Since early 2024, ocean carriers have avoided the Suez route due to armed attacks. Moving into 2025, the market remains in a wait-and-see posture as security risks ebb and flow alongside diplomatic efforts. Carriers and cargo owners alike are repricing risk on Asia–Europe and Asia–Mediterranean lanes, with war-risk insurance, the extra sailing time around the Cape of Good Hope, and empty-equipment availability emerging as critical variables.

2025 Situation: Key Facts

After a brief lull, attacks and threats re-intensified in 2025. Official reports record at least two ships sunk since the crisis began in 2024: the Rubymar in early March 2024 and the Tutor in June 2024. By mid-2025, further incidents causing loss of life underscored that the fuse has not burned out.

From a policy angle, the UN Security Council extended its mechanism for regular reporting on attacks against merchant shipping in the Red Sea, reflecting global concern and the need for monthly, transparent security data. For their part, most major carriers remain cautious: they are tracking diplomatic and on-the-ground developments closely before restoring large-scale deployments to the Suez–Red Sea corridor.

Consequences: Time – Cost – Insurance

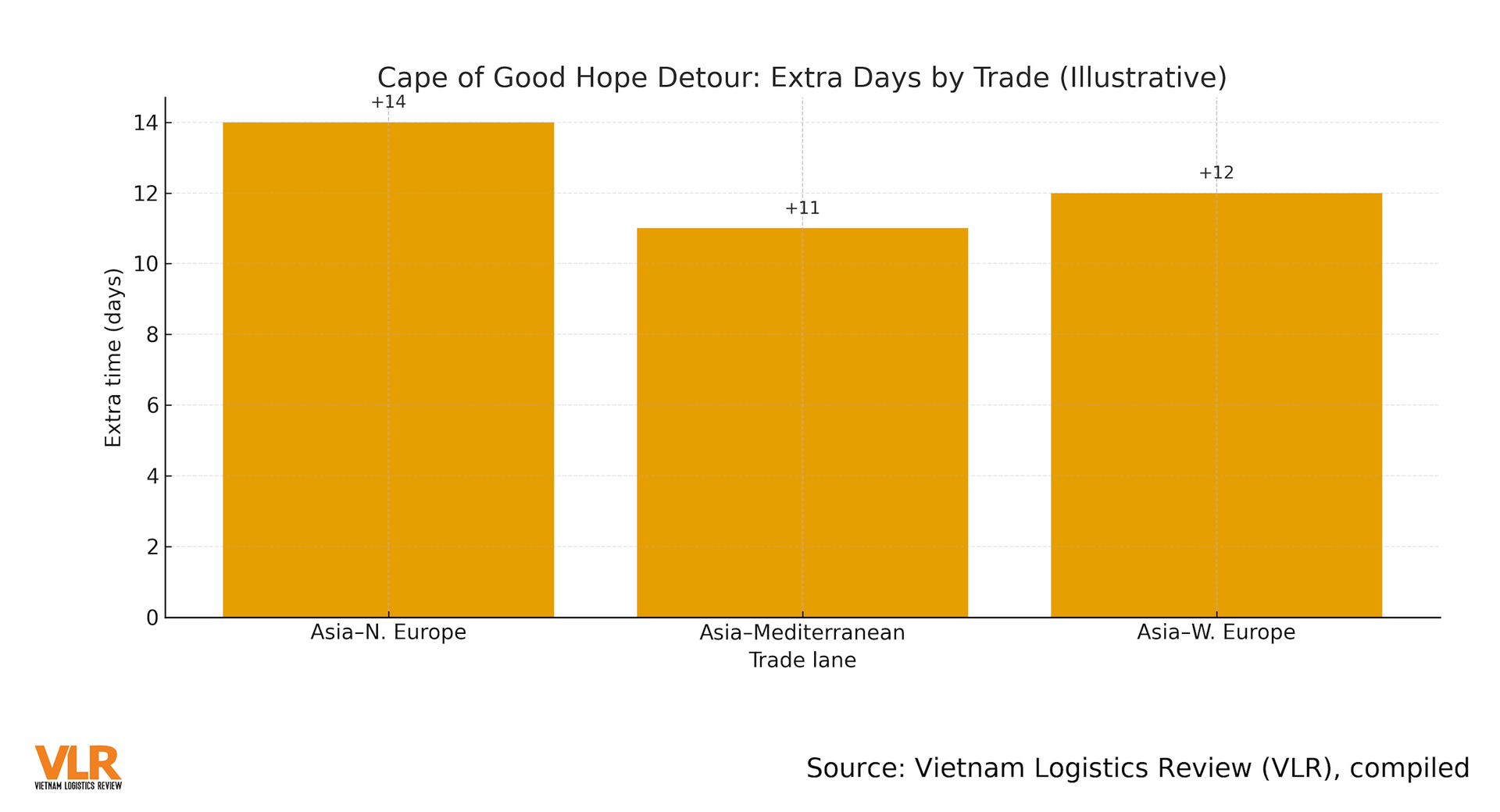

Routing via the Cape of Good Hope adds roughly 10–14 days depending on lane, disrupting vessel turnarounds, upending empty-container plans, and increasing bunker costs. Even when freight rates swing unpredictably, war-risk premiums have become a new layer of cost; at times, premiums surged and some underwriters temporarily suspended cover for certain voyages. A second cost layer comes from security/deviation surcharges. In this environment, schedule reliability varies by trade and carrier cluster, forcing end-to-end supply chains to insert buffers in both production and distribution.

For cargo insurance, a war-risk route typically brings higher deductibles and tighter claims documentation; sensitive commodities may face additional carriage conditions or pre-/post-shipment surveys. Many European importers have had to adjust Incoterms to rebalance risk.

Working with Insurers When You Reroute: Step 1: Engage your broker early to update JWC risk-area status and indicative war-risk premiums by week. Step 2: Review exclusions, especially for dangerous/sensitive goods. Step 3: Agree on a risk-evidence document set (AIS track, NOR/SOF, incident records) to speed up claims. Step 4: Negotiate the deductible and the shipper’s right to choose alternate routing (Cape/Mediterranean) within the policy.

6–12 Month Scenarios & Recommendations for Vietnam

Scenario A — Gradual Opening of a Conditional Safety Corridor: If escort/monitoring regimes and minimum safety standards (AIS behavior, identification, compliance protocols) are agreed, some carriers may partially return via Suez, prioritizing larger ships, less-sensitive cargoes, and contracts with risk-sharing. Rates could cool in bursts, but war-risk pricing is unlikely to snap back to pre-crisis lows immediately.

Scenario B — Prolonged Avoidance: If attacks recur or security arrangements lack credibility, the Cape remains the default. Expect saw-tooth volatility in rates. Shippers should implement flexible price locks (index-linked mechanisms), rebalance EU/Med inventories, and deploy split routing (re-hub, break bulk lots) to soften lead-time shocks.

Execution Playbook for Vietnamese Shippers: (1) Insert contingency clauses in sales/transport contracts to define route-switch triggers, allocate war-risk burdens, and allow delivery-date adjustments within agreed bounds; (2) add lead-time buffers of +10–14 days on Asia–Europe/Asia–Med trades; (3) activate SEA–AIR via hubs such as DOH/DWC/IST/FRA when launch windows are hard and air economics clear internal price thresholds; (4) manage empty equipment by lane-level turn times and pre-reserve space for high-value cargo.

Vietnamese Apparel Case Study: An exporter to the EU split one 40HQ into three flows: (i) Asia–Mediterranean via Piraeus/Valencia for pipeline continuity; (ii) Asia–Northern Europe via the Cape for inventory builds; (iii) SEA–AIR via Doha/Frankfurt for seasonal SKUs. The contract included contingency terms: if war-risk exceeds a threshold, shift 20–30% to SEA–AIR; if Cape lead time goes beyond X days, the carrier must provide a substitute sailing or waive surcharges.

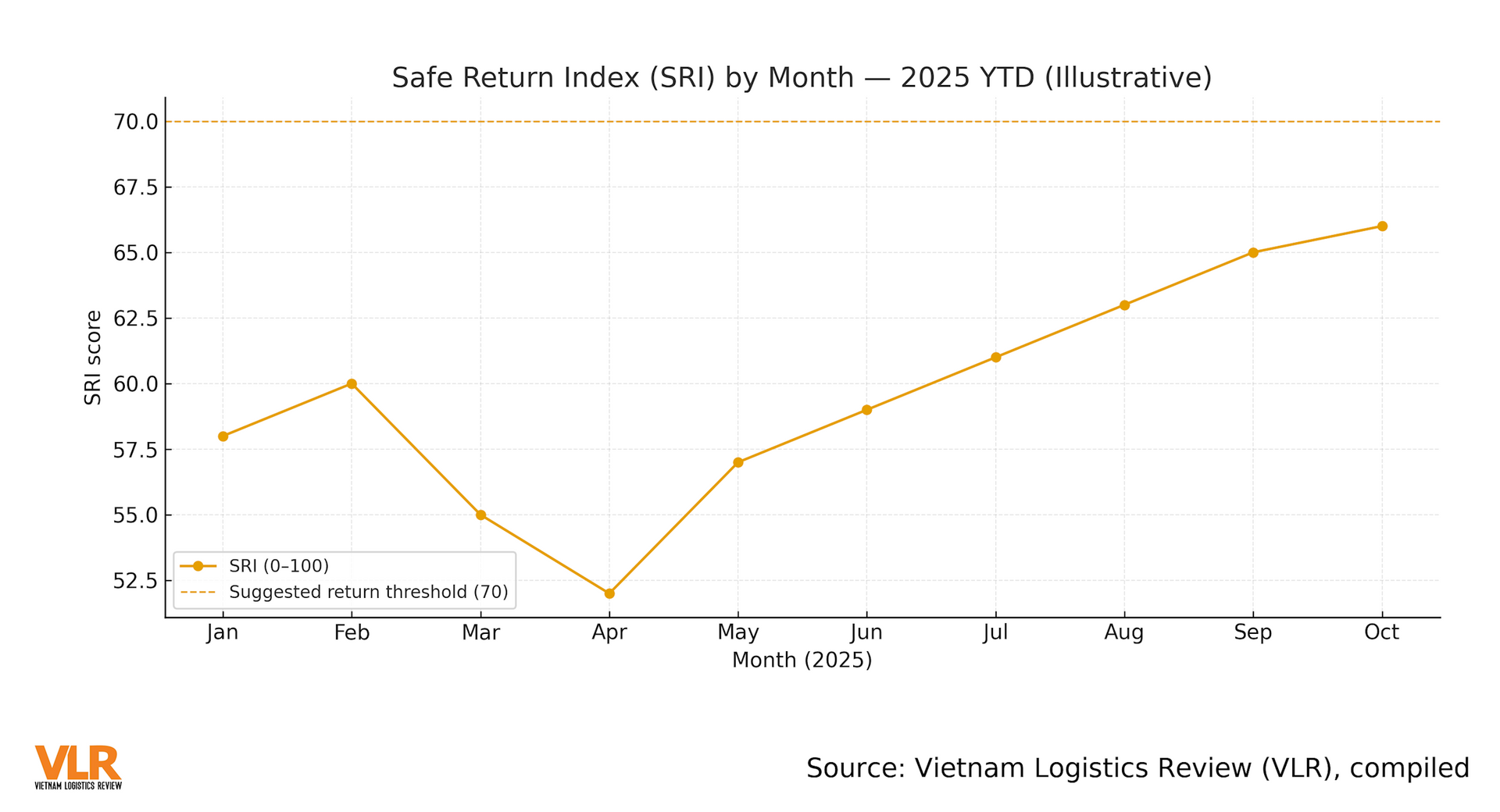

With security still fluid, a return to Suez should be grounded in a credible safety baseline, not sentiment. We propose a monthly Safe Return Index (SRI) comprising: (1) a security score (frequency/severity of incidents); (2) an insurance score (premium levels and cover availability); (3) a schedule score (slot availability, deviations, reliability). When SRI meets or exceeds the internal threshold, consider a conditional return by product, vessel, and contract; when it falls below the threshold, maintain Cape/SEA–AIR and contingency contracts. This shifts decisions from the cheapest route to the most reliable route by data, protecting lead times, margins, and delivery credibility through 2025.