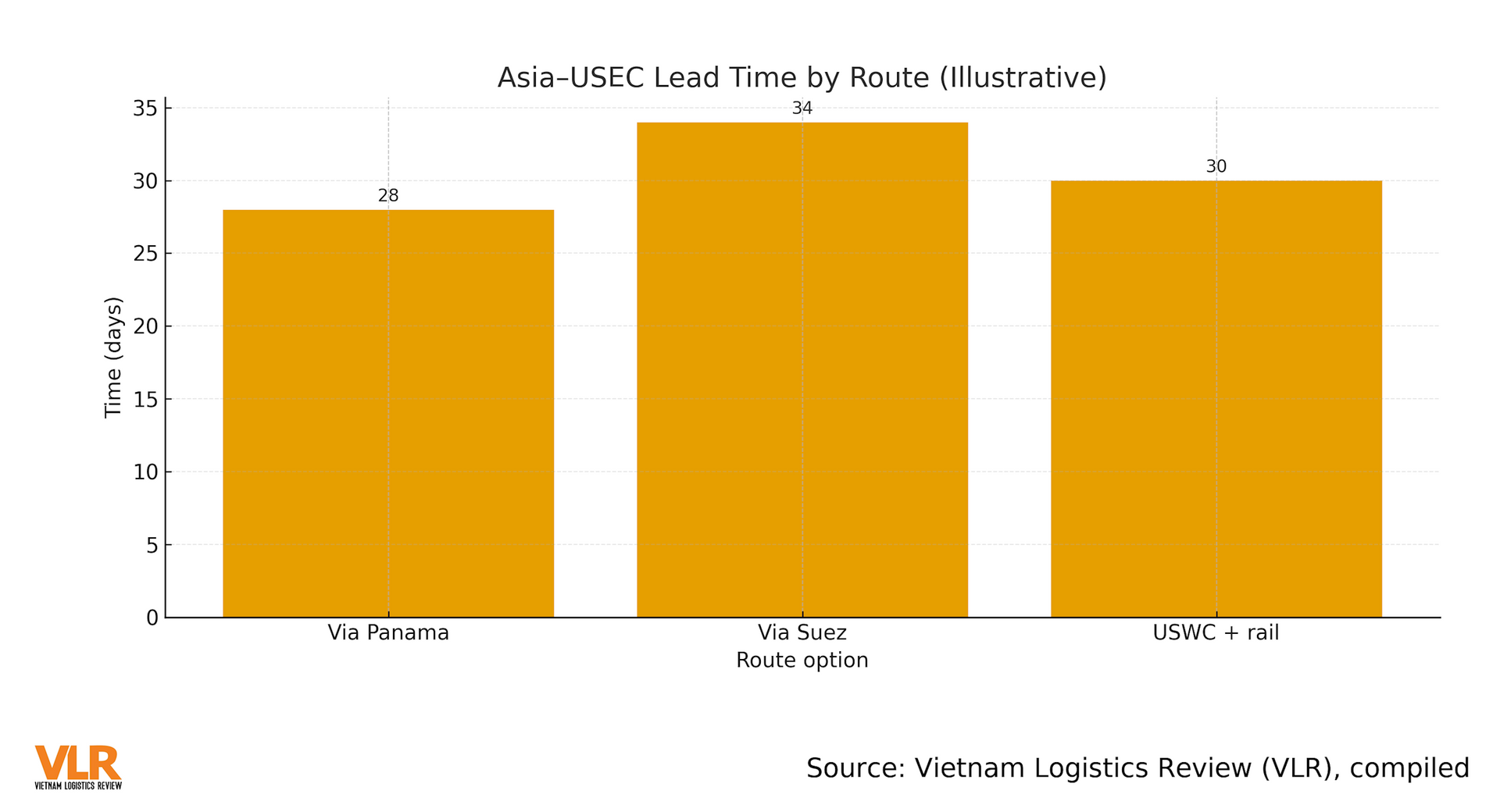

Who gets hit hardest? Cold chains, agricultural products, and seasonal goods: harvest calendars and firm delivery windows are easily derailed when slots are scarce, while demurrage/detention steadily erode margins. Containerized cargo is more flexible, but if ships must detour via Suez or re-route to the US West Coast and then go inland by rail, lead times and costs can swing widely week to week.

Río Indio - A long-term “water valve” for the Canal. The ACP has identified the Río Indio reservoir as a top priority for national water security and Canal reliability: a ~US$1.6 billion project that would add 860–970 million gallons/day, thereby raising capacity by roughly 15 transits/day when complete. Accelerated in 2025 as a “safety net” against 2023–2024-style droughts, the project aims to deliver steadier, more competitive capacity for global trade.

That said, the path is not smooth: social and environmental impacts have sparked legal challenges, including petitions to Panama’s Supreme Court regarding community rights and consultation processes. This means timelines, compensation/relocation scopes, and technical components may be adjusted as final decisions are made.

“Normalization” signals—without eliminating risk. From mid-2025, the Canal recorded a 19.3% year-over-year increase in transits compared with the drought year. The ACP extended booking office hours and optimized the Reservation system to be more responsive to customers. Still, climate/weather risk can quickly pull lake levels down on a cyclical basis. The core lesson: build “schedule discipline” around Gatún water levels and maintenance calendars, instead of relying on old “seasonal rules of thumb.”

WC/EC/Gulf—choose seasonally, not “by default.” When Gatún levels are low and slots are tight, USEC via Panama becomes less dependable; shippers can split routing: push a portion of orders via USWC + rail for SKUs with hard deadlines, and keep the remainder via Panama to optimize cost. As water levels recover and slots loosen, pivot back to Panama to trim East/Gulf line-haul costs. This “two-track” approach helps protect delivery commitments while balancing the transport budget.

Empty equipment and “slot-secure” contracts for high-value cargo. Empty repositioning should reflect wet/dry cycles: when ACP drought advisories appear, move empties early to load ports that match vessel size constraints; for high-value goods, lock slots/reservations week by week and add port-change clauses to pivot quickly if Canal schedules tighten unexpectedly. This is especially crucial for refrigerated and agricultural cargo, where freshness/seasonality determine margins.

Data-driven management and early-warning KPIs.

At minimum, deploy a dashboard that includes:

(i) Gatún/Alajuela water levels;

(ii) TRS slot availability by week;

(iii) Canal wait times and roll rates;

(iv) Empty container allocation

by lane;

(v) Lead-time deltas between Panama and alternatives (Suez / USWC+rail).

Set trigger thresholds (e.g., water below X meters, slots < Y/day) to automate diversion decisions.

Track rainfall patterns across the Canal watershed and weekly Gatún levels; monitor maintenance calendars and ACP advisories; update fee frameworks and vessel-size priorities. Establish early-warning KPIs: (1) water level < Threshold A; (2) slots/day < Threshold B; (3) wait time > Threshold C; (4) roll rate > Threshold D. When two of four turn red, activate the detour playbook (Suez/USWC+rail) and corresponding contract clauses to protect delivery dates.

The Panama Canal has materially recovered in 2025, but long-term stability hinges on water security and data-driven management. Vietnamese exporters should pivot from “cheapest” to “most dependable by water cycle”:

standardize seasonal SLAs, build detour playbooks

around water levels/slots/weather, and keep a close eye on Río Indio

progress alongside the associated legal and social adjustments. Those who embed data discipline into commercial decisions earlier will reduce cost volatility, stabilize lead times, and maintain an edge on Asia–USEC/Gulf trades in the years ahead.