In an era of constant global supply chain disruption, the decision to manufacture in-house, outsource, or build alliances is no longer just a matter of cost. It has become a strategic choice that determines a company’s speed, adaptability, and ability to control risk.

The make-or-buy question is being redefined at the network level, where scenario simulation, risk management, and learning agility form the foundation for designing flexible, resilient supply chains that balance efficiency with long-term sustainability.

Make–buy Redefined at the Network Level

In an extended period of uncertainty, the boundaries between “in-house” and “outsourced” operations have become more fluid than ever. Previously, make-or-buy decisions were made at the factory or department level. Today, they are part of network-wide strategies, where each choice affects the entire value chain from sourcing and logistics to after-sales service.

Businesses are moving toward hybrid supply chain models, retaining a portion of core capabilities to preserve expertise and responsiveness while outsourcing non-core functions to specialized partners. The objective is not only cost optimization but capability restructuring, enabling both autonomy and agility.

The central question is no longer “to make or to buy,” but rather where to make, with whom, and under which scenario the model delivers optimal value.

Scenario Simulation: Balancing Cost and Risk

Modern supply chain analytics platforms now enable companies to model dozens of make-or-buy scenarios. Every variable from labor cost, tariffs, and energy to transit time and geopolitical risk can be quantified and interconnected.

This allows decision-makers to assess each scenario’s “sensitivity”: for example, what happens if transportation costs rise by 15%, or if a regional supply chain experiences a 30-day disruption?

Scenario simulation turns decisions from gut-feel judgments into data-driven probabilities, helping executives see the trade-offs between cost efficiency and risk resilience.

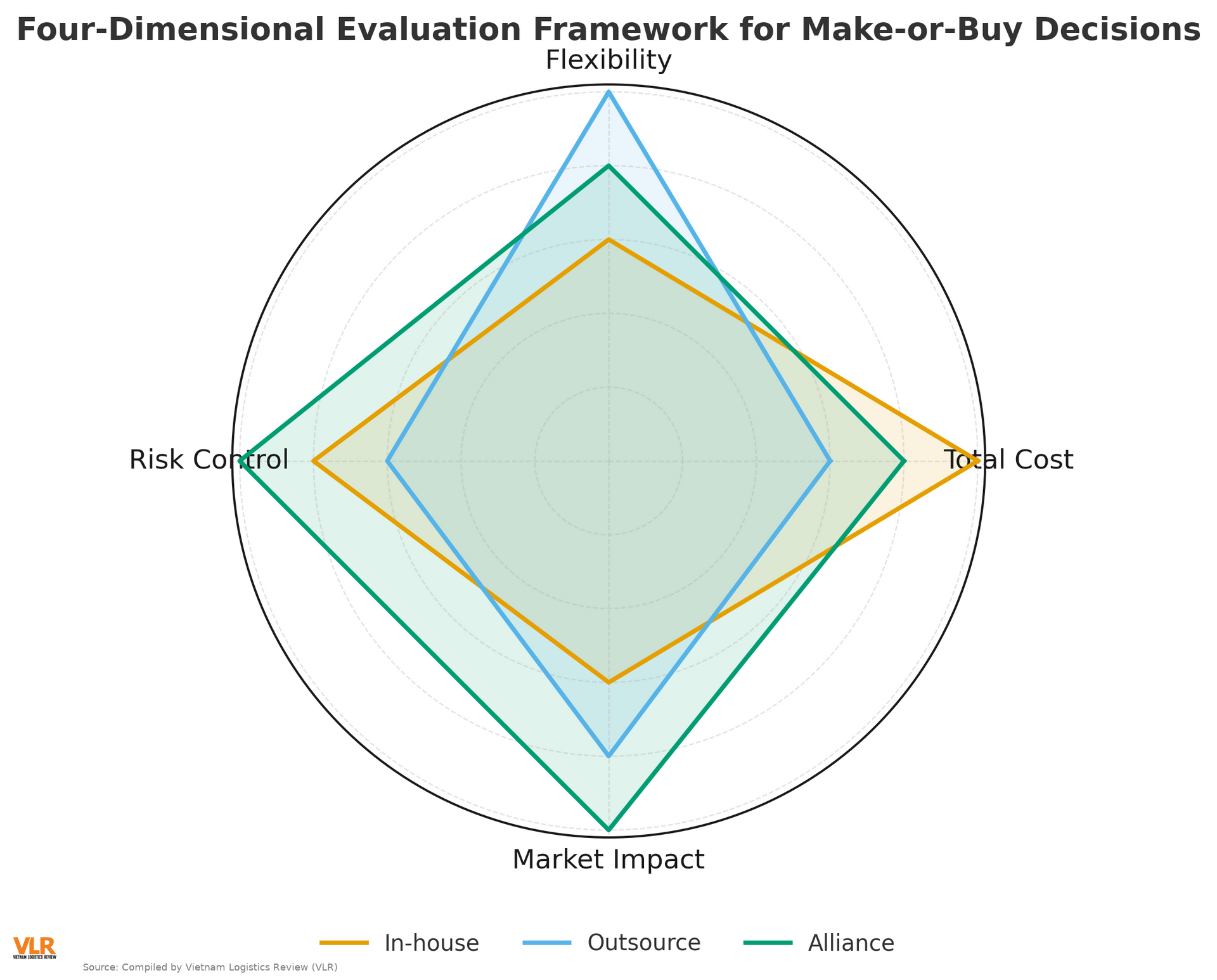

Four-Dimensional Make–Buy Evaluation Framework

Each region can assign different weightings based on strategic priorities. Simulation data helps visualize the sensitivity of costs, tariffs, and lead times over time.

Equally important is factoring in the “learning velocity” - when strategic alliances accelerate capability development faster than independent investment.

Strategic Alliances and Shared Capacity

Today’s procurement and production landscape is no longer defined by simple “buy–sell” relationships, but by conditional collaboration.

Many companies are building supply chain alliances, where multiple parties share infrastructure, technology, and even personnel while maintaining control over proprietary data.

A growing number of industries, especially electronics and logistics, are experimenting with production-sharing models. These allow companies to leverage partners’ facilities in other regions while preserving brand identity and quality standards.

Shared capacity not only accelerates market entry but also reduces “lock-in” risk overreliance on a single source or technology.

Managing Transitions and Avoiding Dependency

Any shift in make-or-buy strategy is a complex transformation requiring careful risk management. Moving from outsourcing to in-house production (or vice versa) demands a non-disruptive transition roadmap with phased handovers and optimization cycles.

Contracts should include clauses on data, training, and technical support to ensure capability retention. At the same time, companies must define a Service Continuity Index and maintain contingency funds for unexpected disruptions.

Finally, a “backdoor mechanism” should always be in place allowing the organization to revert to an alternative plan if market or regulatory conditions change suddenly.

When transitioning make-or-buy models, divide the process into three stages: co-operation, transfer, and optimization.

Include data and training clauses in contracts to preserve internal know-how.

Establish a Transformation PMO (Project Management Office) to oversee progress, monitor supply continuity indicators, and manage risk reserves.

Finally, design a technical backdoor to avoid dependency on any single supplier or platform.

In the age of globalized supply networks, make-or-buy is no longer a cost question but a strategic choice of survival.

Companies that correctly identify their core strengths, form intelligent alliances, and leverage data-driven simulation will not only be more cost-effective but also more adaptive and resilient a decisive advantage in an era defined by volatility and rapid change.