No longer confined to demonstration models, methanol and ammonia are moving into practical deployment at ever-larger scales.

DNV notes that orders for alternative-fuel ships (with methanol taking the lead) kept rising in the first half of 2025 despite a slowdown in overall newbuilds; in April 2025 alone there were 49 alternative-fuel orders, including 24 methanol-fueled vessels—consolidating methanol’s position as today’s “number-one contender.” For ammonia, the first commercial engines begin rolling off the line in 2025, accompanied by the IMO’s interim safety guidance—something that, just a year earlier, was still missing.

The backbone of infrastructure is also coming into focus: Singapore will license methanol bunkering from 2026, Europe has already supplied green fuel to large container ships, and pilot bunkering operations (including for ammonia) are being standardized. This landscape poses an urgent question: along what pathway should Vietnam’s fleet and ports proceed to avoid missing the transition?

Methanol’s Breakout on Twin Pillars: Technology and Infrastructure

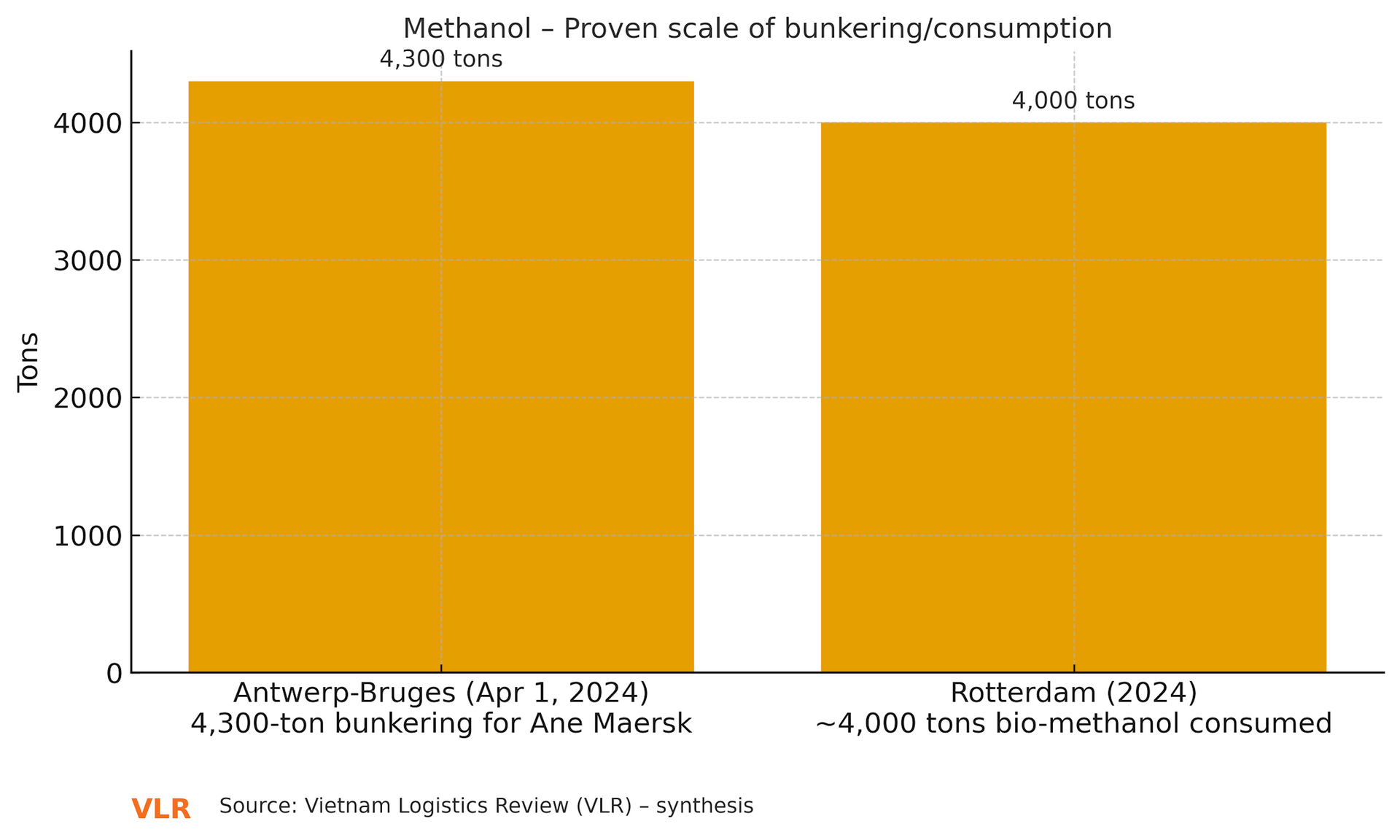

Real-world milestones have come thick and fast since 2024. In Europe, the large container ship Ane Maersk completed a 4,300-ton green-methanol bunkering at Antwerp-Bruges on April 1, 2024—the first large-scale bunkering for a deep-sea vessel in European waters. After Rotterdam’s first bio-methanol bunkering in 2023, demand surged, with nearly 4,000 tons of bio-methanol consumed in 2024 and continuing reports of alternative-fuel sales through 2025, showing that a “supply pipeline” is taking shape. In Asia, Singapore—the world’s No. 1 bunkering hub—has opened applications to license methanol suppliers (2026–2030), requiring well-to-wake emissions accounting and a transparent chain of certification. These developments address the critical “trust bottleneck” around safety, standards, and availability—the deciding factors for whether companies dare to sign long-term contracts.

On the fleet side, major groups like Maersk have wrapped up large dual-fuel order/charter packages to run on e-methanol when supply is ready, making methanol the preferred option on Asia–Europe corridors. On emissions, methanol is essentially SOx-free and significantly reduces PM/NOx versus heavy fuel oil; the remaining challenge is the “color” of the fuel: if it is gray methanol (from gas/coal), life-cycle CO₂ benefits are limited; but e-methanol is accelerating, evidenced by the first large-scale commercial e-methanol plant in Denmark entering operation in May 2025 with Maersk as a flagship offtaker. The question is no longer “does it work,” but “how green can it run—and at what price?”

Ammonia Shifts Gears: From Safety Framework to First Trials

If methanol advances on infrastructure compatibility, ammonia is gradually gaining a clear “blueprint.” In March 2025, the IMO issued interim guidance MSC.1/Circ.1687 on safety for ammonia-fueled ships, providing the regulatory “insurance” that shipowners, class societies, and port authorities have been awaiting. In parallel, the CCC 10 Sub-Committee agreed related guidance (2024), laying a legal foundation for yards, ports, and regulators to implement risk assessments. On the ground, Singapore and partners have carried out pivotal pilots—from the Fortescue Green Pioneer’s first voyage with an ammonia fuel system to a roadmap to establish ammonia bunkering standards in 2025—paving the way for commercial operations. Technically, engine makers report major progress on NOx and N₂O control, with WinGD/J-ENG stating N₂O can be pushed very low through combustion control plus SCR, helping ammonia meet Tier III in ECAs.

Infrastructure availability: Methanol already has operating bunkering chains in Antwerp-Bruges, Rotterdam, Hamburg, and Singapore (with licensing phased 2026–2030). Ammonia is in standardization; Singapore targets completing bunkering standards in 2025, with multiple dedicated ship-and-berth projects under review.

Emission-reduction potential: “Green” methanol (bio/e-methanol) can deliver deep life-cycle CO₂ cuts; gray methanol offers little CO₂ advantage. Ammonia carries no carbon but needs NOx/N₂O treatment via SCR and tight management of “ammonia slip.”

Safety and cost: Methanol is easy to store at ambient conditions, with established safety procedures. Ammonia’s high toxicity demands stringent risk management; costs are currently higher and hinge on standards and infrastructure timing. In return, the potential for zero CO₂ “at the propeller” is attractive for long-haul routes.

Where Is Vietnam on the Transition Map?

A reality check shows a considerable gap remains. An industry survey released mid-2025 indicates Vietnam’s fleet has not yet deployed clean fuels like methanol or ammonia in operations; most owners are still exploring. But there are “green shoots”: Song Cam Shipbuilding (Hai Phong) launched the ST245 offshore wind service vessel with a methanol engine for the European market—evidence that “green” newbuild capability now has domestic footing. On policy, Vietnam has set a 2050 net-zero target and is discussing economic tools such as IMO GHG pricing and regional carbon taxes for maritime transport—“push factors” that compel early planning by businesses.

Ports are the decisive link. While there have been no official announcements on methanol/ammonia bunkering at Cai Mep–Thi Vai or Hai Phong, lessons from Singapore and Europe suggest an effective approach is “controlled multi-fuel”: license under national standards, apply carbon-certificate chains for methanol, run limited and tightly supervised trials for ammonia, and connect green corridors with hubs that are already ready. Vietnam can “leapfrog” by chartering methanol bunker barges in the initial phase before investing in fixed tanks.

A 24-Month Roadmap Recommended for Shipowners and Ports

Risk Management: Technology Is Only Half the Equation

Both fuels come with distinct risks. Methanol is a volatile liquid that burns with an invisible flame; it requires leak detection, ventilation, and specialized firefighting procedures. Ammonia’s high toxicity, cryogenic burn risk, and “ammonia slip” necessitate tight containment and recovery, buffer zones, and community response plans around ports. As Singapore pursues a “multi-fuel” strategy, it has also learned environmental lessons from oil incidents—a reminder that green ambition must be matched with commensurate incident-response capabilities; for ammonia, standards and drills will be even stricter. In the engine room, manufacturers offer configurations to treat NOx/N₂O, but ultimate responsibility lies with the owner and the master—the parties that must demonstrate safe operations to port state control and insurers.

Which Way Forward for Vietnam?

Learning from the global curve, a sensible approach for Vietnam is a “two-phase” path. Phase one: focus on methanol for short-sea and regional routes, leveraging ready standards, “borrowable” infrastructure from nearby hubs, and growing access to bio/e-methanol from Europe to Asia. Phase two: build the technical-legal foundations for ammonia: join green corridors with Singapore to share standards; designate 1–2 ports for restricted-area licensing trials; work with class and domestic yards to standardize “ammonia-ready” designs. The competitive window is open: companies that proactively secure carbon credentials, safety, and voyage data will gain leverage in negotiations on rates, insurance, and slots with major liners.

At the sectoral level, this is also a chance to upgrade Vietnam’s shipbuilding industry. A domestic yard has already launched a methanol-engine service vessel for the European market—proof that technical capability can keep pace when orders are sizeable and incentives are aligned. The remaining pieces lie in the “soft infrastructure”: bunker-barge planning, standardized port operations, and green credit frameworks to lower project capital costs. When these pieces lock together, methanol will help Vietnam “run first” over the next 2–3 years, while ammonia—despite open questions on safety and cost—will be a strategic choice after 2027 for long-haul routes and larger ships.