Panama has “closed the books” on registering oil tankers and bulk carriers more than 15 years old. Experts say this move is aimed at blocking the “shadow fleet,” lifting the compliance bar, and signaling what Vietnamese businesses need to prepare for.

The Panama Maritime Authority’s latest acceleration refusing new registrations for oil tankers and bulk carriers over 15 years of age, while moving to de-register 17 ships newly listed by OFAC sends a very clear message to the market: the lenient era of “reflagging to dodge standards” is over.

As one of the world’s largest ship registries controlling a huge share of global tonnage, Panama’s decision will not only affect tanker fleets but also reshape how actors across the maritime supply chain from shipowners, charterers, banks, and insurers to port authorities define risk and compliance costs over the next 6–12 months.

Ship registries in the crosshairs

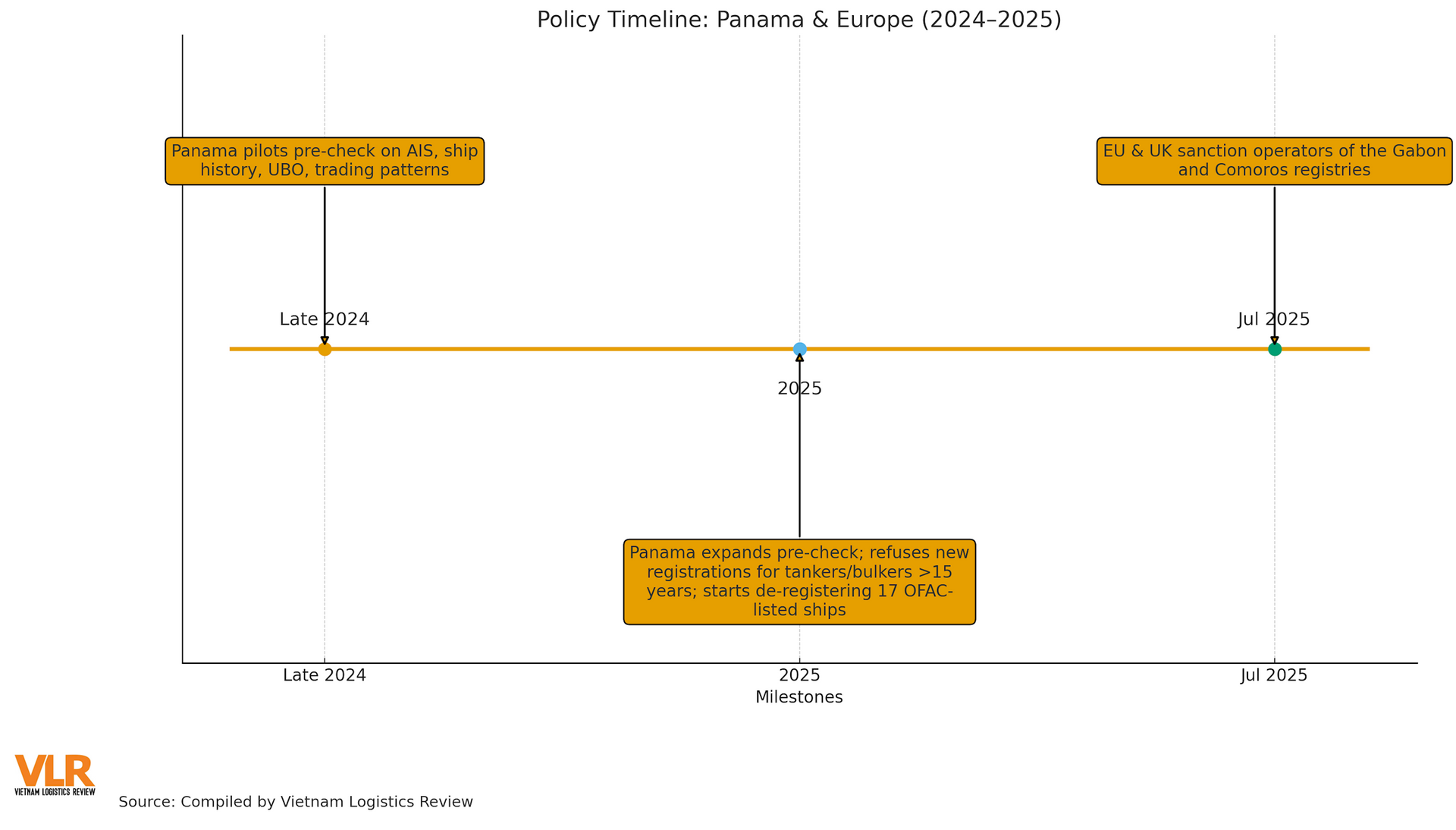

Since the G7 oil price cap took effect, an aging tanker fleet characterized by opaque ownership, AIS disabling/spoofing, and ship-to-ship transfers at hotspots has served as a safety valve for sanctioned oil flows. Rather than only “chasing ships,” Western authorities have shifted focus to the enablers that keep those flows moving: the back-office companies that operate the registries. In July 2025, the EU and the UK simultaneously sanctioned the operators of the Gabon and Comoros flag registries an unusual precedent in which the registry itself, not just ships or owners, was listed. This has made any idea of “reflagging to softer jurisdictions” legally, insurance-wise, and port-access-wise far riskier.

The 15-year threshold through the Paris/Tokyo MoU lens

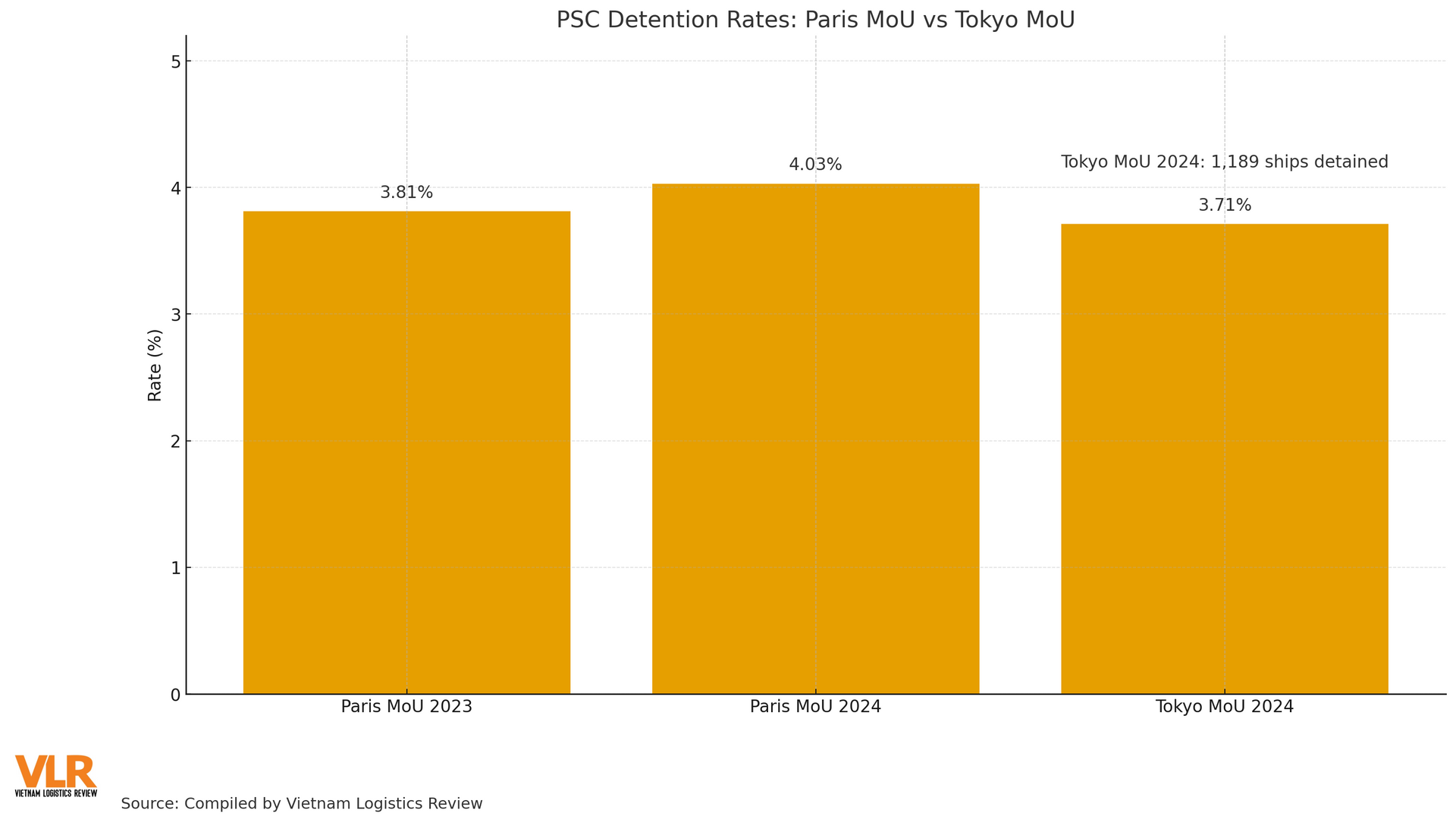

From a safety perspective, quantitative evidence shows a tight correlation between ship age and the probability of detention by Port State Control (PSC). The Paris MoU’s 2024 report recorded a detention rate rising to 4.03% (from 3.81% in 2023) a sustained post-pandemic high, with recurring deficiencies around fire safety, lifesaving appliances, and working conditions. In the Asia-Pacific theater, the Tokyo MoU reported 1,189 ships under 67 flags detained in 2024, a 3.71% rate. Connecting these data points with field observations of older vessels operating beyond close oversight, Panama’s 15-year cutoff is not simply “making life harder” it is a risk-stratification step grounded in data.

Blocking the front door, cleaning up the back

Panama’s policy has two layers. The first tightens entry: new registration applications for oil tankers and bulk carriers over 15 years old are rejected, alongside a stricter pre-check of vessel history, ultimate beneficial owner, trading patterns, and AIS behavior a mechanism Panama piloted in late 2024 before expanding in 2025. The second actively prunes the register: de-registering vessels under sanctions, starting with 17 ships on OFAC’s fresh list. Working in tandem, these locks affect the asset value of older ships, financing capacity, insurance premiums, and especially bargaining power when seeking port calls in tightly monitored regions. For cargo interests and charterers, the immediate consequence is earlier and more extensive demands for evidence of “clean” routes, “clean” documentation, and “clean” counterparties right from booking.

Voyage data becomes a precondition

P&I clubs and banks have already upgraded their risk-scoring models since the shadow fleet surged. The new twist is that voyage data AIS uptime, frequency of off-lane anchorage, STS history at sensitive coordinates, unusual MMSI/IMO changes is shifting from “nice to have” to near-mandatory for opening insurance cover, disbursing L/Cs, or approving transactions. When a major registry like Panama closes its doors to ships over 15 years old, the risk signal to finance becomes even starker; opacity around ship age, flag, and voyage conduct will quickly translate into surcharges, exclusions, or outright denials of service. This picture is not confined to named tankers: older dry bulk vessels with clustered calls in sensitive areas already PSC targets are in scope as well.

Contracts, slots, and PSC risk

For owners under the Panamanian flag, sales reflagging conversions for older tankers and bulkers now face a matrix of new conditions. A more sensible path is to reposition the asset’s remaining life cycle: either invest in deep refits to meet safety-environmental standards, or restructure the fleet early to avoid getting stuck in a “low-liquidity” zone as other registries replicate the policy. For charterers and NVOCCs, contracts will need re-engineering: insert age clauses, sanctions-compliance clauses, substitution rights when warnings arise, and cost-allocation mechanisms for detention or delay due to compliance reasons. For shippers, the issue is no longer just freight rates but the probability of “sailing on schedule” and the risk of box/storage fees if vessels face enhanced inspections in the EU, UK, or North Asia. On the port-authority side, scheduling/VTS/pilotage units now have stronger grounds to demand safety-compliance files before allocating berthing windows to older ships especially those with repeated PSC deficiencies. Companies that proactively assemble the file fire-safety inspection reports, maintenance logs, and voyage-history substantiation will improve their odds of priority acceptance and cut disruption costs.

A narrower gate but a clearer one

As the UK and EU expand sanctions lists and ratchet down price-cap thresholds for services linked to Russian oil concurrent with Panama’s decision—the common trajectory is to squeeze every foothold of the shadow fleet: old vessels, lenient flags, murky routes and behaviors. The upside is lower accident and pollution risks, particularly in constrained waters, gateway ports, or crowded anchorages; it also nudges the system back toward “price signals” based on operational quality and data transparency rather than legal loopholes. For Vietnam a growing transshipment link in Southeast Asia the new normal will require maritime and logistics firms to invest much more in data infrastructure, compliance capacity, and contract terms that prioritize prevention. Schedule reliability and the ability to “prove cleanliness” are likely to become competitive factors on par with freight rates during peak seasons.

An advantage for “clean” operators

Shutting the door on tankers and bulkers over 15 years old is not just an administrative tweak by a big registry; it is a stress test of the maritime supply chain’s self-protection in a complex geopolitical setting. If stakeholders can turn data-and-document transparency into standard practice, the initial costs will be offset by lower detention rates, more predictable turnarounds, and long-run credibility with global customers. Conversely, neglecting rule updates and relying on “flag-hopping” will build latent risk that may erupt into irreparable breakdowns in peak season.

When a top-tier registry closes to older tonnage, the market stops pricing a ship by years alone and looks at its “life history”: where it has traded, what it has done, whether it “vanished” from AIS, anchored in hotspots, or racked up repeated PSC findings. In this new frame of reference, Vietnamese companies that quickly treat voyage data and safety records as core assets will secure better insurance, clearer financing, smoother port calls, and stronger customer trust while laggards will pay an ever-dearer “risk premium.”