Over the past three years, the maritime world has operated within a “new risk band”: from the G7’s oil price cap to crackdowns on the “shadow fleet” carrying Iranian and Russian oil. What changed in 2024–2025 is that sanctions are no longer confined to tankers; enforcement has been “spilling over” into the container supply chain via AIS monitoring, rules on anchorage/ship-to-ship (STS) transfers, insurance paperwork, legal attestations, and partner screening.

Over the past three years, the maritime world has operated within a “new risk band”: from the G7’s oil price cap to crackdowns on the “shadow fleet” carrying Iranian and Russian oil. What changed in 2024–2025 is that sanctions are no longer confined to tankers; enforcement has been “spilling over” into the container supply chain via AIS monitoring, rules on anchorage/ship-to-ship (STS) transfers, insurance paperwork, legal attestations, and partner screening.

Vietnamese ocean carriers, logistics firms, NVOCCs, and shippers therefore need to review their entire compliance “filter set” as soon as possible. New developments out of the U.S., EU, Panama, Malaysia, and the P&I insurance system are drawing a clear line of compliance - where even minor paperwork lapses can morph into legal, commercial, and reputational risk.

From Tankers to Containers: Why the “Collateral Impact” Is Real

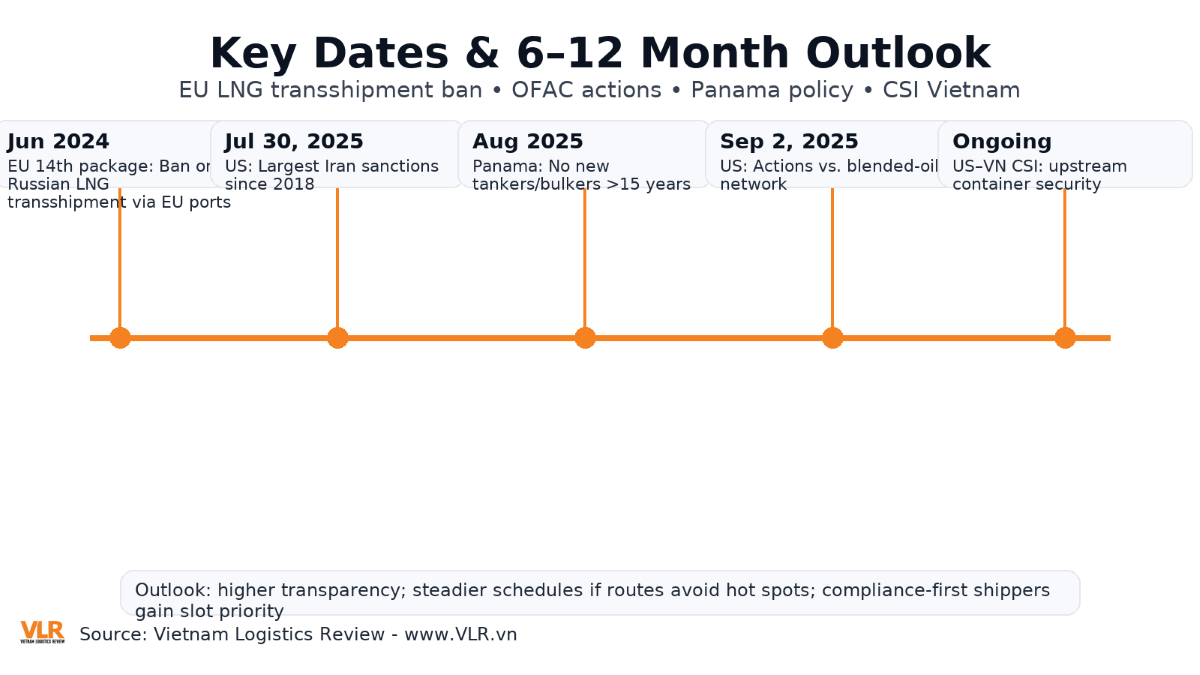

At the end of June 2024, the EU adopted its 14th sanctions package, highlighted by a ban on the transshipment of Russian LNG through EU ports a shift from “targeting ships” to “targeting infrastructure and services” across the chain. This directly affects port operations, warehousing, agencies, insurers, and container lines connected to European ports, even when the cargo itself is not oil or gas. In essence, sanctions enforcement has moved beyond a single vessel segment and become a system-wide compliance requirement for every segment.

On the U.S. side, OFAC has continuously updated its advisories on deceptive shipping practices (DSP), expanding red-flag indicators: AIS disabling/spoofing, vessel identity laundering, unusual class changes, and STS operations in hot spots. The latest guidance requires the maritime ecosystem from shipowners, charterers, and agents to banks and insurers to embed more rigorous due-diligence, record-keeping, and cross-checking processes, not just for tankers.

Container shipping itself is not “standing outside” the frame. In 2024, the EU sanctioned IRISL the Iranian national container line along with related transaction restrictions. The message is fairly clear: maritime networks that feed sanctioned energy revenues are scrutinized at every link, and containers are no exception.

Three New “Tightening Screws” Every Container Player Must Grasp

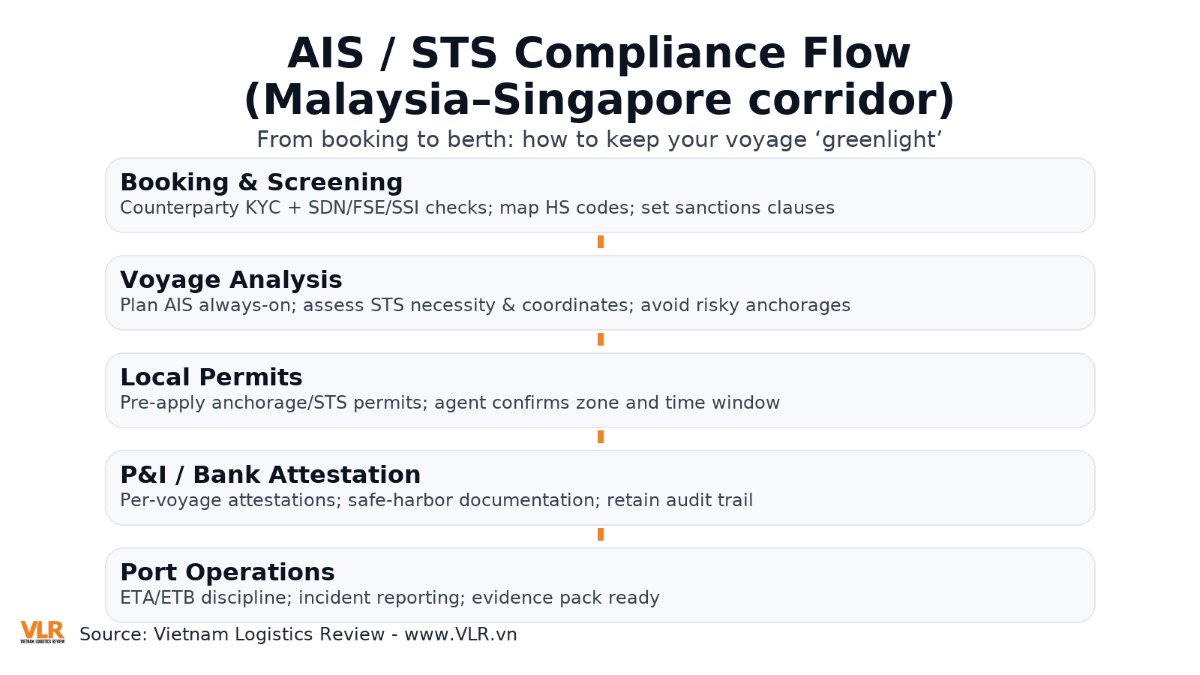

The first screw is AIS – STS – anchorage. Malaysia, a sensitive gateway near the Singapore Strait, has shut down “ad-hoc” anchorages, requires AIS to remain on at all times, and mandates permits and full declarations for operations in its waters. For any service chains that involve transshipment/anchorage around this area, complying with local procedures has become a precondition to avoid detention, heavy fines, or being blacklisted. Numerous law firms and trade media have noted Malaysia’s stepped-up inspections against illegal anchoring and STS transfers.

The second screw is price-cap documentation and insurance legal safety. Since late-2023 adjustments, P&I clubs require per-voyage attestations plus detailed ancillary-cost information to fall within a safe-harbor. Even if you are not moving oil, banks and insurers still demand a process to prove you are not linked to sanctioned oil chains in your payment documentation especially for shipments transiting sensitive points.

The third screw is classification/flag state. In August 2025, Panama, one of the world’s largest registries, announced it would stop accepting tankers and bulk carriers older than 15 years, a blow to the “shadow fleet.” This move is rippling into finance and insurance markets: a vessel’s age, AIS history, and trading areas have become risk signals that container-sector service providers also weigh in pricing.

Why Vietnamese Shippers/NVOCCs Are Vulnerable - Even Without Carrying Oil

First, documentation and payment chains: a document set that fails to vet intermediaries or uses banks/shell companies on sanctions lists can get a shipment blocked at a transit point. Second, unusual routing: circuitous paths through STS hot spots, risky anchorages, or vessels with MMSI/IMO changes tied to oil trades can trigger inspections. Third, “sensitive” HS codes: spare parts, oilfield equipment, certain chemicals, or dual-use goods can create exposure if not screened closely. Enforcement in Vietnam shows authorities ramping up cross-border fraud prevention with enhanced international cooperation and scanning technology; Customs has reported thousands of violations in just the first few months of 2025.

In parallel, the U.S. is advancing the Container Security Initiative (CSI) with Vietnam to strengthen upstream security at foreign ports an indication that containers will remain in the crosshairs of supply-chain controls. This is not a sanction per se, but an extra layer of control that requires companies to prepare compatible data and procedures to keep U.S.-bound cargo flowing smoothly.

Field Illustration: Pulling the Trigger on Oil, Pressure Spilling Over to Containers

On July 30, 2025, the U.S. Treasury announced the largest set of Iran sanctions since 2018, targeting a maritime network alleged to finance Tehran. Then on September 2, 2025, the U.S. added another network accused of blending Iranian oil to masquerade as Iraqi before sale. Although these actions directly target oil-linked vessels and companies, the side effect is that due-diligence standards for counterparties, vessels, and voyages are all ratcheted up meaning container shipments moving along the same sea lanes are scrutinized more closely.

In Europe, adding IRISL and its leadership to sanctions lists in 2024 underscores that containers are not immune. Vietnamese companies dealing with lines, agents, or related entities should activate an enhanced filter: daily checks of SDN lists, verification of ultimate beneficial ownership (UBO), reviews of vessels’ trading areas, and readiness to switch routes/partners upon alerts.

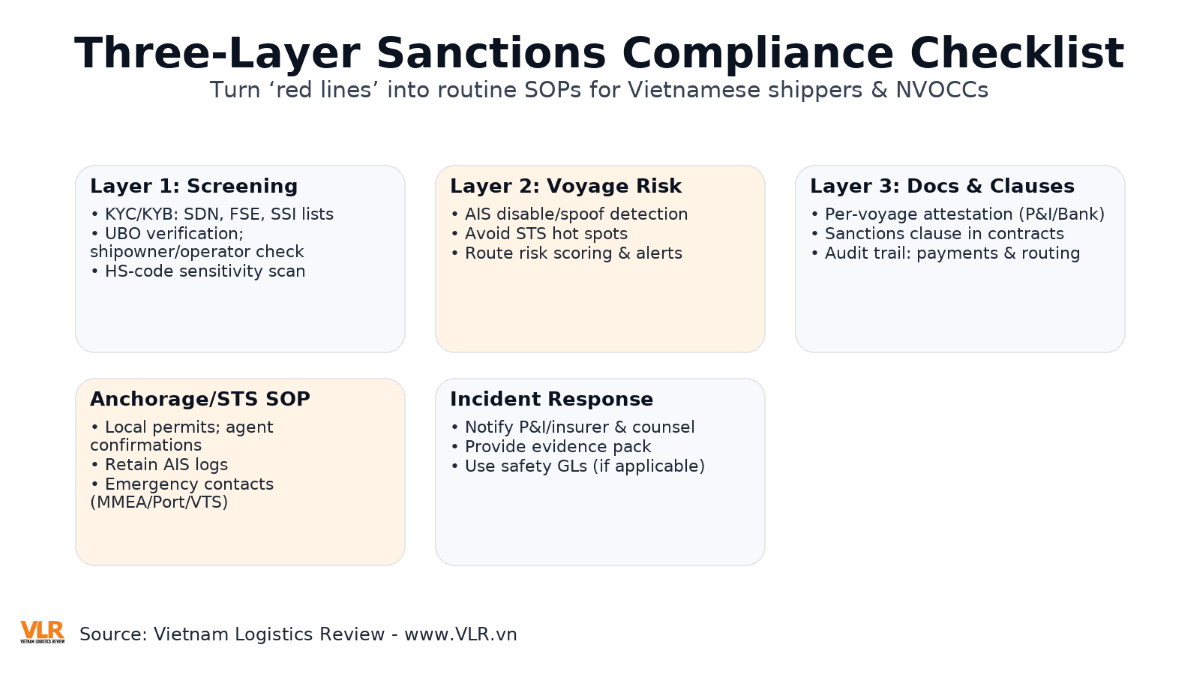

A Minimum Checklist to Stay on the Right Side of the “Red Line”

Start with multi-layer screening: check SDN, FSE, SSI, and companion lists for all entities in the chain (seller, buyer, NVOCC, agent, subcontracted carrier). The second layer is voyage scrutiny: use reliable data to detect AIS disable/spoof events, MMSI/IMO “hopping,” and STS in hot spots; assign route risk scores and flag “detoured” bills of lading. The third layer is documents & clauses: add sanctions-compliance clauses, require disclosures on cargo content and funding sources, and retain records consistent with P&I/OFAC templates to qualify for safe harbor.

Operationally, implement anchorage/STS procedures tailored to sensitive waters (e.g., Malaysia): obtain the correct permits, clearly document purpose, ensure AIS is continuously active; train ship and shore teams on local law and penalties. Import-export lead firms should require transport partners to supply evidence at each step especially when transiting “red zones.”

When Things Go Wrong: Worst-Case Scenarios and How to Limit Damage

If a shipment or vessel is detained on suspicion of sanctions linkage, activate the legal–insurance communications chain immediately: notify your P&I/insurer, local counsel at the port, and the competent authority. Cooperate and provide full attestations, AIS contact logs, routing data, payment records, and contracts. Where safety/environmental risks arise (e.g., dangerous goods), note that OFAC has issued general licenses permitting limited safety-environment transactions such as offloading to mitigate secondary incidents for blocked parties; this is a risk-reduction pathway, not a loophole.

If you must switch vessels/routes at short notice, notify customers transparently about the new lead time, potential storage/demurrage, and available insurance/compensation options. Domestic firms should prepare alternative route maps via hub ports with stronger compliance controls, and keep a reserve of empty equipment to avoid “snaps” from schedule conflicts.

6–12-Month Outlook: Preparing for the “New Normal” of Compliance

The EU’s LNG transshipment ban will move into stricter enforcement, major registries are closing doors to older ships, Malaysia and other busy littorals are “cleaning up” anchorages/STS, and the U.S. shows resolve to expand sanctions lists against maritime networks that finance targeted energy revenues. The direction of travel is clear: better data, stronger screening tools, and higher transparency demands. This may add compliance costs, but in the long run it is an opportunity: Vietnamese container carriers and logistics firms that invest seriously in compliance will get slot priority, face fewer inspections, reduce delay risk, and build credibility with large global buyers.

In this “new normal,” competitive advantage is not just about freight rates or transit times it is about the ability to prove you are clean: clean counterparties, clean voyages, clean paperwork. Those who know these red lines and stay on the right side - will go farther in a global trade system that is being re-shaped.