2025 marks a turning point: companies must demonstrate supply-chain transparency under CSRD and conduct supplier due diligence under CSDDD, shifting from a mindset of “reporting” to “accountability” with verifiable data, processes, and measurable outcomes.

CSRD vs. CSDDD: scope, timeline, and data to collect

The focus in 2025 is no longer polishing an ESG report, but proving the firm understands and can manage environmental and social impacts across the entire value chain. CSRD requires disclosures aligned with ESRS, expanding the lens from risks to the company to include the company’s impacts on the environment and society; the data layer extends beyond policies to metrics, measurement methods, organizational boundaries, scenarios, and assurance.

CSDDD sets a different task: proactive supply-chain due diligence that tracks risks in human rights, environment, child labor, workplace safety, and remediation mechanisms. If CSRD demands “say it with evidence” to the public and investors, CSDDD demands “act responsibly” toward all tiers of suppliers. Many Vietnamese firms embedded in global supply chains will be indirectly affected: EU customers will require Scope 3 data, supplier maps, due-diligence evidence, and may even add termination clauses for non-compliance. The most workable strategy is to merge these two streams into one program: standardize data for CSRD disclosure while installing CSDDD-style diligence mechanisms for day-to-day management.

Designing a “supplier data room” and verification mechanics

To move from statements to accountability, you need a disciplined place to store, control, and share supply-chain data. A supplier data room should start with minimum components: supplier identity files, country and related legal risks, environmental and social certificates, labor information, critical input materials, shipment traceability, and third-party audits. Data must have versioning, a responsible owner, edit logs, and a risk-based verification workflow. Operationally, each industry needs different proofs: textiles focus on fiber sources and working conditions; electronics on conflict minerals; food on origin traceability. A “risk-tiered collection” model helps: low-risk suppliers provide self-declarations and certificates; medium-risk require sample checks and site photos; high-risk must undergo independent audits and periodic monitoring. The goal is not to hoard paperwork but to retain only evidence capable of standing up to auditors and regulators.

Supplier ESG scorecard template: define core E, S, and G criteria; weight them by sector and country risk; set minimum pass thresholds, remediation rules, and deadlines; require mandatory evidence such as certificates, site photos, and audit reports; score on a set cadence and escalate oversight if scores fall below threshold.

Scope 3: how to measure for products and logistics

Scope 3 is the hardest part because it covers indirect emissions outside organizational boundaries, including inbound transport, transshipment, warehousing, product use, and end-of-life. In practice, you cannot measure everything at once; the smart approach is three layers. Layer one uses high-quality data already available, such as fuel data from contracted fleets, freight invoices, transport documents, IoT readings, or metered warehouse data. Layer two applies default emission factors from reputable bodies to items not yet directly measured—clearly noting assumptions and error bands. Layer three is a multi-year plan to improve data quality, shifting from averages to factors by corridor, mode, and carrier, and ultimately to actual data per shipment.

At the product level, select core lines with high revenue or impact for a streamlined LCA, then link logistics emissions to B2B product information. Standardizing units, measurement timing, and allocation rules is essential for Scope 3 auditability.

Contract tools: ESG clauses and audit rights

ESG expectations in the supply chain mean little if they do not make it into contracts. First, add an ESG rider that defines minimum requirements, scope, a mechanism to raise standards over time, and consequences for non-compliance. Next, include audit-right clauses allowing the buyer to request information, conduct risk assessments, appoint independent auditors, and access sites within a reasonable window. For logistics, add data clauses requiring carriers to provide fuel, distance, payload, and mode data and a delivery cadence. In some cases, use incentives: bonuses for high-scoring suppliers, extra credit for low-emission modes, and cost-sharing for technology upgrades. A good contract makes data flow back in the right format, on time, and reliable enough to enter the report without being rejected.

Communications guidance — avoiding greenwashing

ESG communication is not a feel-good narrative; it is a verifiable account. Anchor on three principles: consistency, timeliness, and cross-checks. Consistency means figures in financial reports, sustainability reports, and on the website do not contradict one another; timeliness means updating on the disclosure cycle, not repackaging old numbers; cross-checks mean citing data sources, methods, error margins, and, when appropriate, third-party assessments. Avoid absolute claims like “zero emissions” without evidence and clearly defined system boundaries.

For “green logistics” claims, specify corridor, mode, factors, timeframe, and any offsets—avoiding the use of offsets as a cloak to hide areas without real improvement. Good communication lets readers verify and reach similar conclusions on their own.

Common CSRD reporting mistakes: last-minute, unaudited data grabs; mis-defining organizational boundaries leading to missing core Scope 3 items; using emission factors for the wrong corridor or mode; announcing targets with no baseline and no roadmap; lacking third-party evidence and change-control logs.

Two-year roadmap: sector priorities and risk levels

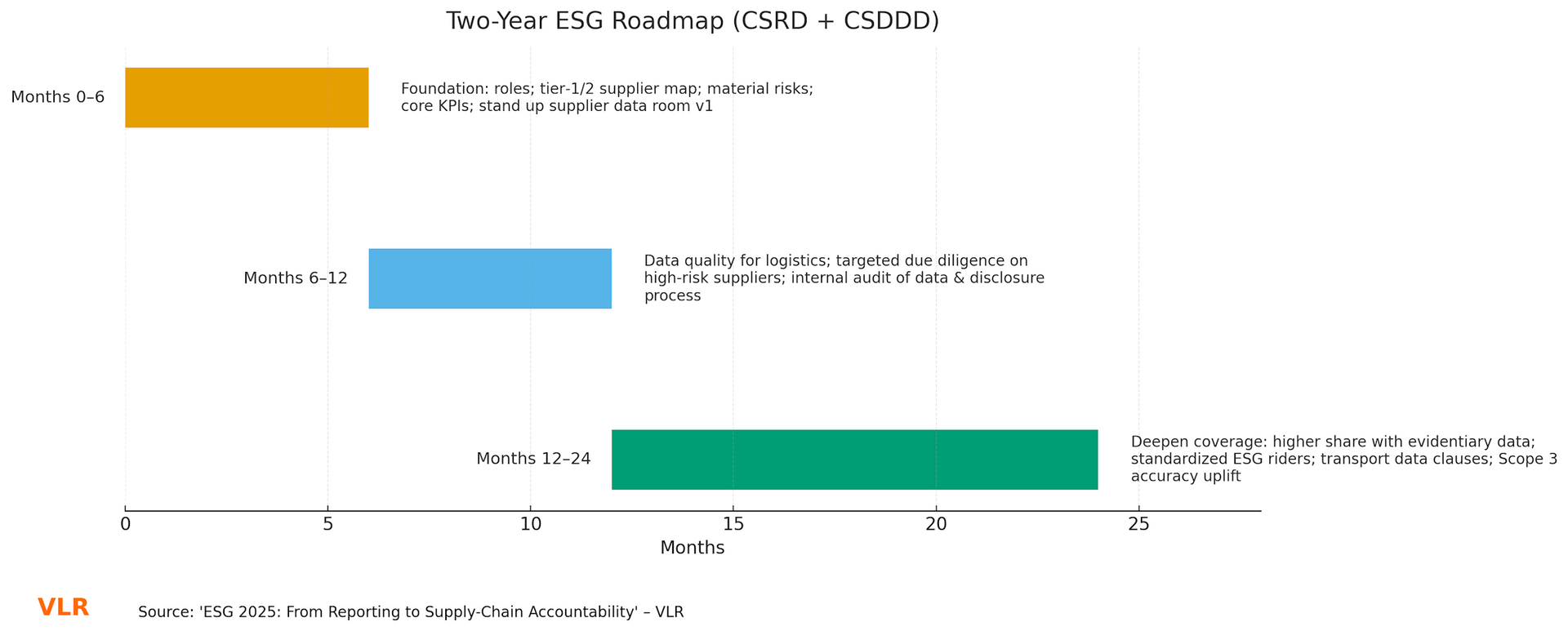

An effective ESG program needs a roadmap that is ambitious yet feasible. For most Vietnamese suppliers in global chains, months 0–6 should build the foundation: assign roles, map tier-1 and tier-2 suppliers, identify material risks by sector and country, choose a core KPI set to start measuring now, and stand up the first version of the supplier data room. Months 6–12 should prioritize two streams: improve logistics data quality and run sample due diligence for high-risk suppliers; in parallel, conduct an internal audit of the data collection–aggregation–disclosure process to patch gaps. Months 12–24 should deepen coverage: raise the share of suppliers with evidentiary data, sign standardized ESG riders, embed data clauses in transport contracts, lift Scope 3 accuracy from average factors to corridor- and mode-specific factors, and pilot shipment-level actuals.

At each stage, tie outcomes to financial decisions: cost of improvement per tonne of CO₂e reduced; lead-time cuts from mode optimization; the share of orders moved to lower-emission modes without sacrificing service.

The operational lens: data technology and human capability

Without data, CSRD is just paper; without people, CSDDD is just a statute. On technology, start with quick-win integrations: pull trip and fuel data from carriers via API or standard files, integrate warehouse and electricity-use data, and schedule monthly data collection. On people, assemble a cross-functional team spanning finance, legal, operations, procurement, IT, and communications; this group sets the indicator set, standardizes definitions, approves verification plans, and handles discrepancies or emerging risks. The ability to explain data matters as much as the ability to measure; when engaging EU customers or auditors, the company must present assumptions, boundaries, and improvement plans—not just standalone numbers. Continuity is vital: even with limited resources, do less but do it regularly—raise one standard each quarter, add one more layer of transparency each year.

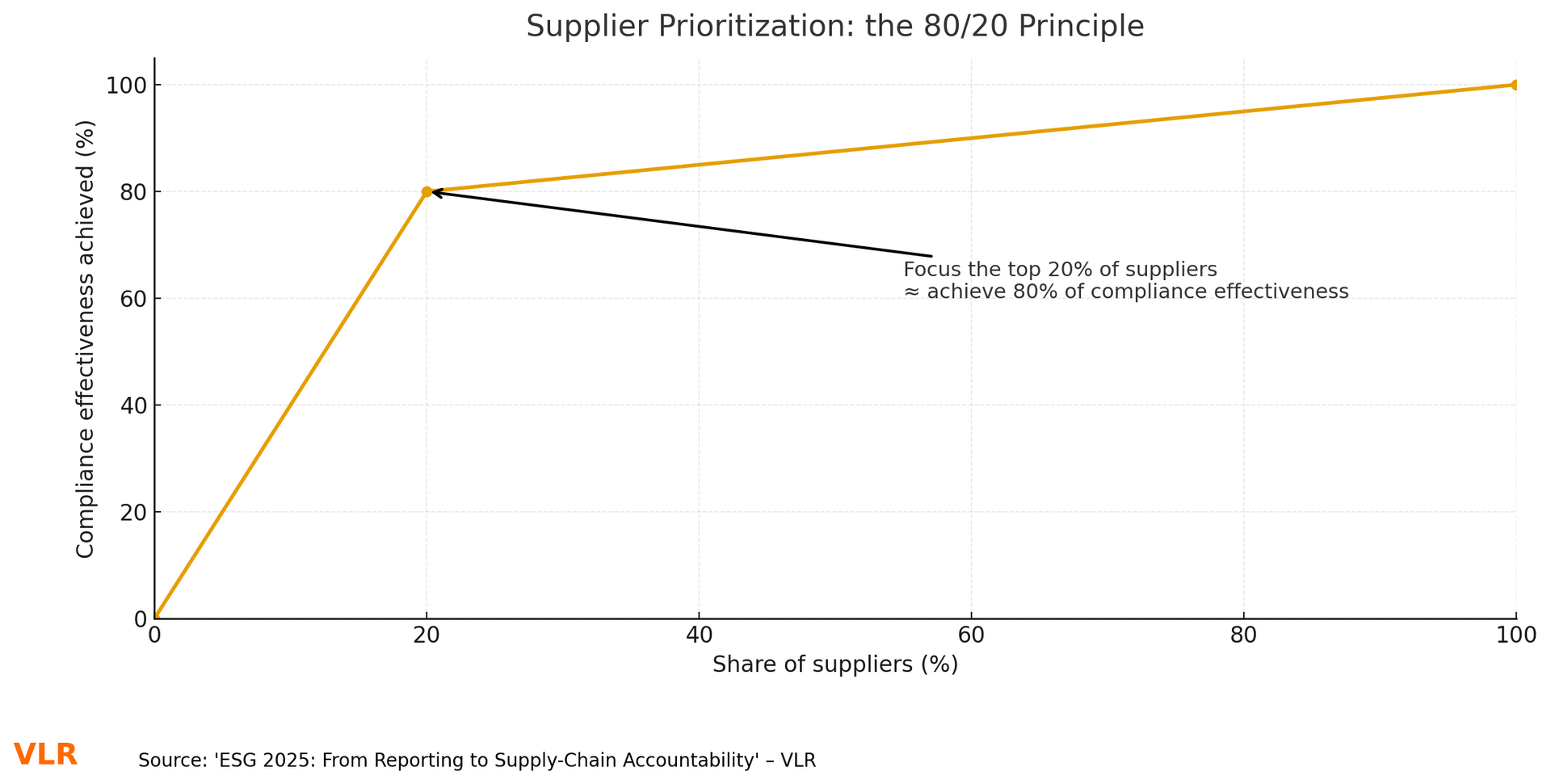

In a world where ESG requirements are moving from encouragement to obligation, the shortest path to meet both CSRD and CSDDD is to focus on the suppliers that drive most of the risk. Start with the top 20% of suppliers by risk value to achieve roughly 80% of compliance effectiveness; use the supplier data room as the data backbone, wire it directly into contracts and verification workflows, and execute a two-year roadmap with clear metrics. When data flows correctly and diligence runs steadily, a company will not only meet EU market demands but also upgrade risk management, optimize costs, and strengthen customer trust worldwide.