Maersk and Hapag-Lloyd launched the Gemini network in February 2025 with a bold pledge of “90% reliability”—even as Asia–Europe services were still rerouting around the Cape of Good Hope to avoid the Red Sea.

Half a year on, early data suggest the new network is pushing industry on-time performance to levels unseen since before the crisis. But behind that 90% lies a whole story of measurement, network design, and exogenous risks that Vietnamese shippers need to understand in order to turn it into real-world advantage.

What does the data say about 90%?

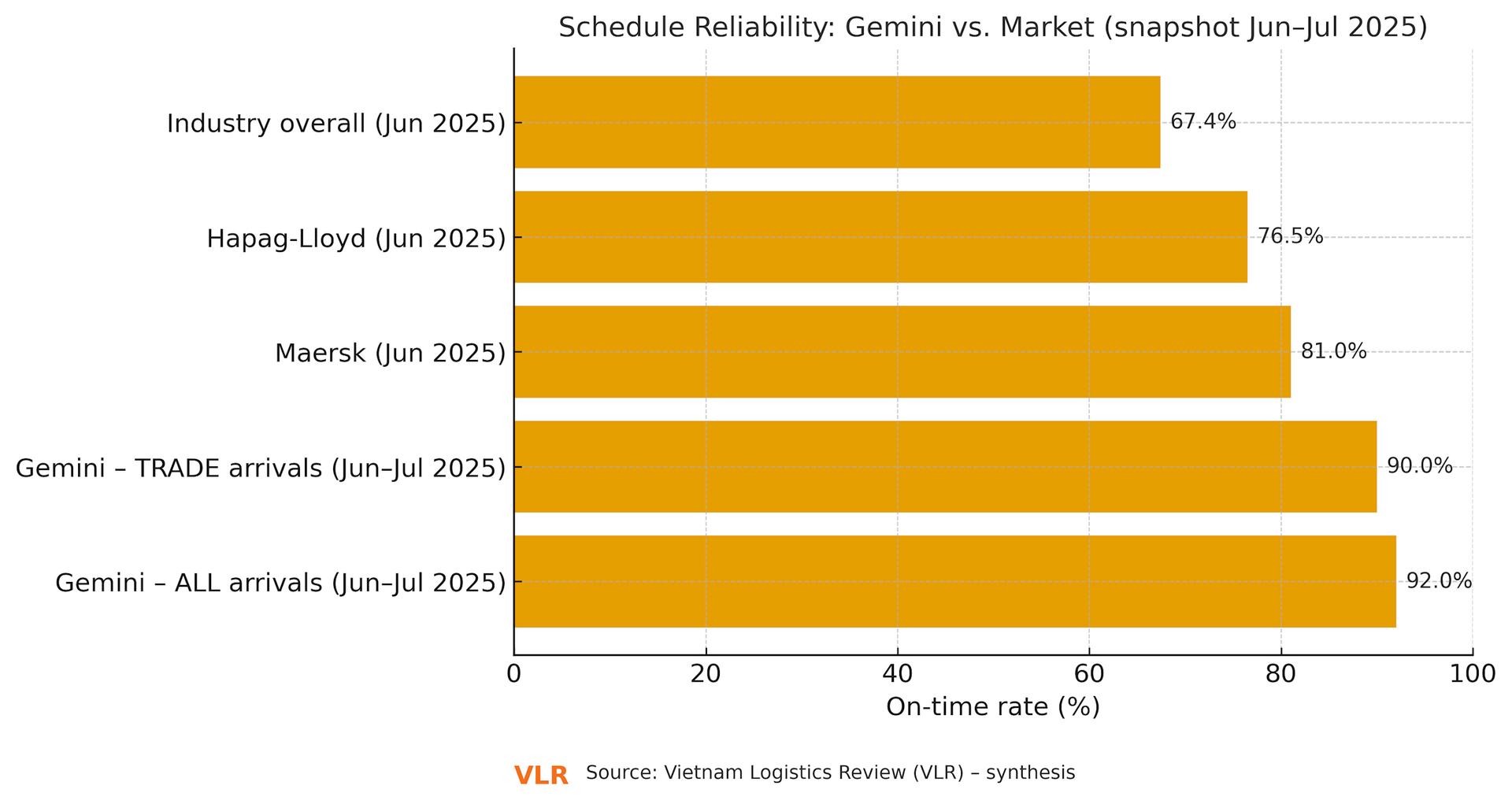

Sea-Intelligence reports that after Gemini went live, industry schedule reliability kept improving, reaching 67.4% in June 2025—the highest since November 2023. Among the major carriers, Maersk led at 81.0% and Hapag-Lloyd at 76.5% in June. Notably, when Gemini is isolated, its index in June–July 2025 stands at about 92% for “ALL arrivals” and nearly 90% when counting only “TRADE arrivals”—far higher than market averages. Other independent sources echo this picture: Kuehne+Nagel cited 93% in June, while Hapag-Lloyd disclosed “90.3%” in its early-period figures. Methods differ, but the broad takeaway is that Gemini is delivering on its promise.

Sea-Intelligence publishes two cuts: “ALL arrivals” covers every call in the network, while “TRADE arrivals” tracks specific commercial corridors. The gap between 92% and 89–90% stems from different samples. Some media analyses note that other datasets may read lower; hence, when negotiating service, the key is to ask for the metric that applies to your actual trade lane, rather than relying on a marketing average.

Operating formula: fewer ports, more shuttles

“90% on-time” doesn’t happen by itself. Maersk and Hapag-Lloyd have trimmed port calls on the Asia–Europe trunk lines and shifted to a model in which mother vessels call fewer hubs, connecting to a dense shuttle network around hubs owned or co-owned by the two carriers. This shortens port time and reduces variability at the quayside. The life-or-death network “switch” is the separation of roles: the mainliner keeps cadence; shuttles handle connectivity. When disruption hits, priority is to protect the mother-vessel schedule, pushing recovery to the transshipment layer. The approach has stirred debate in Europe—some ports lost direct calls—but operationally it paves the way to high on-time scores.

The Red Sea remains a big variable

Since late 2023 the market has gotten used to the Cape detour, adding 10–14 days depending on the route. Reliability hovered around 50% through 2024 before rebounding in 2025, showing carriers have partially absorbed the shock. Still, maritime security risks haven’t vanished, and any escalation in the Red Sea can shake the cadence of the whole chain. In other words, Gemini markedly improves the endogenous side of timetables, but no carrier is immune to exogenous shocks like conflict.

Some trade press has “dissected” the 90% claim: even using the same Sea-Intelligence source, how the sample is assembled, what threshold counts as “late” (how many minutes/hours), and whether internal legs are included can shift results by several percentage points. This isn’t about “right vs. wrong,” but about method transparency for customers. For large shippers, building “lane- and port-specific” KPIs into contracts is more useful than arguing over global roll-ups.

Implications for Vietnamese shippers

Gemini’s crux is trading access for reliability. If your port is no longer a direct mother-vessel call, the time from factory gate to mother-vessel deck will depend heavily on shuttles and transshipment. Experience from H1-2025 shows that by booking earlier, splitting lots to match shuttle cadence, and accepting a “hub-first, connect-later” path, total real lead time becomes more predictable, especially in peak season. For cargoes needing fixed delivery calendars (electronics, seasonal apparel, FMCG), a steadier schedule lets you trim safety stock and other buffer costs, offsetting part of peak-season rates. The caveat is missed connections when a shuttle arrives near the mother-vessel CY cut-off; the remedy is to hold a 24–48-hour buffer at the hub, even if that adds a modest port-storage cost.

When negotiating for 2025–2026, ask for on-time metrics tied to your exact corridor and port pair, agree on compensation or space-priority if the carrier misses the threshold, add a “cut-over protection” clause at the hub to reduce missed-connection risk, define clearly whether “on-time” is measured vs. ETA or ETB and what the lateness threshold is, and require monthly reports backed by Sea-Intelligence data rather than marketing tables.

Why the whole industry improves when Gemini improves

Even though Gemini holds only about 20% of East–West capacity, one network hitting 90% forces rivals to optimize. Sea-Intelligence shows global reliability rising continuously from February to June 2025, reaching 67.4% before the first correction in July. A higher baseline won’t automatically push rates down, but it reduces the time-risk premium in supply chains—from drayage costs and container storage to inventory carrying. As “on-time” becomes a selling point, shippers gain bargaining leverage over less reliable offerings.

Even in the best months, a risk tail remains: bad weather, port congestion, strikes, or maritime-security incidents. The fewer the port calls a network has, the more systemic a hub-level incident can become. One European lesson is that ports pushed to the sidelines may counter with aggressive commercial campaigns, causing temporary volatility in inland connectivity. The smart choice is not to “put all your eggs in one basket,” but to portfolio your routes by time-criticality: book early on KPI-driven services for priority cargo, and let the rest move on more flexible networks.

When reliability turns into a price advantage

If the Red Sea does not deteriorate, holding ~90% is plausible thanks to the few-ports/many-shuttles structure and hub control. Sea-Intelligence even notes Gemini’s shuttle services reached up to 98% from their first month, showing the cadence is already embedded in operations. Once a new standard is set, the winners aren’t only the carriers; they are also the shippers who translate on-time KPIs into contract terms, transport budgets, and tighter inventory configurations. Conversely, if maritime security suddenly worsens, every model must yield to exogenous forces; then, the yardsticks of “on-time” will shift to how well a carrier repositions boxes, cuts and reconnects shuttles, and communicates ETA transparently.